Mark Carney — a chance to reboot globalisation

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

On a crisp October day in 2008, I sat in the gilded Cash Room of the US Treasury with the other G7 central bank governors and finance ministers. With the financial system in freefall, we’d only made it to the weekend because of a co-ordinated emergency interest rate cut, and there still wasn’t a plan. All we had was a long, garbled communiqué written in toothless G7-speak. I had once slaved over such documents as a deputy. They had their place, but this was definitely not it.

Suggestions that markets would right themselves were shot down. Peer Steinbrück, the German finance minister, recounted that he had met a woman that week in the former East Germany who told him “she’d seen the fall of communism, and now she was witnessing the fall of capitalism”. The focus turned to the only thing that mattered: saving what was left of the system to prevent a depression. A consensus was forged that governments and central banks would unequivocally backstop their banking systems. We had a plan, based on overwhelming force, and it was to be clearly communicated. Finally, all the lessons of crisis management were being applied.

We then headed into a hastily convened meeting of the G20. With the economies of the emerging world being hit by the implosion of the financial systems in developed economies, we had to forge a new consensus for the global economy. President George W Bush spoke well, admitting the mistakes the US had made, vowing to fix things, and then asking for our help. “We will be stronger together,” he emphasised. Humility. Responsibility. Resilience. Solidarity. He won the room.

Mark Carney at the FTWeekend Festival

Watch Mark Carney speak on How to save the planet — and rethink the global economy with the FT's US editor-at-large Gillian Tett, tune into the FTWeekend Festival.

As we walked out, Mario Draghi recounted to me how he had met Mikhail Gorbachev in the early 1990s, when the Soviet Union was asking the G7 for advice on economic reform. Draghi, then director-general of the Italian Treasury, looked at the General Secretary of the Supreme Soviet and thought: “What’s a guy like that doing meeting a guy like me? These Russians must be in more trouble than I thought.” He continued: “Mark, you know what? Right now, I’m thinking exactly the same thing about the Americans.”

The world had moved from boom to bust, G1 to G0. Could the system survive without a hegemon? Only if it could rediscover its values.

What inspiration can we draw for the post-Covid world from those dramatic moments — the last great inflection point for the global economy?

The crisis and its aftermath marked the end of the market fundamentalism in finance that began with the Reagan-Thatcher revolution and which grew to the point where the answer to any market failure was to build more markets and/or to deregulate. As chairs of the Financial Stability Board, Mario Draghi and I were at the forefront of efforts to reform the global financial system. Our aim was a system that once again valued the future, financed innovation and was prepared for action in the event of failure.

The new approach balanced market dynamism with innovative forms of regulation that took into account the needs of the system across regions and over time. As its performance during the Covid-19 crisis has demonstrated, although far from perfect, the financial system is now safer, simpler and fairer. Moreover, the process of developing these reforms points to a new form of international co-operation.

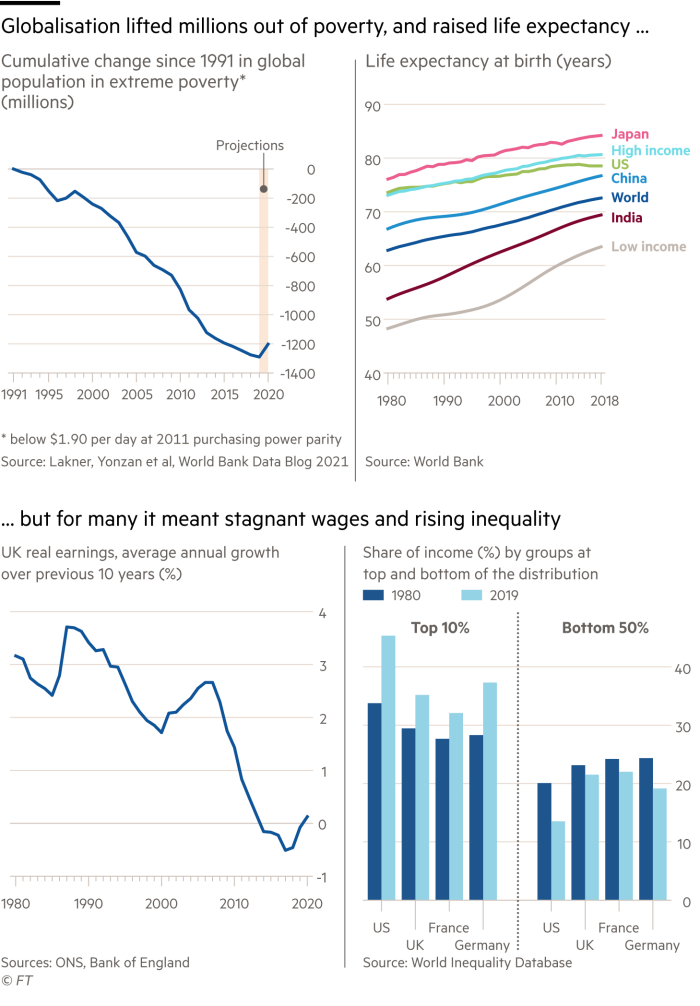

And yet the broader response to what has been a crisis of globalisation has been woefully inadequate. In the past few decades, the freer movement of goods, capital and ideas has lifted more than 1bn people out of poverty, made the sum of human knowledge available to 4bn more and raised global life expectancy by almost a decade. For many, however, such aggregate measures of progress ring false. In too many places, globalisation and breakthrough technologies mean low wages, insecure employment and widening inequality.

The 10 years after the financial crisis marked the first lost decade for real incomes in the UK since the middle of the 19th century. If you substitute digital platforms for textile mills, machine learning for the steam engine, and current dynamics echo those of that era. Then, Karl Marx was scribbling The Communist Manifesto. Today, radical blogs and viral tweets voice similar outrage.

Now, along with Covid, new forces are intensifying these concerns. The climate transition will require enormous and rapid structural change. If it’s similar to previous periods of technological upheaval, our Fourth Industrial Revolution will lead to a long period of difficult adjustment and rising inequality before increases in productivity, wages and jobs. The Covid crisis is already accelerating this transformation — even while it deepens existing inequalities.

The traumatic events of this past year have generated arguments to nationalise medical supply chains, restrict the sale of key technologies and form carbon clubs of like-minded countries. Whatever their merits, these policies spring from the same root: citizens resist the pooling of sovereignty that openness requires because they no longer believe it is in their best interest.

If we want to preserve the important gains of the past decades of growth and realise the promise of new technologies, structural change will need to be managed for all and welcomed by all. We need to fashion a renewed global economy founded on new dispersed networks of trade, capital and ideas that harness the creativity of billions of people, who will share fully in its rewards.

There are four pillars of this new order: resilience, solidarity, connectivity and sustainability.

For economies to remain open, they must be resilient. Just as the Bank of England and FSB plan for macro-financial risks domestically and internationally, we need a similar architecture for non-financial risks, from climate change to Covid.

We have to plan for failure. Stress tests and war games are valuable not because they predict future calamities but because they build current capacity. The BoE’s preparations for Brexit built buffers, reserves and contingency plans across the financial system that were quickly repurposed when the pandemic struck.

Building resilience means building buffers. Banks now carry much more capital and liquidity. Pandemic preparedness requires PPE stockpiles, the capacity to test and trace and the ability to produce vaccines. Digital resilience means putting in place cyber defences, and contingency plans if those defences fail. No buffers can insure against climate risks, however; the only protection is immediate action.

The most important buffer is fiscal capacity. Budget choices are often talked about in terms of the sustainability of debts or the amorphous dictates of the markets. They are really about the sustainability of people’s livelihoods. Over the past year, people have needed extraordinary support. As we exit these measures, the best support will be policies that drive broad-based growth. That means tapering emergency Covid schemes, focusing on regenerating the most affected industries, balancing current spending over the medium term, and concentrating investment on physical, digital and in particular climate initiatives that are job heavy and capital intensive.

To be clear, this does not herald the return of the Big State. It is about building the supporting infrastructure for the two great re-wirings of our economies: the digital revolution and the sustainable transformation. This requires credible, predictable regulatory policies, such as future paths for carbon taxes, mandates for hydrogen fuels and moratoria on internal combustion vehicles. And it must include a series of measures to empower people to participate fully in the economy — solidarity through regeneration, not by redistribution.

An extension of the long period of wage stagnation for swaths of people is neither morally justified nor politically sustainable. Our test should be that everyone’s real earnings and prospects grow over their lifetimes. To pass it, we need to focus on how technologies can increase the skills of existing jobs, and how workers can build their skills for the jobs of the future.

As a society, we need to choose to be “digital by design” — leveraging new technologies to create new jobs and better communities — rather than “digital by default”, letting technology drive our choices. We can start by valuing the outcomes that we want technology to help achieve, such as reducing carbon and raising labour income. Remarkably, most tax systems favour investment in machines and software over people. Regulation, public investment and tax policy should incentivise technology to support labour rather than supplant it.

Most fundamentally, there needs to be a radical rethink of life-long learning. During the first three industrial revolutions, the skills of workers were transformed by the advent of primary, secondary and tertiary education, respectively. Now, we need to institutionalise retraining in mid-career — quaternary education — and integrate it with the social welfare system.

After the tragedy of education under Covid, where poor broadband access meant that many children struggled, it should be clear now that universal, affordable and fast internet access is a right. We should explore all options, including ambitious low Earth orbit satellite systems that leapfrog existing technologies, not least because, in a world where remote working is increasingly possible, the potential of the revolution in information and communications technology to “level up” can finally be realised.

Greater global connectivity can drive an explosion in access to opportunity by bringing billions of people on to new platforms of global commerce. But that will require a new international architecture that can draw on what went right after the financial crisis.

This century’s crises have strained the old, rules-based international architecture to breaking point. It has become increasingly difficult to reconcile democratic accountability with binding rules to govern the global flow of trade, capital and ideas. The experience of financial reform suggests that multilateralism can still be powerful and effective. In response to the charge of G20 leaders, hundreds of reforms were developed at the FSB and then implemented in national jurisdictions through a sense of common ownership and mutual reliance.

The FSB has succeeded, when others from trade to peacekeeping have struggled, because it has a clear mission with political backing and brings the leaders of the right agencies around the table. Country buy-in of FSB standards is created because they helped to develop those standards, not because they are forced on them by treaty obligations. Standards are tailored to national circumstances, but common outcomes on financial stability are relied on to support openness.

By pursuing such co-operative internationalism, there are several ways nations can build new networks for a more inclusive, resilient and sustainable globalisation.

First, free trade in services. The playing field between trade in goods and services is uneven, with barriers to services trade currently up to three times higher than that of goods. Bringing these barriers into line could halve global current account imbalances. And doing so can help make growth more inclusive as services account for a 10 percentage point larger share of women’s employment than men’s.

Liberalising services is not straightforward, as barriers are typically not tariffs but “behind the border” differences in regulatory standards and trading conditions. That is why the experience with financial services is so relevant. FSB reforms have helped maintain financial market openness by giving national authorities the confidence to rely on each other.

Crucially, a co-operative approach to services trade could be an effective way to leverage the explosion of digital service provision during the pandemic. Freer trade in services can spread opportunity globally, provided comparable standards achieve broadly similar results.

Second, after decades of “multinational” trade deals, the time has come for free trade for small and medium enterprises. They are the engine rooms of most economies, yet they account for only a fraction of exports. A large part of this underrepresentation reflects the much higher costs of doing business across borders — from regulation to the costs of transferring money. Like-minded countries can leverage platforms, such as Shopify, Tmall, Etsy, Amazon, that are at the heart of the new economy. These platforms give smaller businesses direct stakes in local and global markets, allowing them to bypass big corporates in a form of artisanal globalisation that can drive inclusive growth.

To spread opportunity, the priority should be to eliminate tariffs for SMEs and focus on broadly comparable outcomes, such as for product quality, rather than obsessing over exact duplication of standards. These efficiencies can be reinforced by using the rich data of the platform economy to improve SMEs’ access to finance and reduce the carbon footprint of fulfilment. In parallel, new central bank digital currencies can transform financial inclusion, dramatically lower the costs of domestic and cross-border payments and, by integrating with smart contracts, track carbon across value chains.

This points to a third set of networks that can turn the existential threat of climate change into the greatest commercial opportunity of our time. The investment required is enormous, reaching $100tn over the next three decades, with the majority of it needed in the emerging and developing world. This can only be achieved by the rapid growth of private finance.

Companies are increasingly addressing sustainability across their operations, including their suppliers, distributors and consumers. This focus will spur substantial green investment in developing countries. Free trade for SMEs and faster digital payments can all reinforce these incentives and further boost capital flows.

In parallel, company net zero plans are driving demand for carbon offsets as a complement to their primary focus on absolute emissions reductions. The current carbon offset market is tiny, opaque and of uneven quality. Now a large group of stakeholders — under the Institute of International Finance’s Taskforce on Scaling Voluntary Carbon Markets, chaired by Bill Winters — is developing a large-scale, high-integrity carbon offset market. When proper governance, increased transparency and robust market infrastructure are combined with a relentless focus on the integrity of the supply and demand of carbon offsets, investment flows could reach $100bn a year. Demand will overwhelmingly be from companies in advanced economies for investments in projects in the emerging and developing world.

Finally, the world needs to rapidly expand blended finance, which combines public and private capital, to maximise impact. With proper structuring, billions of dollars of risk capacity at multilateral development banks, such as the World Bank and African Development Bank, can support trillions of dollars of private investment in emerging and developing economies. With momentum growing for the core of the private financial sector to commit to net zero carbon emissions, now is the time for the G20 to ensure that all development finance institutions are fully Paris Agreement-aligned.

COP26, the UN Climate Change Conference, this November in Glasgow can be the watershed in a new, more inclusive and sustainable global economic system. A financial system that has the information, tools and markets so that every decision takes climate change into account. A system that turns billions of dollars of public money into trillions of private investment in climate solutions. A global economic system where national commitments and international co-operation harness the power of new technologies, from renewable energy to AI, to accelerate the transition to net zero.

When I was a student and took the bus from Oxford to London, I would always look out for a landmark — a terraced house just outside the university town where a man had installed a sculpture of a shark attacking his roof. Triggered by the Chernobyl disaster, the display expressed feelings of “impotence and anger and desperation” at how challenges from abroad could quickly become local.

Over the years, I have often thought of that shark because, of course, it isn’t just nuclear fallout that spreads across borders. We cannot just withdraw from the world and hope sharks won’t attack. Covid will not be over anywhere until it is over everywhere. We cannot self-isolate from climate change. Rather than confuse independence with sovereignty, we must design a new form of international co-operation to serve the needs of the many, not the few. With such a renewed globalisation founded on the pillars of resilience, solidarity, connectivity and sustainability, all can thrive.

Mark Carney is the UN’s special envoy on climate action and finance, was the governor of the Bank of England from 2013 to 2020, and is the author of ‘Value(s): Building a Better World for All’, published by William Collins

All photographs shot by Harry Mitchell in London’s financial districts in March. Data visualisation charts by Keith Fray and Ian Bott

Follow @FTLifeArts on Twitter to find out about our latest stories first

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here

Letters in response to this article:

Like a rallying cry beloved of disaffected Trotskyists / From Tom Carver, Washington, DC, US

Comments