We’re asking the wrong questions about stablecoins

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is professor of law at the American University Washington College of Law

In the wake of the collapse of one of the world’s biggest so-called stablecoins, people are asking the wrong questions.

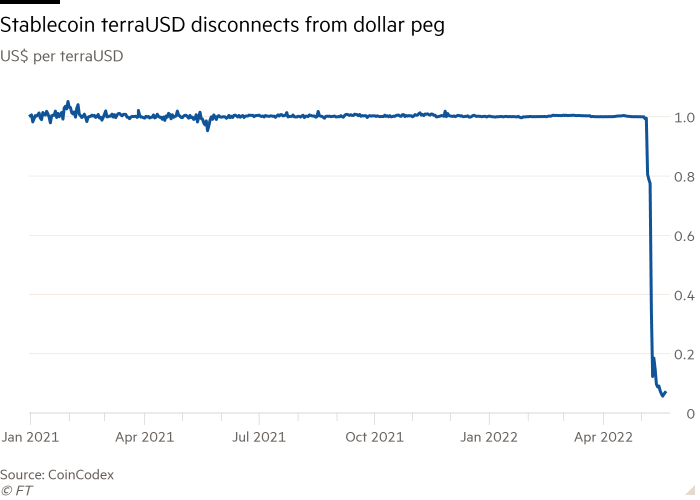

Stablecoins are touted as the safer part of the crypto market, designed to hold a constant value per coin of $1. But it did not work out that way for the recently stricken terraUSD.

Its dramatic failure has raised questions about which kinds of stablecoins are the most stable, and about what guardrails are needed to protect users. These are not the questions we should be asking, though. The real question is: “Should stablecoins even exist?”

Yes, terraUSD had a more fragile structure than some other stablecoins. It was a so-called “algorithmic” stablecoin that sought to maintain a $1 value through a complex relationship with a paired cryptocurrency, luna. Last week, terraUSD plunged in value to under 10 cents as demand for both nosedived.

However, terraUSD’s idiosyncrasies do not mean that other forms of stablecoins are actually stable, nor that there is a place for stablecoins in our financial system.

We often hear that stablecoins are the future of payments, but they aren’t really used to pay for real-world goods and services. We are told by supporters that “it’s early days”, but what could stablecoins ever do that non-blockchain-based payments solutions couldn’t do better?

Blockchain technology needs to involve wasteful computations in order to discourage attacks, so it does not scale well. In addition, blockchains can have data added but not deleted from them, which prevents the reversal of mistaken or fraudulent transactions. It’s hard to see how blockchain payments could ever be faster or more efficient than more centralised alternatives.

Crypto lobbyists may say that these technological limitations are worth it because they get rid of centralised intermediaries. In reality, though, crypto is rife with intermediaries. The biggest stablecoins, tether and USDC, are both issued by centralised intermediaries. TerraUSD claimed to be decentralised, but when things started to unravel, holders looked to the Twitter feed of co-founder Do Kwon — who was clearly calling the shots.

And let’s not forget that to buy stablecoins or convert them back into fiat currency, most users will rely on an exchange, such as the Bitfinex and Coinbase exchanges that are affiliated with tether and USDC, respectively. (The biggest stablecoins are affiliated with the biggest exchanges, which profit from the associated transaction fees).

In sum, stablecoins start with a convoluted and inefficient base technology in order to avoid intermediaries, and then add intermediaries (often with apparent conflicts of interest) back in.

And then there are the negative impacts on those of us who don’t even use stablecoins: the environmental costs of blockchain transactions; ransomware attacks; and the risk of future financial instability caused by stablecoin runs if the sector continues to grow.

Given these fundamental flaws, asking “what guardrails should we put around stablecoins?” is the wrong question. As we’ve learned from experience with bank deposits and money market mutual funds, the only truly effective way to prevent runs and make stablecoins stable is to put a government guarantee behind them. It seems like a truly terrible idea to guarantee something that has no real use case other than facilitating crypto speculation.

One option that should be on the table is banning stablecoins. This is something we already do with other dangerous products, but hasn’t really been part of this debate so far. Maybe that’s because people believe the decentralisation hype, and think that there’s no way to do it. But given how intermediated stablecoins actually are, there are many points through which a ban could be enforced.

Centralised intermediaries could be banned from issuing stablecoins, and centralised exchanges could be banned from trading them. As for the more decentralised stablecoins and exchanges out there, these are typically operated by “decentralised autonomous organisations” or “DAOs” that act based on votes cast by those who hold governance tokens in them.

Authorities could prohibit anyone from holding governance tokens in any DAO that issues or provides services in connection with a stablecoin. Right now, these governance tokens tend to be concentrated in the hands of founders and venture capital firms. Without VC funding, there’s a good chance that stablecoins would disappear — and that we’d all be a lot better off.

Letter in response to this article:

The horses have already bolted from the stablecoin / From Steve Harrison, London SE15, UK

Comments