US venture capital fundraising hits a 6-year low

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

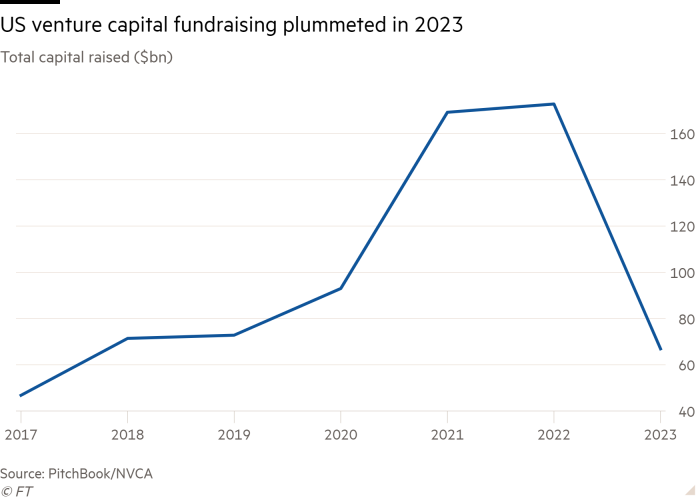

Fundraising by US venture capital firms hit a six-year low in 2023, an ominous sign for start-ups with dwindling cash reserves and fledging businesses reliant on such backing for survival.

The $67bn raised by US VCs in 2023 is the lowest annual total since 2017 and represents a 60 per cent drop from the $173bn raised in 2022, the peak year for fundraising, according to analysis by private markets data provider PitchBook and the National Venture Capital Association.

Globally, in 2023 venture investors raised the lowest level of capital since 2015.

The sharp decline ratchets up pressure on start-ups, which have endured a funding drought over the past 18 months. VCs are reluctant to pour more cash into businesses they backed at the top of the market while private tech valuations are falling.

Kyle Stanford, lead VC analyst at PitchBook, said: “The bottom still feels a ways off. A lot of these companies that are still private will still struggle, we’ll see a lot more down rounds and a struggle to exit. There’ll be a lot of competition for the money that’s available.”

VCs have struggled to raise new funds as their own limited partners — institutional investors such as pension funds, insurers and university endowments and foundations — pull back because of rising interest rates, which have made risky tech bets a costlier proposition.

A number of prominent venture investors, including Insight Partners and Tiger Global, lowered fundraising targets to reflect the tougher environment last year.

That in turn has given US VCs less fresh capital to deploy. Last year, they invested a total of $171bn, according to PitchBook and the NVCA, less than half the amount they spent in 2021.

As well as a reduction in investment from limited partners, US VCs are contending with a sharp slowdown in start-up exits, such as initial public offerings or acquisitions, which is hampering their ability to return capital to their backers.

The value created by start-up exits in the US last year was just $61.5bn, compared to a 2021 peak of $797bn, according to PitchBook and the NVCA. In Europe, start-up exit value amounted to less than €12bn across the year, the lowest level for a decade.

The downturn is increasing the pressure on start-ups that spent last year burning through cash raised in 2021 and early 2022. As those companies run out of road, founders and existing investors are more likely to accept harsher terms for new funding, according to Peter Hébert, co-founder of US venture fund Lux Capital.

“The days of Band-Aids and hope are behind us, and people are accepting the new reality,” he said. “For new financings, you’re starting to see the presence of bids that are low. [In 2023] people were embarrassed to have that conversation, now everyone is becoming more constructive.”

This will also be the year in which VCs abandon poor performers, predicted Hébert: “It’s been two years of internal bridging. Now VCs are saying to companies: ‘I’m sorry we’ve gone as far as we can.’”

Late in 2023, a trickle of start-ups once valued at $1bn or more started to collapse. Among them were trucking start-up Convoy and healthcare company Olive, both valued at about $4bn at their peaks. Electric scooter company Bird, once valued at $2.5bn, also filed for bankruptcy in December.

Roughly one in six start-ups raising cash last year cut their valuations, according to PitchBook. That move is typically anathema for founders and investors who prioritise growth above all else, but Stanford expects that proportion to increase dramatically in 2024 as founders run out of other options.

As valuations fall towards a level that new investors can stomach, deal volume is likely to increase, said Hébert: “Those with capital are king in this market.”

Thanks to bumper fundraising years in 2021 and 2022, some venture firms have accumulated sizeable funds, which they have been reluctant to invest into a declining market.

Similarly, some cash-rich start-ups have chosen to wait for more certainty before making their next move. Nick Schneider, the chief executive of $4.3bn cyber security firm Arctic Wolf, said in an interview with the Financial Times that he would wait for as much clarity as possible on market conditions before launching a long-anticipated IPO.

Comments