Is the last mile really the hardest?

Simply sign up to the Central banks myFT Digest -- delivered directly to your inbox.

This article is an on-site version of our Chris Giles on Central Banks newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday

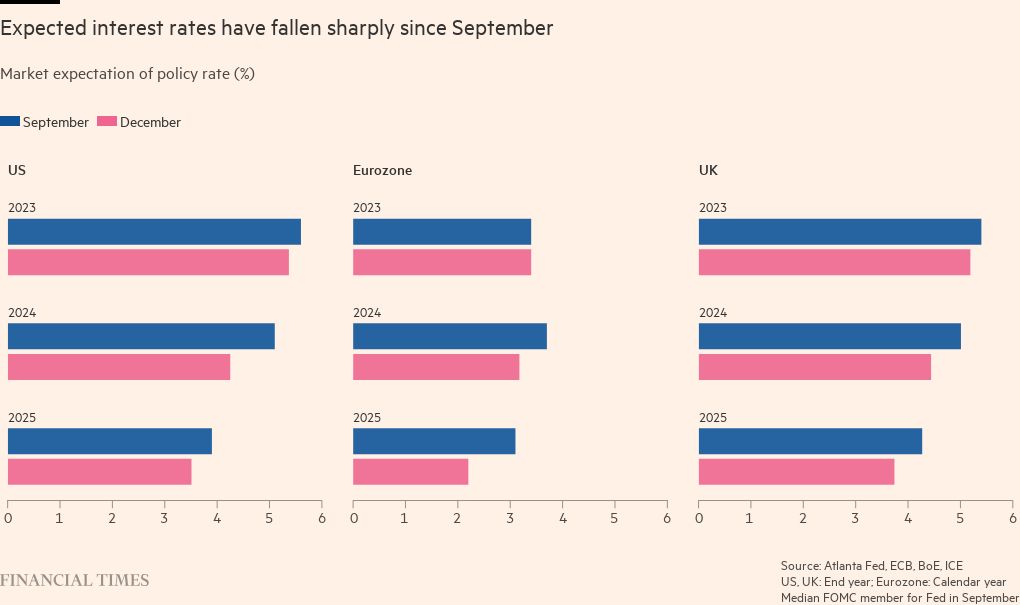

Three leading central banks meet this week to set interest rates with the Federal Reserve due to give its verdict on Wednesday, followed swiftly by the European Central Bank and Bank of England on Thursday. None will change interest rates. All three are likely to resist financial market optimism over the speed and degree of rate cuts. I show just how far market expectations have moved since September in a chart that matters below. Next week, I’ll assess who won in this battle of wills between central bankers and traders.

Today, I want to look at the evidence behind the idea that reducing inflation will become harder as we get closer to the 2 per cent target. As you will see, I’m on the fence on this one. What do you think? Email me: chris.giles@ft.com

The last mile

If there has been one metaphor that leading central bankers have used most often recently to describe inflation reduction, it is the running analogy that the last mile is the hardest. The idea is that bringing inflation down from a peak to around 3 per cent is relatively easy, but completing the job and sustainably achieving a 2 per cent inflation target is harder. Here are some examples of the idea in action:

Fed chair Jay Powell in his November 1 press conference:

“As you get further and further from those highs, [reducing inflation] may actually take longer”

Isabel Schnabel, ECB executive board member, in a November 2 speech:

“In long-distance running, the last mile is often said to be the hardest. With the finish line within reach, one must push even harder to achieve the long-held goal. The same could be said about tackling the last mile of disinflation.”

BoE deputy governor Sir Dave Ramsden giving evidence to the UK parliament on November 21:

“There is this phrase, ‘the last mile is the hardest’. We have inflation coming back to 3 per cent by the end of next year, but then it takes another year to get to 2 per cent. That comes back to this persistence issue that [BoE governor] Andrew [Bailey] is emphasising.”

I don’t want to be a boring metaphor pedant here, but, having run three marathons, the last mile is far from the hardest because the finishing post is in sight. And in a welcome deviation from this cosy central banker consensus, the gloriously straight-talking Chicago Fed governor, Austan Goolsbee, broke ranks this month at his regional Fed’s economic symposium (eight minutes in) when speaking about the reduction in US inflation:

“I just don’t get that. There’s no evidence we’ve stalled at 3 per cent. Look at the 1 month, 3 month, 6 month [annualised] inflation, it didn’t stall at 3 per cent because it’s working through in the way that we anticipated.”

The question about the last mile, therefore, lies at the heart of monetary policy strategy. Here is some relevant evidence, followed by my nuanced answer.

Sub-par growth

Inflation often drops quickly at first when some large initial price rises fall out of the 12-month comparison — for example in March 2023 in the eurozone when the annual rate fell to 6.9 per cent from 8.5 per cent in February. Further falls can become more difficult when the remnants of inflation must be squeezed out of the system with sub-par growth ultimately preventing companies from raising prices for fear of a sharp reduction in demand.

These Phillips curve arguments — that economies need a period of sub-par performance to force inflation lower — support the last mile thesis. The current difficulty here is that improved supply performance, either through higher labour force participation (US) or lower energy prices (Europe), can allow “sub-par” economic growth even when actual growth numbers are not particularly low.

In any case, eurozone and UK growth rates have been hovering around zero and the latest indications suggest US growth has slowed in the fourth quarter. It all suggests economies are already in the last mile, so it might not be such a difficult prospect.

Historical evidence

The best corroboration of the last mile thesis comes in a recent IMF working paper that looked at more than 100 inflation shocks since the 1970s. The big fact in the paper was that inflation was successfully brought back down within five years only in 60 per cent of the episodes studied. The median time it took for resolution was three years.

The authors reasonably conclude from this meticulous historical effort that inflation is generally quite persistent, there are often premature celebrations of its defeat and that fiscal and monetary tightening are valuable in slowing price rises. Although these policies lower nominal wage growth and economic growth in the short term, this disappears after five years.

The problem with the paper (apart from reasoning too much from the 1970s) is that inflation took off in early 2021 and we are talking about ending the episode sometime in 2024 after a significant monetary tightening. This is exactly the median timescale of successful past inflation resolutions alongside appropriate policy.

Apart from cautioning central bankers not to dance a jig, the findings are therefore weak in cautioning about the difficulty of the last mile in 2024.

Sticky wage growth

It is crystal clear that recent wage growth numbers — a 5.2 per cent rate in the US on the Atlanta Fed index in October, a 4.7 per cent third-quarter negotiated rate in the eurozone and 7.3 per cent rise in regular pay in the UK in the three months to October — are not consistent with 2 per cent inflation targets if they persist at these levels. Productivity growth is not strong enough. Were these wage growth rates to persist, the last mile of inflation reduction would indeed be extremely difficult.

But wage growth at these levels, especially in Europe, is partly a lagged catch-up response to previous domestic price growth. That means it is not inherently inflationary so long as it soon stops. Here, the jury is out. Central bankers have due cause to be cautious. Until they know that wages are growing at sustainable rates and their real level is close to pre-pandemic benchmarks, they should worry about the last mile. Those real wage levels need, of course, to be adjusted upwards for productivity growth and downwards for the relative growth in the price of imports.

Inflation expectations

If companies and households expect higher inflation to continue, they will raise prices and wages in what can become a difficult spiral or ratchet, making inflation reduction more difficult.

Corporate and household surveys of inflation expectations have been relatively well behaved. Although still elevated, the University of Michigan year-ahead expectation of inflation for the US plunged from 4.5 per cent to 3.1 per cent in the December report, with the five-year inflation expectation dropping from 3.2 per cent in the November data to 2.8 per cent in December.

Eurozone figures have been a bit more sticky, while those in the UK were a bit muddled. The UK has better statistics on business expectations of price growth in the year ahead, which have fallen from 6.2 per cent last November to 4.4 per cent a year later.

Expectations are often heavily influenced by inflation data. The latest evidence on prices is encouraging globally with 53 per cent of inflation data for October lower than economists expected and another 25 per cent in line. So, although some of the data is noisy, expectations evidence is rather encouraging for the last mile of disinflation.

Shocks

I’ve heard some officials talk about the risk of new shocks, such as an escalation of the war in the Gaza Strip, threatening price stability and the defeat of inflation.

Since central bankers correctly said they could neither predict nor have any effect on the global shocks raising inflation, it makes no sense to use the threat of future shocks as a reason to predict inflation will stay higher for longer.

It’s a difficult one

It is important to come to a view and mine is nuanced. I am not especially persuaded by the concept of a difficult last mile, the need for additional sub-par growth or the historical evidence. But it is clear to me that wage growth, expectations and the possibility of premature celebration suggest that now is a time for some caution. The worst mistake would be to allow high inflation to persist for too long. I fully expect the Fed, ECB and BoE to come to similar conclusions this week even if, deep down, they and I might think this inflation episode is probably over.

What I’ve been reading and watching

Andy Haldane uses the correct economic jargon, saying that central bankers have a time consistency problem when trying to persuade people that rates will stay higher for longer. It is the same point I made in blunter terms last month, when asking whether we should believe central bankers.

Pork prices in China are crashing. Bad news for livestock farmers, but great news for Chinese consumers. These have pushed the Chinese CPI to -0.5 per cent, not a deflation yet to be concerned about.

Just as financial markets are expecting cuts in interest rates in the US and Europe, they have become convinced that Japan will buck the trend and end its negative rates policy soon, sending the yen to a three-month high.

Talking of currency movements, I wrote my column on how we should not be fooled by statistics showing the US as the world’s largest economy based primarily on a strong dollar.

If you want lunch with my brilliant colleagues (I have time off for good behaviour this year) and to raise money for good causes, do place a bid here.

A chart that matters

Financial markets now firmly believe rapid interest rate cuts are coming. In September, they were not sure.

Comments