Investors bet on European consumer stocks as economic confidence grows

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors are buying up European travel, retail and luxury goods shares, betting that a rebound in the region’s economy will tempt consumers to spend on more on holidays and expensive items.

Carmakers Renault and Stellantis have risen more than 25 per cent since the beginning of February. German entertainment group Eventim is up 23 per cent and Danish jewellery maker Pandora up 15 per cent in the same period, as fund managers bet pessimism over European economic growth is overdone.

Fund managers’ enthusiasm for stocks linked to discretionary spending has in part been driven by growing confidence that central banks have successfully tamed inflation without pushing economies into a downturn.

“It does feel like we’re getting to the light at the end of the tunnel,” said Dan Boardman-Weston, chief investment officer at BRI Wealth Management. “Consumer confidence has risen, granted from a very low base, [ . . . ] and the European Central Bank is clearly expected to cut rates in June, which will provide more relief.”

The gains have propelled the Stoxx indices of European consumer discretionary shares and carmakers up 10.3 per cent and 14.5 per cent, respectively, this year.

They have also helped broaden the benchmark Stoxx Europe 600’s rally, which had largely been driven this year by a small cluster of megacap stocks.

BRI Wealth Management said it favoured retailers and luxury groups in Europe as the region’s economic outlook starts to “look a bit brighter”.

John Goetz, co-chief investment officer of Pzena Investment Management, said valuations on European consumer stocks had fallen to appealing levels.

“We’re only paying for a very dark outlook so if some sun turns up: cool!” he said. The US fund manager has stakes in French tyremaker Michelin, hotelier Accor and German carmakers Volkswagen and Porsche. “Anything in Europe touching the consumer that’s auto-related is very very cheap”, Goetz said.

Analysts said a fall in natural gas prices, a crucial fuel for many European consumers, had also contributed to better than expected economic performance.

Last month, gas prices fell to a level last seen before Russia started to curtail supplies to Europe in 2021. Declines have come as a mild winter, falling demand and strong imports of liquefied natural gas eased traders’ fears of a shortage.

Luca Paolini, chief strategist at Pictet Asset Management, said: “If you think about the fall in inflation, the fall in gas prices, and the fact that you still have a lot of excess savings, which you don’t have in the US, you can certainly make the case for the European consumer.”

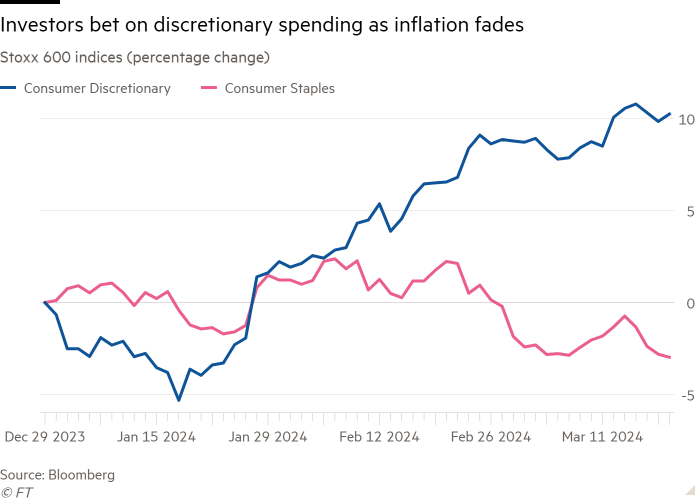

Pictet began to buy more consumer discretionary stocks and cut back on consumer staples at the beginning of March to benefit from what Paolini called “the potential for a positive surprise” in personal spending in Europe.

These stocks are a relatively safe bet, Paolini said, because the companies that would profit most from rising consumer strength in Europe would also benefit from continued resilience of consumers in the US, offering secure returns even if Europe’s economic recovery falters.

Retailers lagged behind the broader Stoxx Europe 600 at the beginning of 2024, as market gains were driven by large healthcare and technology companies, but the sector began to rise in mid-February.

At around the same time, Goldman Sachs increased its recommended allocation to European consumer, travel and leisure stocks. Sharon Bell, a senior equity strategist at the bank, said the sectors “will be the obvious beneficiaries of a pick-up in consumption in Europe”.

Strategists also point to improving European business activity surveys, which are considered a leading indicator of economic growth.

S&P Global’s flash eurozone composite purchasing managers’ index — which measures business activity across the bloc — rose to an eight-month high of 48.9 in February, as growth in services offset declines in manufacturing production. The reading was below the threshold of 50, which separates a contraction from expansion, but an improvement from a low of 46.5 in October.

Citigroup’s European economic surprise index also turned positive in February for the first time since May. The benchmark measures how economic data compares with expectations, and a positive reading indicates market expectations are now consistently weaker than the published figures.

Some of the optimism even extends to the UK’s underperforming stock market, which has risen just 0.1 per cent in 2024, compared with an 8.7 per cent gain for France’s luxury-heavy CAC 40 and a 7.4 per cent gain for Germany’s Dax.

“The UK, if anything, has got a tighter labour market than the rest of Europe and lower unemployment,” said Goldman Sachs’ Bell. “You’ve got energy prices coming down, sterling going up, and rates potentially coming down. All of that mix is good.”

Others, however, remain unconvinced. Bank of America argues Europe’s economy remains fragile and will weaken as the effect of the ECB’s rate rises continues to feed through.

Andreas Bruckner, an equity strategist at the bank, said carmakers and banks “look most vulnerable” to a slowdown.

He recommended clients invest in consumer staples such as food and beverage and chemicals stocks, which have underperformed the wider market this year.

“The full negative impact of the aggressive monetary tightening has yet to be felt and will eventually trickle through to the consumer,” Bruckner said. “Things may be fine now but we would see this as a false dawn.”

Comments