Stocks and bonds diverge as investors worry less about inflation

Simply sign up to the Global inflation myFT Digest -- delivered directly to your inbox.

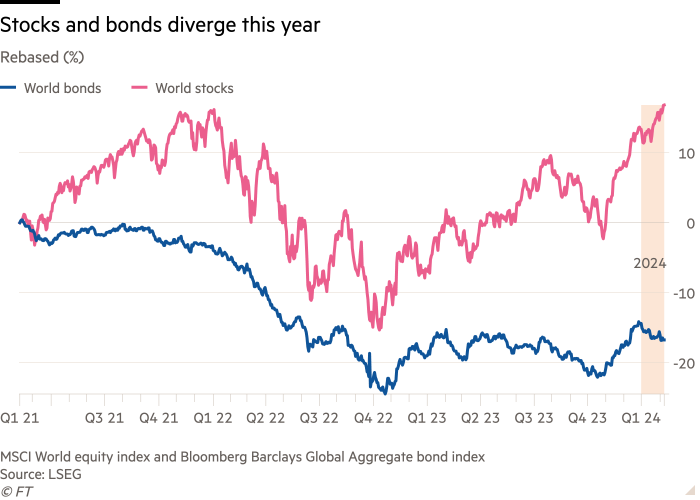

A sell-off in global bond markets combined with a rally in stocks this year shows that investors’ all-consuming obsession with the path of inflation and interest rates may finally be ending, say analysts.

Wall Street has led a 3.8 per cent gain for developed market stocks so far this year, boosted by the outsize strength of the US economy, while an index of global bonds has dropped 2.8 per cent as investors have dialled back their expectations of interest rate cuts.

Such divergent moves mark a break from the past year or more, when the two assets have tended to rise or fall together, and could herald a return to the previous pattern where lower-risk fixed income acted as a counterweight to riskier equities.

The shift is likely to come as a relief to the many investors holding forms of the so-called “60/40” portfolio, which allocates 60 per cent to stocks and 40 per cent to bonds and is designed to lower risk and provide diversification during market shocks.

“60/40 is not dead, it was just taking a break,” said Ronald Temple, chief market strategist at Lazard.

Such portfolios were hard hit in 2022 when both stocks and bonds tumbled — a scenario for which such portfolios were not designed, although they performed well late last year when both assets surged in tandem on hopes of rapid interest rate cuts in 2024.

Some strategists believe the divergence this year between stocks and bonds is set to continue.

“We see the bond-equity correlation shifting back to negative this year,” said George Saravelos, global head of FX research at Deutsche Bank. “We have indeed started to observe this since the start of the year with US equities making fresh record highs but US yields also rising.”

When interest rates were at rock bottom levels, bonds struggled to deliver any positive returns and then suffered big losses as interest rates rose. But when rates are higher they offer a consistent income, while investors normally expect them to rise if the economy sours.

Analysts believe the shift in correlation has been driven by the market’s focus switching from fears about inflation and the timing of the next move in interest rates to concerns about the strength of the economy.

That has come as markets have become more comfortable that inflation is heading back down to central banks’ target levels, while also gradually starting to accept that policymakers will not be cutting borrowing costs as quickly as investors had been hoping.

Investors are also rethinking whether they need to be quite so focused on monetary policy, given that the buoyant US economy so far appears to have shrugged off much of the impact of higher rates, which have been held at a 22-year high of between 5.25 per cent and 5.5 per cent since July last year.

Economists polled by Bloomberg expect benchmark 10-year US borrowing costs to fall from a current level of 4.2 per cent to 3.6 per cent in 2025, still higher than under 2 per cent at the end of 2019. Higher yields bode well for the 60/40 portfolio, because they allow more room for prices to rise and for the bond component of the fund to perform well.

Stocks have been given a boost this year by figures earlier this month showing the US economy added twice as many jobs as forecast in January.

Investors also say the impact of fiscal policy on the economy has been underestimated. Legislation including the Inflation Reduction Act, the Bipartisan Infrastructure Deal and Chips and Science Act have helped channel more than $1tn of investment so far into the US economy in recent years, and pushed the budget deficit close to 6 per cent.

“I feel that we are too obsessed with monetary policy, as fiscal policy has a big impact on growth,” said Luca Paolini, chief strategist at Pictet Asset Management. “We have seen an incredible expansion of fiscal policy, which, unlike monetary policy, continues to be extraordinarily loose and expansionary.”

Paolini thinks the correlation between stocks and bonds will fall “quite significantly” this year as risks shift from inflation to growth, which he thinks will accelerate “in the next few quarters” with a weakening of the US economy.

“When growth risks rather than inflation risks become dominant, bad news is bad news. So [when] you have bad economic data, you have a strong positive impact on bonds and very negative on equities, he said, adding that it meant “bonds again will offer some diversification”.

Investors say the key question now will be whether inflation re-emerges as a major concern. US consumer prices excluding food and energy items rose at a 3.3 per cent annualised rate in the final three months of 2023, down from more than 5 per cent early last year.

Analysts at PGIM note that market pricing for long-term inflation remains “contained but stubbornly above” the Fed’s 2 per cent target, with an average annual rate of 2.6 per cent priced for five years starting in five years’ time.

But Kamakshya Trivedi, head of global FX at Goldman Sachs, said he did not think it would prove “particularly hard” for policymakers to bring inflation back down to target.

“The important thing is the nature of the shocks driving markets is shifting from a regime where it was almost exclusively inflation that mattered to one where growth matters too,” he said.

As inflation comes back to target, positive growth is “good for equities and not so good for bonds”, he added.

Comments