How European investors can ride the bitcoin ETF wave

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

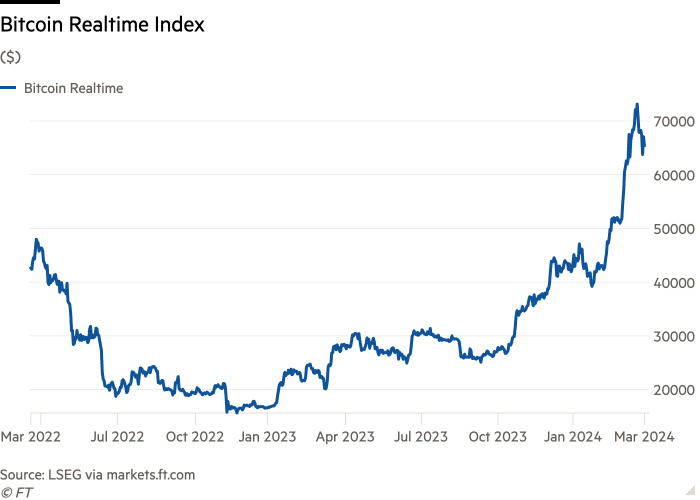

Bitcoin exchange traded funds have grabbed the headlines in the US this year, attracting strong investor interest and — for a time — helping to drive the price of the world’s most popular cryptocurrency to record highs.

Since January, when the US Securities and Exchange Commission approved “spot” bitcoin ETFs — which hold the actual currency, rather than futures contracts on it — 11 have been launched by firms including BlackRock, Fidelity, WisdomTree, and VanEck.

And they have already amassed $48bn of assets under management between them, according to Morningstar data up to March 5.

Frank Koudelka, head of ETF servicing at State Street, says the SEC’s decision and the ensuing rally in the bitcoin price will probably lead to more interest among asset managers, and new funds based on other cryptocurrencies.

“We anticipate the next important date for the expansion of the digital assets universe to be in May, when the SEC will decide on whether to approve a spot ethereum product,” he says.

Europe has had its own spot bitcoin ETF since August last year, when Jacobi Asset Management launched a fund, following approval by the Guernsey financial regulator.

But the Jacobi ETF remains the only bitcoin product investing directly in the currency in Europe, and it is not available to retail investors. It had to be structured as an alternative investment fund, because the standard Ucits structure adopted by mass-market European ETFs cannot be used to hold cryptocurrencies, for regulatory reasons. European retail investors cannot invest in the new US bitcoin ETFs, either.

However, that does not mean they are cut off from investing in bitcoin products altogether.

European asset managers have created other crypto-related exchange traded products over the past five years, and Morningstar data shows these held $12bn of assets at the end of February.

These products can hold digital assets by being structured as exchange traded commodities or exchange traded notes and, technically, they are debt instruments, rather than funds.

Michael Delew, head of capital markets for Europe at WisdomTree, explains that, while an ETP of this kind is not referred to as a fund, it provides a similar investment experience.

“It functions like a fund, has strong investor protections, maintains full transparency of assets, and appoints an independent trustee who holds the legal right to those assets and represents investor interests,” he points out. “Regardless of their set-up, [US ETFs and European ETPs] both provide a flexible and liquid wrapper representing transparent exposure to an underlying asset.”

Koudelka notes that these European products were initially only marketed to institutional investors, due to the nature of the underlying asset. “But we are now increasingly seeing ETC issuers seek approval for retail investment into the ETCs through the secondary market,” he says.

The SEC has mandated that US spot bitcoin ETFs must process their creations and redemptions — ie, buying and selling their underlying crypto assets — by delivering cash in exchange for shares. However, European crypto ETPs are able to exchange their underlying assets for shares, in what is known as an in-kind transaction.

Dellow says in-kind transactions can be significantly more efficient than cash processes, particularly when dealing with digital assets such as bitcoin.

“This can have long-term implications on the performance, trading spreads and security of the product that can have a sizeable effect on overall investor costs and returns over time,” Delew stresses.

He adds that, although investors do not directly deal with the primary market creation and redemption process, the option of in-kind transactions is something they should be aware of when choosing an ETP — particularly when it comes to digital asset products.

But selling these products to investors is not without its difficulties for asset managers.

Martijn Rozemuller, chief executive officer of VanEck’s European business, says marketing and distribution of his firm’s crypto ETNs is usually “relatively straightforward” but can be challenging in some countries — including the UK and Belgium.

“Serving potential clients from the US is complicated, although they now have access to the VanEck Bitcoin ETF, while the Asian and Middle East markets present potential growth opportunities,” he says. “Navigating local jurisdictions is challenging outside of the EU, the majority of our investors are retail investors based in the EU.”

Despite those challenges, the assets held in European crypto-related ETPs have risen by 300 per cent since the end of 2022, Morningstar data shows.

However, a blog posted on the European Central Bank’s website last month said the US regulator’s decision “doesn’t change the fact that bitcoin is not suitable as means of payment or as an investment”. This suggests that while bitcoin products have turned the heads of Europe’s investors, its financial authorities are yet to be convinced they should follow the SEC’s lead.

Comments