Chinese investors buy gold as property and stock markets fall

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese investors and households have been buying gold as a refuge from local property and stock market mayhem, helping to support record prices for the haven asset.

China was the principal bright spot globally for gold jewellery and investment flows in 2023, according to industry group the World Gold Council’s quarterly report, as local property, equity and currency markets disappointed following the country’s exit from Covid-19 lockdowns.

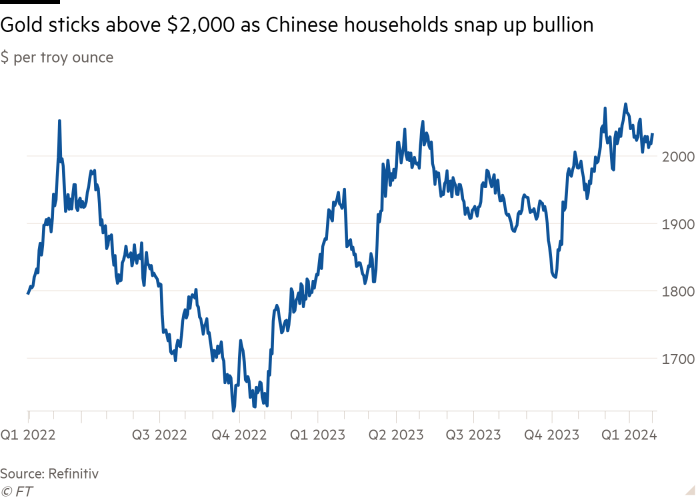

Together with “blistering” demand from central banks, according to the WGC, Chinese demand helped push the gold price to record highs last month and keep it above $2,000 per troy ounce this year.

Chinese investment demand for gold — spanning bars and coins — grew 28 per cent to 280 tonnes, largely offsetting a steep drop in Europe. The country’s jewellery consumption rose 10 per cent to 630 tonnes last year, even as global demand remained flat.

“China was key to a lot of what was happening last year,” said Louise Street, senior markets analyst at WGC. “When you look at the consumer sector, China is not the price-setting factor but it is providing a floor.”

The country’s CSI 300 equity index has fallen more than a fifth in the past year, while the value of new home sales among the country’s biggest developers in December was down 35 per cent from a year earlier.

Chinese investors face an “ugliness contest” over where to put the huge level of savings they have accumulated during the pandemic, according to Colin Hamilton, analyst at BMO. “Gold exposure has become a necessity for Chinese portfolios as they continue to expect disinflation and income uncertainty,” he said.

Analysts at UBS said Chinese demand had been “under-appreciated” as a factor driving gold prices.

Overall, gold demand slipped 5 per cent to 4,448 tonnes last year, cooling off from a strong 2022, according to the WGC report. However, after incorporating over-the-counter and stock flows — which capture an opaque source of buying by wealthy individuals, sovereign wealth funds and futures market speculators, as well as changes in exchanges’ inventories — annual demand was at its highest on record at 4,899 tonnes.

The record demand levels and soaring prices for gold have come despite interest rate rises last year, which increased the attractiveness of bonds relative to the non-yielding asset. That helped push investment demand for gold to a 10-year low of 945 tonnes.

But offsetting that weakness in investment demand was central bank buying led by China, Poland and Singapore, which helped keep net purchases above 1,000 tonnes.

However, more than half of the central bank buying was attributed to mystery buyers, as official financial institutions conceal the true volume of purchases from the IMF or use other sovereign vehicles to acquire the gold.

BMO’s Hamilton said gold was in a “new era”, having broken its correlation with real rates and instead being driven by central banks and Chinese household asset allocation.

“Surging demand in gold’s number one consumer nation shows no sign of letting up,” said Adrian Ash, director of research at BullionVault, an online precious metals investment service.

Comments