The circularity challenge: expect disruption

The climate crisis and unsustainable resource consumption pose a major challenge for leadership teams. At current consumption rates, humanity is using the equivalent of 1.75-times the earth’s natural resources each year. The solution, a circular economy, will fundamentally reshape industries – and it’s already underway.

Circularity represents a decoupling of economic growth from resource consumption. For companies, it means conserving materials, extending a product’s lifetime through repair and reuse and recycling. It also includes improving utilisation through new business models that offer products as a service.

Bain & Company research conducted in partnership with the World Economic Forum shows that business leaders feel a growing sense of urgency to embrace circularity. A survey of senior executives completed in March 2022 shows that leadership teams grow more aware that they are vulnerable to circular disruption the more time they spend preparing for it. Supply chain executives that took part in the study are planning to double the share of revenue from circular products and services by 2030.

Leaders also recognise that well-designed circular products and business models can boost growth, cut costs and build resilience. More than half the executives surveyed view circularity as a prerequisite for being best in class in the future.

The case for circularity is clear. However, the path to a circular business model is uncharted territory for most companies. It requires sweeping change, and progress can feel painstakingly slow. Bain & Company’s research highlights that reality. But a handful of leaders are overcoming the obstacles and making significant gains.

New ways of thinking

Developing circular products or strategies requires new ways of thinking – an approach that industry insurgents often wield to their advantage. Take the RealReal, which has helped create a booming global market in preowned luxury goods by selling authenticated brands, such as Gucci and Burberry, online and in shops. Or French startup Back Market, which sells refurbished electronics, including smartphones and computers, backed by quality control and support services. The company has helped change consumer views about buying preowned electronics, raising more than $1bn in funding since its launch in 2014.

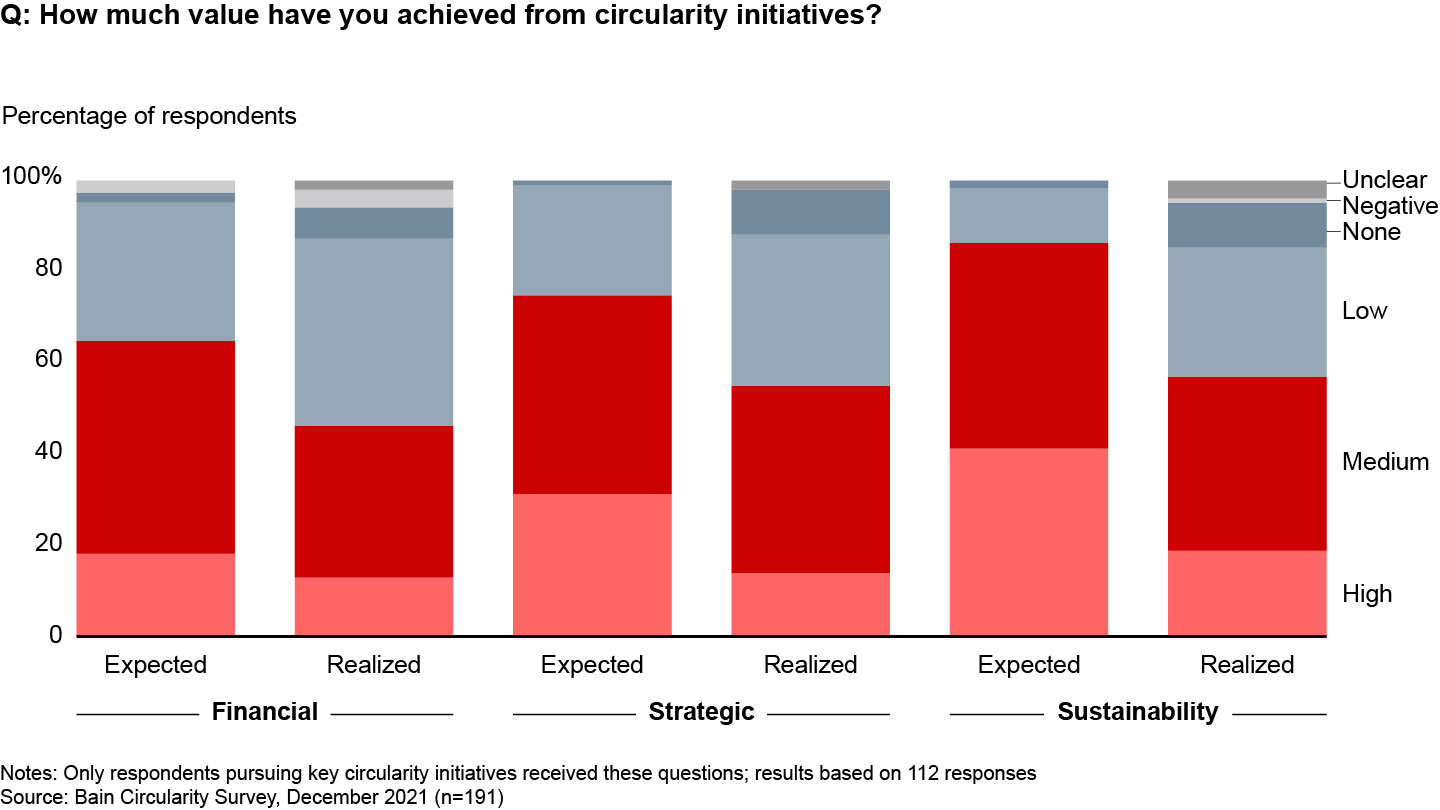

Of course, it’s easier for a startup to disrupt an industry’s value chain than it is for an established leader. Most larger firms have set broad sustainability targets, but few have specific circularity goals. And executives who have launched circularity initiatives say the outcomes fall short of financial, strategic and sustainability expectations (See Figure 1).

Key challenges

One of the obstacles to successful circularity initiatives is internal alignment across business functions. While executives recognise that circularity is a strategic issue, they don’t agree on how to prioritise it. Sales, marketing and finance executives consider circularity to be more of a priority than their operations and supply chain colleagues do (see Figure 2).

A related challenge is building the right cross-functional team to implement a circular strategy. Many companies take one of two approaches: bottom up or top down. Each tends to falter for different reasons. Bottom-up strategies are often small, incremental, one-off pilots that struggle to show clear value. By contrast, top-down strategies that span the full value chain often fail because they are too high level and too generic to translate into concrete initiatives.

Circularity leaders embrace both approaches and make sure teams collaborate to push change throughout the organisation. They make parts of their existing business circular at scale while deploying cross-functional teams to radically reimagine the business for a circular future.

Another obstacle is getting the needed engagement from a broad set of external stakeholders. Suppliers rank as the most vital external partners in circularity initiatives, but 60 per cent of companies said getting them involved was a challenge future (see Figure 3).

In fact, Bain & Company’s research shows that the number one barrier for companies pursuing circularity is the lack of a coherent ecosystem of peer companies, suppliers, industry consortia, technology and data partners, NGOs and regulators.

A way forward

Despite the operational challenges of a circular business transition, leading multinationals are showing that progress is possible. The frontrunners establish measurable goals for the overall share of circular products and services, as well as target levels of recycled content, reuse and recycling. Consumer goods giant Unilever, for example, is aiming for 100 per cent reusable, recyclable or compostable packaging by 2025. Michelin has pledged that, by 2048, its tires will be made using 80 per cent sustainable materials and every tire will be recycled. Leaders also set specific revenue targets for circular products and services.

The magnitude of change for each individual business is enormous, and achieving a circular economy is likely to take a decade or longer. But early movers will gain a powerful strategic advantage. These leaders will be poised to disrupt their own industries and win a growing share of new markets. Above all, they will be in the strongest position to sustainably meet their customers’ needs.

By Hernan Saenz, Joshua Hinkel, Harry Morrison and Phillip Doolan

Hernan Saenz is a Bain & Company partner based in Dallas; Joshua Hinkel is a partner in Dallas; Harry Morrison is a partner in Europe; and Phillip Doolan is as associate partner in Copenhagen.