China’s economy springs back from pandemic hit with record growth

Simply sign up to the Chinese economy myFT Digest -- delivered directly to your inbox.

China’s economy continued its strong recovery from coronavirus in the first quarter of 2021 as the country unveiled a record annual growth rate, but the figures masked the lingering damage left by the pandemic last year.

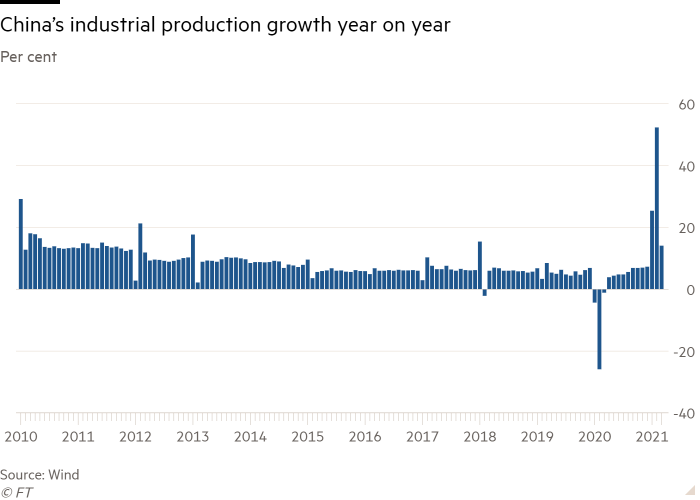

China’s output leapt 18.3 per cent year on year in the first three months, the fastest rate since records began in the early 1990s. The high rate was anticipated because in the same period last year China’s economy contracted for the first time in decades as the country went into lockdown.

On a quarter-on-quarter basis, the economy expanded just 0.6 per cent, according to the National Bureau of Statistics, well below expectations.

The official figures nonetheless highlighted the rapid recovery that has unfolded across China’s economy since the first quarter last year, when the city of Wuhan was first to be placed under lockdown as the outbreak emerged.

The subsequent containment of coronavirus cases and a frenzy of industrial production meant that GDP growth in China surpassed its pre-pandemic rate by the end of last year.

China benefited from being the first major economy to emerge from lockdown, although the US is catching up rapidly, boosted by the Biden administration’s $1.9tn fiscal stimulus. The US economy is on track to regain its pre-pandemic level of output in the first half of this year.

In contrast, the eurozone is still grappling with rising coronavirus infections and national lockdowns which are expected to drag the bloc into a double-dip recession in the first three months of this year. Its GDP is not expected to return to pre-pandemic levels until mid-2022.

The IMF last week forecast that by 2024, the US would be one of the few major economies to be bigger than it would have been if the pandemic had not taken place, based on earlier estimates — while it predicted China and Europe would both still be smaller.

China’s growth figures were released as Xi Jinping’s administration prepares to mark the centennial of the founding of the Chinese Communist party in July. In the run-up to the celebrations, the party has favourably compared its virus management and robust economic recovery with the struggles of its western rivals, especially the US.

“We are confident that the current recovery trend will continue throughout the year,” Liu Aihua, a spokesperson for the NBS, said at a briefing.

But the NBS also sounded a note of caution: “We must be aware that the Covid-19 epidemic is still spreading globally and the international landscape is complicated with high uncertainties and instabilities.”

The sharp jump in the first quarter, which was far higher than in any period since quarterly reporting began in the early 1990s, was again supported by industrial production. The metric added 24.5 per cent in the first quarter and alongside booming exports has helped prop up growth over the past year, though it missed expectations in March and only rose 14.1 per cent year on year.

The expansion was also supported by household consumption, which had previously lagged behind the wider recovery but is expected to play a greater role in driving growth this year. Retail sales beat expectations to add 34.2 per cent in March, rebounding from a period of lockdowns a year earlier.

Eswar Prasad, a China finance expert at Cornell University, said that even after taking into account the “phantom effect” of the low-base comparison from last year, the first-quarter figure was “clear confirmation of the resilience and momentum of the Chinese economy”.

Focus in China has shifted to monetary policy, with signs of overheating across parts of the economy despite persistently low consumer price inflation. The government is trying to curb leverage across its property sector, as well as rein in record rates of steel production following a construction boom.

Yue Su at the Economist Intelligence Unit said such concerns would cause the government to curb investment stimulus measures. “Authorities are unlikely to hasten approval of infrastructure investment in the second quarter even if economic activity slows,” she said.

Prasad said: “The recovery will give the government more room to wind down stimulative macroeconomic policies and intensify [its] focus on financial risks.”

Several high-ranking officials have warned about the threat of high asset prices in recent months. Guo Shuqing, China’s top banking regulator, said in March that the country was exposed to “bubbles” in international markets and in its own real estate sector.

The Chinese stock market hit an all-time high in February but has since lost 15 per cent. Following the release of the data on Friday morning, the country’s CSI 300 index of Shanghai- and Shenzhen-listed stocks was flat.

The Chinese recovery from the pandemic has also helped it dominate global trade, with exports rising every month since June 2020. In March, exports added 30.6 per cent in dollar terms compared with the same month a year earlier.

Despite the eye-watering year-on-year figures, officials and economists sounded a note of caution over aspects of the recovery, as well as its pace compared with the previous quarter, against which it grew 0.6 per cent.

Liu, the NBS spokesperson, noted that manufacturing investment has not returned to its pre-pandemic level. “Factories are facing many difficulties in their operation,” Liu said.

Louis Kuijs, head of Asia economics at Oxford Economics, said: “The headline year-on-year data really doesn’t tell us the story of how the economy has performed in the first quarter . . . in fact that performance was a bit disappointing. The silver lining is that March was better than the first two months.”

Fixed asset investment rose 25.6 per cent in the first quarter. The urban unemployment rate was 5.3 per cent.

Additional reporting by Xinning Liu in Beijing and Tom Mitchell in Singapore

Comments