Stepping onto the world stage: how UK exporters can seize global opportunities

Opportunities for businesses that export go far beyond increased sales – and if companies are supported to compete internationally, the boost to innovation and employment can benefit the entire economy.

Four in every five UK businesses that export say that trading internationally is critical to their company’s future. But exporting is about more than moving products and services further afield. Selling outside the domestic market can fuel innovation and product development, diversify business models, foster job creation and unlock partnerships.

AceOn is a Telford-based battery manufacturer that specialises in energy storage systems and custom battery packs. The value of its export business has grown sevenfold over the past year alone, owing to strong partnerships with industry-leading suppliers around the globe. In May 2023, AceOn was able to secure a £300,000 loan to win new export contracts in the Portuguese renewable energy market. The loan was made possible by support from UK Export Finance (UKEF), a ministerial government department helping UK businesses to trade internationally. UKEF facilitates trade finance through guarantees and insurance schemes to help businesses export goods and services.

AceOn used UKEF’s General Export Facility (GEF), which guaranteed up to 80 per cent of the loan from its financial services provider. Through products like these, UKEF is able to mitigate a bank’s risk while unlocking more working capital or investment for businesses to support their export ambitions. “Our GEF allows the bank to provide the exporter with a larger facility than they otherwise would, supporting the business to expand their exporting ambitions,” says Tim Reid, Chief Executive of UKEF.

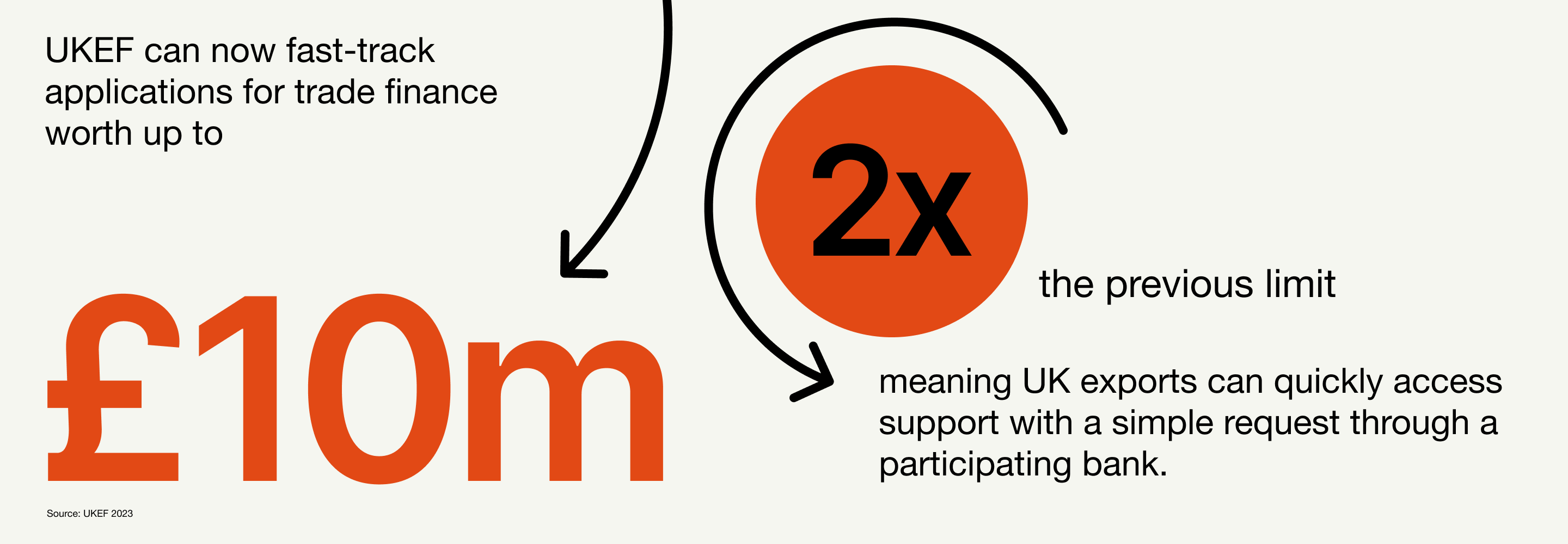

What’s more, as part of the Autumn Statement in November 2023, the export credit agency announced new measures to help small businesses export, expanding its “auto-inclusion” scheme, which provides rapid access to trade finance products such as the General Export Facility. UKEF can now fast-track applications for trade finance worth up to £10mn – double the previous limit – meaning UK exports can quickly access support with a simple request through a participating bank.

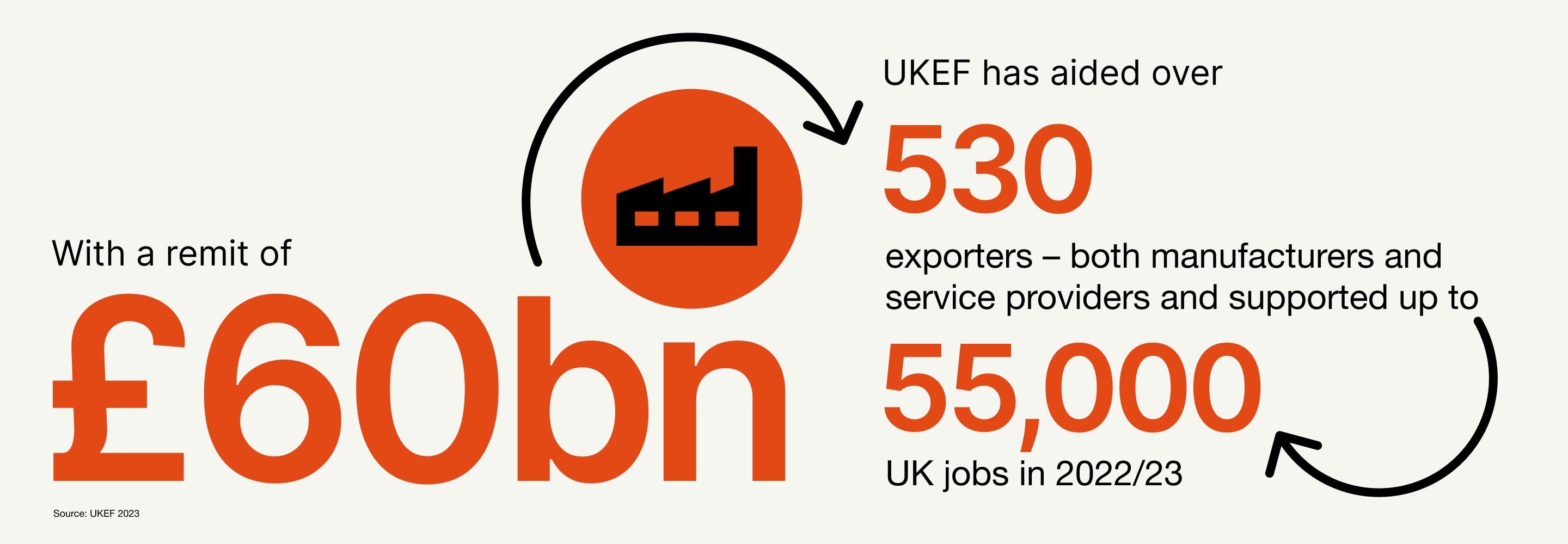

Despite the opportunities, fewer than one in eight British businesses currently export, according to the latest government data. So what is holding companies back? “Expanding the export business and identifying the right opportunities, delivering on a new contract, making sure you get paid – each stage of exporting brings its own challenges,” says Reid. “That's where we come in. We’re there to support exporters at every step of that process.” With a remit of £60bn, UKEF has aided over 530 exporters – both manufacturers and service providers – and supported up to 55,000 UK jobs in 2022/23.

What reservations do businesses have?

Some 40 per cent of UK businesses say that cost is a major factor holding them back from exporting, according to a recent government survey. Trade and energy costs are some of the most common financial challenges for UK exporters; then there are supply-chain and legal risks, quality issues and logistical obstacles – not to mention language and cultural barriers. Payment delays are also an issue, with companies now having to wait an average of 59 days to get paid, according to Allianz, which can have a huge impact on cash flow and operational continuity – both overseas and back home.

UKEF’s Export Insurance Policy provides up to 95 per cent cover against non-payment or contract cancellations for exports, which can give UK exporters the confidence and assurance they need to reach and expand in new markets. The department also works to alleviate financing difficulties, either by offering flexible finance solutions to overseas buyers or helping UK businesses with access to working capital to win new export contracts.

Supporting local communities

One such exporter was Northern Ireland-based bus manufacturer Wrightbus, which was supported by an Export Development Guarantee from UKEF in June 2023, enabling it to obtain £50mn in financing. Wrightbus, which made the first-ever hydrogen-powered double-decker bus in 2020, is currently seeing strong demand in existing markets, such as Singapore and Hong Kong, as well as new territories including Germany and North America. The funding will support its ambition to grow exports by nearly a fifth and create 1,000 new green jobs.

Like AceOn, Derbyshire-based recycling firm Ward used UKEF’s General Export Facility in August 2023 to serve its growing export market for recycled metal. Through the government guarantee, it was able to obtain £9mn in funding to help meet significant demand from clients in India, Pakistan, Turkey and Egypt.

Although UKEF helps businesses across every sector, Reid says that clean growth, renewables and the energy transition are priorities. “We've made some very clear commitments in terms of net zero, and are building up our capabilities to support renewables and transition,” he says.

Creating global impact

It’s not only environmental credentials that are taken into consideration: social and economic benefits also figure in decisions on funding. “We want to empower UK businesses, drive local growth and create global impact,” says Reid. “When we make a decision to support a company, we are looking at the impact that our financing can have on jobs, certain communities in the UK and on the communities that they're providing to overseas.”

We want to empower UK businesses, drive local growth and create global impact

In June 2021, UKEF helped FoundOcean, an offshore construction grouting specialist in Livingston, Scotland, with a bonding requirement for a contract on a 100-turbine offshore wind farm in Taiwan. By putting forward a significant deposit, worth 15 per cent of the contract value, even before work had commenced – something FoundOcean couldn’t arrange alone – UKEF was able to help the company fulfil its contract and create 30 jobs in the local area, while also helping Taiwan pursue energy transition.

“Whether it's solar farms, hospitals, utilities or ports, someone out there, around the world, is building it – and they want to use the latest technologies and capabilities to build these facilities. And the aggregate demand is in many billions of pounds,” says Reid. “What's exciting for us is that UK businesses are in a prime place to play their part in this.”

UKEF will outline its ambitions to support more SMEs as part of its new five-year business plan, to be published in spring 2024. Businesses interested in seeking support from UKEF should get in touch.