The limits of the pursuit of profit

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In February 2016, Emmanuel Faber, chief executive of Danone, put a radical proposal to the French food multinational’s senior US executives at a meeting in White Plains, New York.

Against the grain of agricultural production in the US, where the vast majority is genetically modified, Mr Faber proposed shifting about half Danone’s products — representing some $1bn of yoghurt sales — to non-GMO ingredients. He argued that this was an important change that would improve soil health and biodiversity.

The reaction from Mr Faber’s lieutenants was immediate: impossible. One said it could only happen if the group imported the non-GMO feed for dairy cattle from Russia. As they went to work, though, the executives started to change their gloomy prognosis about how long such a shift would take.

“Three weeks later, it was 10 years. Two months later, it was five years. Finally, it was two years — and we did it in two years,” says Mr Faber, in an interview at the group’s Paris headquarters.

The pledge triggered vocal protests from some US farm and dairy groups. It did not harm sales. Despite a price rise, the children’s yoghurt brand Danimals, now certified as containing only non-GMO ingredients, has increased its US market share from 30 to 40 per cent.

Danone’s shift on GMO might be dismissed by some as a marketing gimmick and criticised by others as an exercise in managerial self-indulgence. But it is one sign of a powerful shift in the way that large companies think about their purpose and their responsibilities — and an example of the challenges companies face in managing that shift.

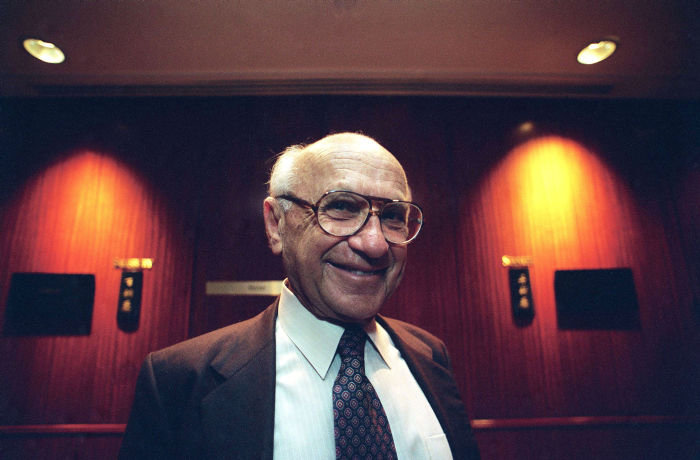

For 40 or more years, corporate boardrooms latched on to the doctrine that economist Milton Friedman had laid out in a 1970 article with the blunt title “The Social Responsibility of Business is to Increase its Profits”. That approach was supercharged in the 1980s and 1990s by the ratcheting up of share-based executive rewards.

But the tide is beginning to change. In August, the Business Roundtable, the influential US business group, amended its two decade-old declaration that “corporations exist principally to serve their shareholders”. The Roundtable said: “While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders” — customers, employees, suppliers, communities and — last in the list — shareholders.

Advocates for the idea that companies should adopt a broader purpose argue that the global financial crisis laid bare the limits of pursuit of profit for its own sake. What was once a nice-to-have addition — often tidied away and kept in a box labelled “corporate social responsibility” — is now a must-have, they say. Businesses that combine profit with a wider purpose will benefit from the reinforced commitment of employees and customers. Those that fail to do so will not survive to become the companies of the future.

Sarah Kaplan of Toronto’s Rotman School of Management says: “Companies are increasingly a positive force for society and, as people see their governments let them down, [they] see companies replacing that role.” As for “the idea that shareholder value is the only way”, she says it “is just a consensus”, in the same way the more socially responsible postwar model was once a consensus.

Mr Faber, 55, exudes enthusiasm for the wider purpose of his company. He has set an objective to turn Danone into a “B Corp”, a business which voluntarily adopts broader societal goals but submits its social and environmental performance, transparency and accountability to third-party certification.

Mr Faber says from the 1980s the economy, “instead of serving people, started to really serve finance and all the processes — the governance, the incentives, the stock options, the compensation committees, the independent boards — went in the same direction”.

But catering to multiple stakeholders is a “super-delicate balance”, he adds. “What keeps me awake at night is the pace of change. Are we changing too fast? Or not fast enough? And where?”

Not everyone believes he is getting that balance correct. One of the main criticisms of the stakeholder approach is that it can allow executives to set their own criteria for success and let them off the hook for poor financial performance. Danone already faces investor scrutiny for distracting itself from more profitable business.

Jefferies’ sector analyst Martin Deboo summed up the doubts in a note about the French company published last October. “We worry that a too-obsessive pursuit of purpose-driven benefits and brand-as-social-advocate might blind Danone to the value of more mundane, but potentially broader, consumer appeals,” he wrote. “It is shareholders, not other stakeholders, who are most in need of convincing with regard to Danone’s good intentions.”

A variety of factors is driving companies towards asserting a broader purpose. One is a desire to offset a lack of trust in business that has lingered well beyond the end of the financial crisis. Another is the realisation that job hunters — particularly younger candidates — will shun employers that cannot prove they have a positive, and sincerely held, purpose.

The growing appetite of some investors to back companies that are improving their performance on environmental, social and governance (ESG) measures provides another impulse to change. Finally, there is pure self-interest: as critics pointed out, the BRT statement and other initiatives could be merely a way of seeing off the threat of new legislation and regulation.

Corporate advocates say that they are tackling the risks that unbridled growth might pose to the very communities that buy their products.

Roberto Marques is chairman of Natura & Co, the Brazilian cosmetics company that also owns The Body Shop and Aesop and is in the process of acquiring Avon of the US. From its foundation, Natura has aimed to satisfy a “triple bottom line” of social, environmental and financial outcomes, sometimes paraphrased as “people, planet and profit”. Among other initiatives, it sources sustainable ingredients in the Amazon rainforest, simultaneously preserving some 18,000 sq km against development and supporting small farmers.

Natura’s quarterly analyst calls sound little different from a million other listed companies. Mr Marques says that should not come as a surprise: “We do care about short-term results because I don’t think companies can be relevant if you are not a successful company.”

Still, setting a broader purpose is fraught with risk and you do not have to be a sceptic to see them.

Ioannis Ioannou, strategy and entrepreneurship professor at London Business School, researches the impact of sustainability projects on corporate value. He says purpose is “something to excite people at the level of the individual, rather than at the level of the organisation”. An organisation could have a guiding mission that was morally objectionable, he says: “The mafia has a purpose: it’s very unifying, it’s very effective and it’s lasted for a long time . . . Do we want to go to a moral or ethical sphere which veers into a philosophical question of what is a bad or a good purpose for our organisation?”

The Company of the Future

This article is part of an FT series exploring the difficult trade-offs companies must make between purpose and profit to survive in an uncertain future.

Part one

The limits of the pursuit of profit

Part two

Royal Dutch Shell searches for a purpose beyond oil

Part three

Novo Nordisk walks moral tightrope

Part four

Governance reboot keeps Hitachi in the spotlight

Part five

Levi Strauss bets moral mission can survive public markets

Interactive game

The Trade-off: Can you balance profit and purpose?

Follow the series at ft.com/future-company

Prof Ioannou’s latest research, with George Serafeim of Harvard Business School, shows the adoption of common sustainability practices is increasingly a survival issue. “ The ones that fall behind in adopting best practices are the ones whose performance gets hit in the long run,” he says.

Chief executives face the threat that if they fail — or if they only apply a veneer of stakeholder concern — they will be accused of “purpose-washing”, leading to further cynicism about their motives.

One way to survive, according to Ms Kaplan, is for companies that have already pursued the business case for responsible action, to “innovate around trade-offs”. One example is how Nike, attacked over its suppliers’ working conditions in the 1990s, not only improved standards but developed an entirely new manufacturing process to take pressure off the old supply chain. The US sportswear company’s Flyknit “woven” shoe was one result.

Similarly, in the face of a recent consumer boycott in Morocco, Danone started selling its pasteurised fresh milk at cost. It also introduced higher-margin products, such as semi-skimmed milk in affordable sachets, cereal yoghurt and regional and seasonal desserts.

As Danone found in Morocco, size and a high profile can make any company, purpose-led or not, a bigger target. When the possibility of acquiring Avon was raised in Natura’s boardroom, it ignited a fierce debate about the risks of greater complexity and a mismatch of cultures. Mr Marques quotes Anita Roddick, the late founder of Body Shop, who was insistent that “the world doesn’t need another big company”. But he also says increased scale will help Natura “make sure that our narrative is heard by more people in more households”.

This is a common justification heard from big companies. Referring to the non-GMO initiative, Danone’s Mr Faber says: “See how many $10m start-ups you have to add up if you want to move $1bn of sales in two years. This is what big brands can do and these super-nice start-ups can’t.”

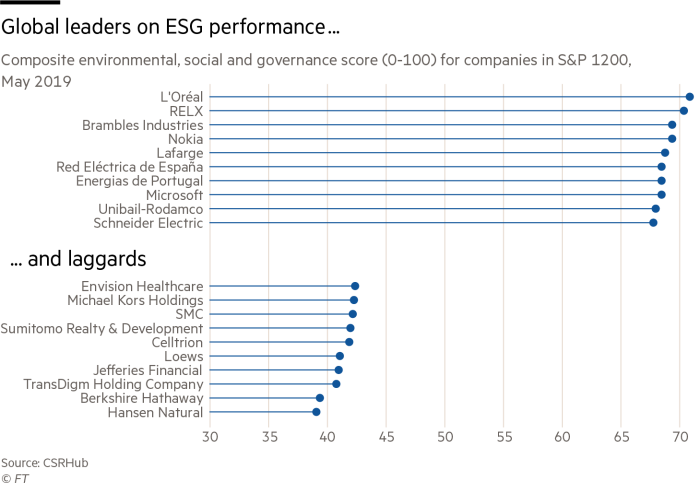

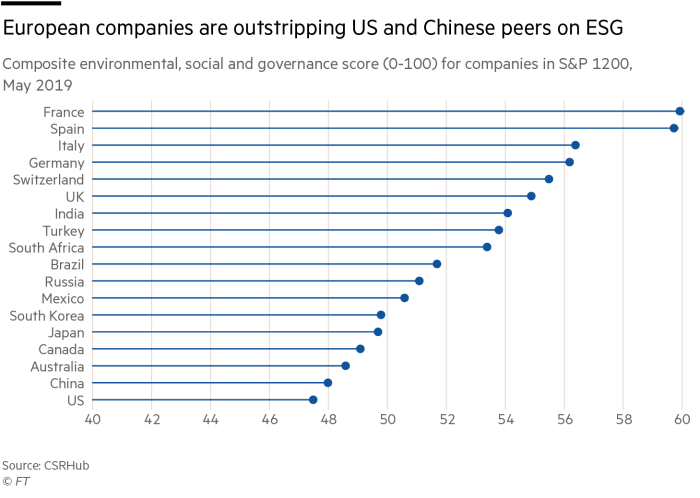

Particularly in the US, there is intense scepticism about the growing focus on goals other than profit. In a speech in June, Hester Peirce, a Republican appointee to the US Securities and Exchange Commission, compared critical ESG ratings to the “A” — for adultery — that moralistic authorities forced her namesake Hester Prynne to wear in The Scarlet Letter, Nathaniel Hawthorne’s classic novel. ESG raters, Ms Peirce said, also attach labels “based on incomplete information, public shaming and shunning wrapped in moral rhetoric preached with cold-hearted, self-righteous oblivion to the consequences, which ultimately fall on real people”.

Her criticism goes to the heart of one of the snags in assessing different stakeholders’ priorities — the difficulty of gauging non-financial commitments with the same accuracy and consistency as financial measures.

Cultural differences also make it hard to apply a one-size-fits-all approach to the pursuit of profit with purpose. Japanese companies have long professed to a strong sense of corporate mission and long-termism, to such a degree that they sometimes use it to cover up lacklustre short-term results. US and UK companies generally face the opposite charge, that they sacrifice long-range goals for the next quarter’s targets.

Progress towards wider long-term objectives also runs up against the short-term approach of some investment managers. In his letter to chief executives last year, under the headline “A Sense of Purpose”, Larry Fink, who heads BlackRock, the asset manager, urged chief executives to show how they made a positive contribution to society. But Mr Faber says: “I’ve been receiving letters from Larry Fink, but apparently his portfolio managers are not reading them.” He says “a disconnect” will continue until asset managers’ incentives are tied to wider goals, such as reducing carbon emissions. “At some point there will have to be a serious conversation about how serious the leaders of the financial world are about it.”

For now, the US investment community seems divided. The Council of Institutional Investors — a US lobby group of which BlackRock is a non-voting associate member — “respectfully disagreed” with the BRT statement, saying “accountability to everyone means accountability to no one”. Earning a rate of return for pension funds and charities “is itself a social good — a very high one”, Paul Singer, founder of activist hedge fund Elliott Management, told The Economist last month.

So, could companies of the future simply revert to the pursuit of shareholder value that still drives many companies of the present?

Stephan Chambers, director of the London School of Economics’ Marshall Institute for Philanthropy and Social Entrepreneurship, says that scenario is possible: “There will be an investment opportunity at some point where the investment pitch is, ‘You should be buying us because we don’t waste money, time or energy on the illusion that we’re an NGO: we’re a corporation.’”

But Mr Faber says the soundings he takes from outside the elite corporate bubble — including from dairy-farming friends in the French Alpine region where he was brought up — suggest change is unstoppable. “The time where I take everything and then I give back as a company or as a billionaire is over. It’s good, but it’s not good enough,” he says.

Andrew Hill is the FT’s management editor and chair of Blueprint for Better Business, a charity

Discuss with the journalist

Andrew Hill will be responding to comments throughout the day

What trade-offs do you think are needed to balance profit and wider purpose? Do you have experiences to share from your own business? Share your thoughts and ideas with Andrew in the comments below or email at andrew.hill@ft.com.

Letters in response to this article:

Vesuvius seems to have forgotten that it has wider commitments / From Jonás Fernández Álvarez MEP, Brussels, Belgium

Ethical business is easy when the policy delivers / From Aziz Sunderji, Brooklyn, NY, US

Comments