Now Money offers alternative for Gulf’s unbanked expats

Simply sign up to the Financial services myFT Digest -- delivered directly to your inbox.

The Gulf’s economy — from oil production to tourism — is underpinned by expatriate workers, the majority of whom are not paid enough to open a regular bank account.

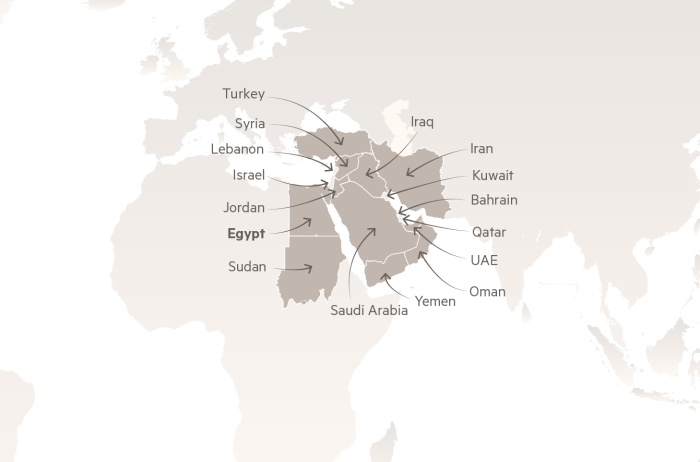

About 70 per cent of the population in the Middle East and north Africa do not have access to banking services, says Ian Dillon, co-founder of Now Money, a Dubai-based financial technology group.

Founded four years ago, the company aims to open up financial services for the low-income workers in the six-nation Gulf Cooperation Council: labourers, taxi drivers, cleaners and hotel staff who arrive largely from south Asia and Africa.

“I was coming out to the region for business and saw a huge opportunity with all the unbanked people in the Middle East,” says the former banker.

The GCC recorded outbound remittances of $120bn in 2017, according to World Bank data. However, Gulf banks tend to exclude workers earning less than $1,400 a month, leaving most of them reliant on exchange houses to remit cash home.

“This is a huge market in front of us,” Mr Dillon says. “They come here for one purpose: to earn and send money back to their families.”

Utilising a smartphone app, Now Money offers access to competitive exchange rates. It also provides access to the broader financial system via a debit card for store and online purchases — such as mobile phone top-ups — as well as cash machines.

Now Money has agreements with 12 companies to provide services to their employees. Since launching in May in the United Arab Emirates, Now Money has gained 1,500 customers and says it is adding 600 more each week. The group is also looking to launch operations in Bahrain and Saudi Arabia, the region’s largest market.

As a payment services provider, Now Money has teamed up with established exchange houses and banks — currently Al Fardan Exchange and Noor Bank — and is preparing to bring on more partners to broaden options for customers. Its business model involves taking a cut from the service providers such as exchange houses or telecoms providers.

However, fintech start-ups must navigate numerous hurdles — from their basic incorporation to the complex process of forming business relationships with partner banks or exchange houses — before they can get off the ground. Tackling such challenges meant that it took Now Money four years to come to market and begin processing customers.

Established financial institutions are often reluctant to agree partnerships with innovative technology groups, with many executives and compliance departments fearful of the unknown.

“And it is time that kills. It can take 18 months to get the partnership that you need with the bank, but most start-ups get killed off because that time costs a lot of money, and it’s difficult to raise funding without banking partnerships already in place,” Mr Dillon says. “This is a huge issue here, though it is starting to improve.”

Indeed, Now Money has gone through several funding rounds — backers include US venture capital group Accion Venture Lab — to see it through to launch. Now Money has raised $3.3m in total, with a further round expected in the first quarter of next year targeting a valuation towards $20m. Now Money employs 12 staff, which it expects to boost to 30 in 2020.

While Now Money was establishing itself, as many as 10 companies folded while attempting to launch similar products in the region, Mr Dillon says.

“Fintech firms face challenges with the regulatory environment and need to raise large amounts of capital if consumer facing,” says Heather Henyon, founding general partner at Mindshift Capital, a venture fund. “It is hard for them to work with the banks. It is hard to integrate back-end systems.”

The region, for years criticised for lax money laundering regulations, has had to improve its compliance, especially vetting potential customers’ credentials such as identification cards, proof of address and compliance with sanctions.

“Compliance is always a focus, especially in this region, and when dealing with international players. For Now Money one of the real challenges is being able to achieve this digitally,” says Ms Henyon, whose group has invested in Now Money.

In Abu Dhabi’s financial centre, the company has been testing technology to improve “know-your-customer” processes that Mr Dillon believes will prove beneficial for others in the industry.

The service, now awaiting approval by the central bank, allows customers to scan ID documents via their smartphone and use automated techniques to verify the information.

Disrupting the region’s long-established exchange houses and banks opens fintech groups like Now Money to potential acquisition from larger rivals that are looking to boost their technology offering to shore up their market positions.

Finablr, a payment and foreign exchange platform that grew out of Abu Dhabi-based UAE Exchange to become a global player, listed on the London Stock Exchange earlier this year to help fuel its expansion.

Mr Dillon says Now Money will look for an exit when the time is right.

“We’ve got quite a clear mission that we want to accomplish, which is to be the best financial services company in the Middle East, full stop,” he says. “Not just for low income workers, we want to be the best for anyone.”

FT Future 25: Middle East

Supported by

Comments