Global stocks rise as markets digest Bank of Japan policy change

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

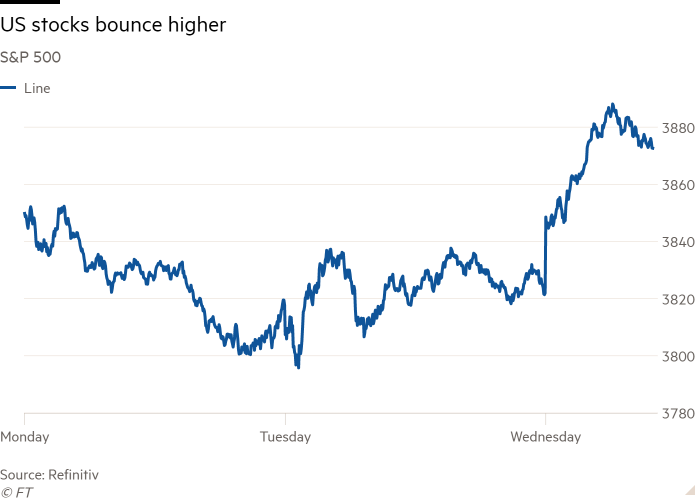

Stocks climbed on Wednesday and global bond markets steadied following a heavy sell-off sparked by the Bank of Japan’s unexpected decision to relax its policy of pinning yields close to zero.

On Wall Street, the S&P 500 and tech-heavy Nasdaq Composite each added 1.5 per cent. Stocks were given a boost early in the trading session after a report showed US consumer confidence rebounded to its highest level in eight months.

European stocks also rose, with the Stoxx Europe 600 index closing 1.7 per cent higher.

The gains came as stability returned to most government bond markets, which on Tuesday were rocked by the BoJ’s announcement that it would allow 10-year Japanese yields to climb as high as 0.5 per cent, compared with 0.25 per cent previously.

Although prices of Japanese debt continued to fall, the yield on the benchmark 10-year US Treasury crept down 0.01 percentage points to 3.67 per cent, having earlier risen as high as 3.72 per cent. Lower yields reflect higher prices.

The yield on the 10-year UK gilt dipped 0.05 percentage points to 3.56 per cent, while the 10-year Bund yield was steady at 2.3 per cent.

BoJ governor Haruhiko Kuroda stressed Tuesday’s move was not a shift away from Japan’s ultra-loose monetary policy, but investors sensed a crack in the central bank’s resolve to stand apart from the global dash to higher interest rates.

“The BoJ has taken a first step toward tighter monetary policy,” said Ulrich Leuchtmann, currency strategist at Commerzbank.

The yen was 0.5 per cent weaker on Wednesday at 132.3 to the dollar, following a rally of almost 4 per cent on Tuesday.

The currency was likely to strengthen further as Japanese investors sold dollar holdings to buy Japanese debt, drawn by the rise in yields, said George Saravelos, strategist at Deutsche Bank.

“The BoJ policy shift (despite governor Kuroda’s claims to the contrary) should start to put the Japanese wall of money to work,” Saravelos said. “There is a lot to move.”

The BoJ’s decision came after US Federal Reserve chair Jay Powell said there was “more work to do” in taming US inflation after increasing interest rates last week, while Christine Lagarde, president of the European Central Bank, said it was “not done” raising rates.

“The Fed, ECB and BoJ have all delivered hawkish surprises over the past week,” said Steve Englander, head of G10 FX research at Standard Chartered, pointing out that recent moves by the world’s most influential central banks had added a “risk-off flavour” to markets heading into the Christmas period.

Additional reporting by Nicholas Megaw in New York

Comments