How is blockchain changing financial services?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Blythe Masters, a former top JPMorgan Chase executive and one of the most prominent financiers on Wall Street, was appointed chief executive of blockchain company Digital Asset Holdings in 2015, many saw it as a sign that the technology — for building secure transaction networks — would upend financial services.

At the time, Masters told Bloomberg News: “You should be taking this technology as seriously as you should have been taking the development of the internet in the early 1990s.”

Eight years later, blockchain start-ups, such as Digital Assets, have yet to make much of an inroad into the world of finance beyond the realm of cryptocurrencies, which is where the technology started. Masters left Digital Assets three years after she joined. In May, she returned to Wall Street as part of the ill-fated effort to save Swiss bank Credit Suisse.

Crypto crash spooks the industry

Following crypto’s spectacular blow-ups last year, the question of how seriously the financial services industry should take blockchain seems even more up in the air than it was eight years ago. Late last year, in the wake of the collapse of cryptocurrency exchange FTX, several high-profile blockchain projects, including one by the Australian stock exchange, were put on hold.

“A lot of the energy was being put around the crypto side of it,” says Robert Ruark, who leads the US fintech practice of Big Four accounting firm KPMG. “When the crash happened, all of those investments pulled back.”

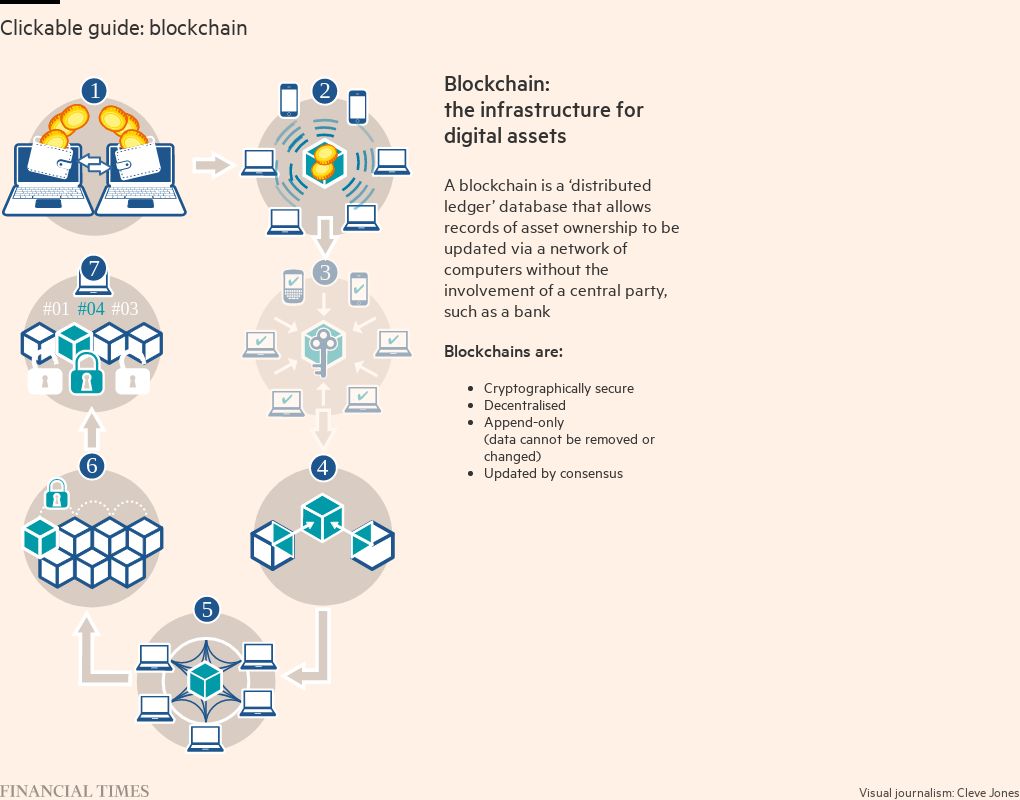

Finance experts, though, say the promise of blockchain technology and the potential for it to change Wall Street and beyond remains. A major reason for that has to do with what a blockchain is.

Blockchains, often described as distributed ledgers, are in essence sophisticated but open spreadsheets. Imagine a Google sheet where the editor has given access to anyone in the world. And there is not one blockchain, but each digital asset, or currency or token, has its own blockchain.

The one wrinkle — and this is the innovation within blockchain technology and where the “crypto” in cryptocurrency comes from — is that the code that makes the spreadsheet work is encrypted. So, while anyone can look at a blockchain spreadsheet, in order to edit it (typically to enter a transaction) you need to have the exact code (sometimes called a key) and you must be entering a change that makes sense in the context of the rest of the spreadsheet.

So while anyone can view blockchains, they are almost impossible to hack. Not that you don’t hear about blockchain or crypto hacks — there are lots of them. But most hacks involve gaining access to key codes, which are stored off the blockchain.

The fact that blockchains make markets more transparent is a significant benefit for the technology, says David Treat, a senior managing director at consultancy Accenture who specialises in technology and capital markets. “Everyone gets the exact same information at the exact same time.” He says that matches the direction in which financial markets are going — namely, towards “greater access to information in an auditable way”.

Why haven’t financial markets already migrated to a blockchain?

So, what is holding up the move to blockchain? In large part, it is about regulation, says Treat. Regulators must ensure markets are fair, so they have to approve changes. That slows down how quickly markets can migrate to new infrastructures — especially in securities, such as bonds or commodities or stocks, where individual investors have already invested a large amount of money.

Another hurdle, industry specialists say, has to do with liquidity. The markets with the most activity tend to have the best prices and lowest transaction costs, even if technology and market structure is better elsewhere. That could be why blockchains have taken off in crypto markets, which were non-existent before the technology, but not, say, in the bond market, where trillions of dollars already trade through established networks.

Where has blockchain been adopted?

Observers say the most immediate areas for growth in the use of blockchain are in functions that are adjacent to trading and cash markets, such as trade settlement and processing. Connecting blockchain-recorded transactions to those recorded off a blockchain has been the hold-up, here.

But several companies, the most prominent of which is Web3 services platform Chainlink, have been developing software that connects blockchains with external data. Earlier this year, Swift, the global financial messaging platform jointly owned by the largest banks around the world, announced a partnership with Chainlink. In August, Swift and Chainlink successfully tested a system that can transfer value from one blockchain to another, allowing the open, but siloed, networks to communicate with one another.

In another sign of how blockchain is being more widely adopted in traditional banking, both Citigroup and JPMorgan have announced blockchain projects in recent weeks.

Citi is testing a blockchain project that will allow its institutional and corporate customers to turn cash into digital tokens, making it easier to move money at times when traditional financial markets are closed. For now though, Citi’s tokens can only be transferred internally, but the bank is working with regulators and others in the financial industry to create architecture that will allow the tokens to be moved between banks and other institutions.

In early October, JPMorgan said it was starting to process transactions between customers using a settlement network built with blockchain technology.

“When I stand back and look at the blockchain projects in traditional financial markets, I think the progress has been pretty good,” says Accenture’s Treat. “The vision for simplified blockchain-enabled networks are there — it just takes time.”

Comments