Hedge funds oppose SEC’s reform plans after GameStop debacle

Simply sign up to the US financial regulation myFT Digest -- delivered directly to your inbox.

Hedge fund managers fear the painful losses they suffered in the meme stock trading frenzy of January 2021 will be repeated if US regulators press ahead with reforms to securities lending, one of the most opaque practices in financial markets.

Melvin Capital, Light Street and White Square all lost heavily when their bets against meme stocks, such as the struggling video game retailer GameStop, were pulverised by retail investors who swap trading ideas on bulletin boards such as Reddit’s r/wallstreetbets.

But the extreme volatility unleashed in the meme stock battle alarmed the Securities and Exchange Commission, the US financial markets regulator which is determined to prevent a repeat of the debacle.

Gary Gensler, the SEC chair, said in November that it was time to bring securities lending “out of the dark”.

The SEC has proposed extensive reforms to securities lending arrangements which allow hedge funds to pay a fee to borrow stocks and bonds in order to bet that an asset will fall in value — the process known as “short selling”.

Lenders and lending agents will together pay about $375m in initial costs and $140m annually thereafter to comply with the proposed reporting requirements, according to the SEC.

But the drastic changes in reporting and disclosure standards planned by the SEC have triggered opposition from hedge funds and other key players in securities lending, including BlackRock, the world’s largest asset manager.

Jennifer Han, head of regulatory affairs at the Managed Funds Association, the Washington-based trade body that represents hedge fund managers, said the SEC’s proposals were “misguided” and could create more meme-stock style volatility “leading to situations similar to the GameStop market event”.

Han said the MFA was “strongly concerned” that other market participants would be able to reconstruct or reverse-engineer a hedge fund’s trading strategy if the SEC insisted on highly detailed reporting of securities lending transactions, even if this information was anonymised.

Similar objections were voiced by the Alternative Investment Management Association, the London-based trade body that represents hedge funds and private credit managers with combined assets of more than $2tn.

The SEC’s proposals would allow other traders to “front-run or short squeeze” hedge funds that wanted to bet against a company’s stock, said Jiri Krol, head of government and regulatory affairs at Aima.

Several hedge fund managers said they saw little upside in talking about their short positions in the current environment. David Einhorn, founder of Greenlight Capital, which made big bets against Tesla and Lehman Brothers, has sharply curtailed his public discussions around his short positions. Einhorn declined to comment.

But Carson Block, the founder of Muddy Waters Research, said the new reporting requirements would benefit all market participants by “making it easier to gauge scepticism about a company and its propensity to be driven upward in a short squeeze, GameStop being the modern day poster child”.

Demand from hedge funds pushed the cost of borrowing GameStop shares to more than 100 per cent during the second quarter of 2020 — an exceptionally high level. By contrast, average lending fees on other US securities were around 1.5 per cent at the same time.

Revenues from lending GameStop shares reached $121.7m over the 18 months ending June 30, according to the data provider IHS Markit.

The SEC said that the high costs required to borrow GameStop shares could have constrained short sellers and contributed to a price bubble.

Many ordinary investors also lost out when the GameStop bubble popped and the value of the retailer’s shares collapsed from an intraday high of $483 in late January 2021 to $40.59 by mid-February.

“Speculators are not the only ones harmed when a bubble collapses. There is collateral damage to innocent bystanders including buy-and-hold retirement investors in index funds,” said James Angel, a finance professor at Georgetown University’s McDonough business school.

One of the SEC’s most contentious proposals is that all lenders of securities should be required to provide details of their transactions within 15 minutes to a central regulatory body, most likely the Financial Industry Regulatory Authority, which will publish some of the data.

BlackRock, which earned $555m from securities lending last year, said intraday reporting would provide “low informational value” to the SEC while imposing significant additional costs on lenders. BlackRock wants the deadline for reporting to be shifted to the close of the following trading day.

Better Markets, a Washington-based think-tank, warned that high-speed traders would be able to exploit the delay in reporting transactions and said shortening the deadline would be “eminently feasible without adding significant cost”.

Stephen Hall, legal director at Better Markets, urged the SEC not to dilute its proposals.

“The financial industry often seeks to weaken or eliminate regulations by arguing that the [proposed] requirements will have a devastating impact on their business which will in turn harm the public interest. These types of claims are typically exaggerated if not entirely groundless,” said Hall.

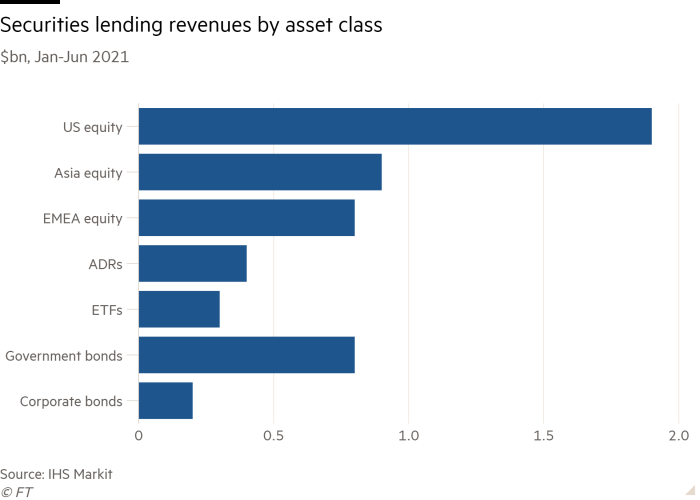

The scale of the business that could be affected is widely unappreciated.

IHS Markit reported the average daily value of US equities on loan at $540bn in the first half of 2021, compared with $428bn for the whole of the previous year. This created a revenue pool worth $1.9bn in the first half of last year and $3.3bn over the whole of 2020.

According to the SEC, the value of all securities on loan in the US stood at around $1.5tn at the end of September 2020. The data are, however, both incomplete and unavailable to the general public. Aggregate short interest for individual stocks is currently reported only twice a month, meaning market participants are often relying on stale data.

Comments