E-cigarettes: no smoke without fear

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

Entering his thirties, Umer Sheikh decided he’d had enough: it was time to give up cigarettes. As he resolved to quit his 20-a-day habit, he spotted an advertisement for an electronic cigarette, available from a Chinese company called Ruyan. It was 2006 and these strange contraptions – they looked more like assembly-kit plastic cigars than cigarettes – were an oddity. But, desperate for anything to ease his dependency on tobacco, he bought one for $200. It arrived and he took his first drag. “It was amazing,” he says. “It was guilt-free smoking.” A few hours later it broke. Sheikh sent off for another. That lasted a day. Nonetheless he was hooked.

Soon after this epiphany, in November 2006, the British government passed a law to ban smoking in virtually all enclosed public places in England from July 2007 (following Northern Ireland, Scotland and Wales). For Umer, it was a light-bulb moment: he convinced his brother, Taz, of the business opportunity presented by e-cigarettes. The brothers already had an IT consultancy and software-development company based in Britain and Bangalore, and they shared an appetite for entrepreneurial risk – their parents ran their own retail company and took them to trade fairs and wholesalers at the weekend. If it had not been e-cigarettes, it would have been something else, reflects Taz: “We took a punt.”

Keen to improve on the e-cigarette experience, the brothers hired two Chinese engineers to experiment with the technology. Instead of Ruyan’s three-piece version (made up of battery, vaporiser and liquid-filled cartridge) they came up with a device that used just two. That overcame the overheating problem which had made Umer’s original purchase break down.

At first, it was difficult to get retailers to stock their Gamucci e-cigarettes. “They hadn’t heard of electronic cigarettes and didn’t know where to position them – alongside traditional tobacco products or in the health section,” says Umer, blunter than his brother Taz, who speaks with the patter of a salesman. In 2008, at Gamucci’s first trade show – the NEC Birmingham spring fair, a business-to-business show for retail products – the brothers were sandwiched between a stall selling swords and another that was punting hemp-seed chocolate.

The breakthrough came when Genting Casinos, a UK gambling chain that had been hit by the smoking ban, agreed to stock their product. E-cigarettes allowed gamblers to “vape” (as inhaling the vapour from an e-cigarette is known) while remaining at the roulette wheels.

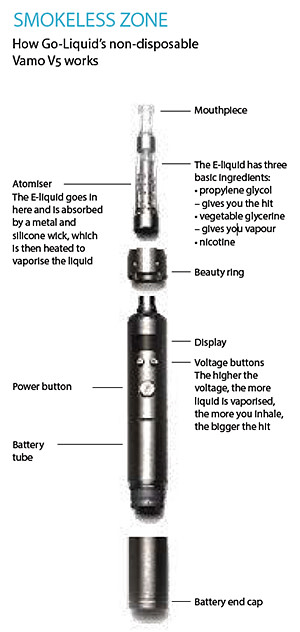

The way e-cigarettes work is that, as a user puffs on one end, a tiny electronic device heats up a nicotine cartridge, turning it into a vapour that is then inhaled, supposedly exposing only the smoker to nicotine. The remaining vapour evaporates without any smoke exposure to others. The products do not use tobacco.

Today, operating out of an office on the edge of the City of London packed with higgledy-piggledy piles of boxes, Gamucci is finalising a fundraising round of £20m. Last year its revenues were £5m. The company has signed a distribution deal with WH Smith and opened a “vaping lounge” at Heathrow airport. “We didn’t envisage it would be such a large industry,” says Taz. To bolster growth it has also hired former tobacco executives. Its chief executive, Tony Scanlan, spent nearly two decades at Rothmans International in a number of senior roles, including strategic new brands director.

Gamucci’s story mirrors the broader rise of e-cigarettes. In just a few years, the sector has become big business. According to financial services group Canaccord Genuity, global sales reached $3bn last year, a steep rise from $20m in 2008.

Big tobacco has muscled in, acquiring smaller players – among the first examples was US company Lorillard’s acquisition of Blu for $135m in 2012. But the arrival of tobacco companies has alarmed some public health experts who see their presence as a ploy to gain respectability and, paradoxically, to keep smokers hooked on cigarettes. It also raises a fundamental question: is this the greatest innovation in tobacco harm reduction or a way to keep consumers addicted to the stuff?

The pioneers

In 1963, Herbert A Gilbert, a Korean-war veteran from Beaver Falls, Pennsylvania, filed a patent for a “smokeless non-tobacco cigarette”. Gilbert is considered the inventor of the e-cigarette but he was no scientist. He had studied business administration and worked at his father’s scrapyard, dabbling in hobbyist projects (he also designed a plastic sled and a particle reduction machine). “I’m basically a logical guy,” he says, speaking by telephone from Florida.

At that time, “everyone smoked”. Gilbert got through two packets a day, a habit formed aged 13, when his father handed him a pipe to mark his passage to manhood. As the health risks started to become more widely known, he decided to tackle the issue. Yet he could not get anyone to bite. “I took it to tobacco and medical companies,” he says. “No one was interested.”

“They wanted to wait until the patent expired. [Tobacco companies] are smart, they protect their business interests. They could make a bigger profit on cigarettes – that’s what they’re interested in,” says Gilbert, adding that he has “no bad feelings”.

In fact, Gilbert was unable to persuade even himself of the merits of his own product. “I was like everyone else. I enjoyed smoking and it wasn’t bothering me even though I invented the e-cigarette.” He didn’t quit until 20 years ago when he caught pneumonia. Then he stopped through the traditional route: going cold turkey.

It took another four decades after Gilbert’s invention before someone else picked up the baton. In 2003, Hon Lik, a Chinese pharmacist, developed a version to kick his own habit after his father died of lung cancer. It was his company Ruyan’s products that Umer Sheikh tried in 2006. Gilbert stresses the similarities between Lik’s invention and his own. “Does it have a battery? Is it in a tube? If it has a bill, webbed feet and goes ‘quack quack’, it’s a duck.”

Today’s devices follow the same basic principle as Gilbert’s patent, with an atomiser heating the liquid mixture of nicotine, flavourings and dilutants. The so-called cig-a-likes, shaped like cigarettes, are disposable. Others look like miniature oboes: users refill the liquid and the thick, stainless steel tube lets “vapers”, as users are called, enjoy a longer battery life.

While improved technology by small e-cigarette producers was important to winning over consumers, ultimately it was the outlawing of smoking in public places that prompted the growing demand.

Enter big tobacco

In February, Vype, the e-cigarette owned by British American Tobacco (BAT), aired an advertisement on British television, almost 50 years after cigarette adverts were first banned. It shows an athletic young man and a glossy-lipped woman running through an urban streetscape, before leaping through a burst of vapour. “Experience the breakthrough”, declares the tagline, promising “pure satisfaction for smokers”.

In the foyer of BAT’s headquarters in a squat, modern office block overlooking the Thames in central London, crisp pamphlets extol the group’s dedication to “harm reduction” and tobacco-free devices – even though cigarettes were the main source of the FTSE 100 company’s £5.5bn in pre-tax profits in 2012.

Big tobacco’s emerging dominance in the market is “a natural progression”, explains Des Naughton, who is in charge of BAT’s next-generation products. “We understand smokers.” Naughton has spent his career in the tobacco industry, selling cigarettes in the Middle East, eastern Europe and South Korea. He speaks in the precise terms typical of tobacco executives, keen to soften their image.

BAT launched Vype, its first e-cigarette, online last summer and then distributed it to 10,000 shops across the UK. It comes in a cigarette-lighter- shaped case, which clicks back like a Zippo. The e-cigarette itself is a short white stick, with a brown, squidgy tip. “It’s deliberate to look like a cigarette,” says Naughton, before adding: “The line between a conventional cigarette and a nicotine product should be pretty clear.”

The tobacco industry has a poor record with new products that contain the addictive nicotine but not tobacco. RJ Reynolds, the US maker of Camel cigarettes, pumped $300m into a “smokeless” cigarette in the 1980s. Initial reviews were not good. Smokers complained it tasted like burning plastic, and it was canned a year after launch.

The sudden growth in e-cigarettes’ popularity took tobacco multinationals by surprise. Last year, Goldman Sachs described e-cigarettes as one of eight “creative destroyers” – alongside 3D printers and big data – for their potential to overturn the tobacco industry. Wells Fargo, the investment bank, predicts revenues from e-cigarettes could overtake tobacco sales in the US in less than a decade.

But the industry has been forced to meet swelling demand. All the big four – RJ Reynolds, Philip Morris International, Japan Tobacco International and Imperial Tobacco – now have e-cigarettes either on the market or in development.

Most of the innovation has not been in-house but from small private companies that have been acquired by the tobacco companies. (Gamucci declines to comment on whether it has been targeted but says that remaining independent for a few more years would boost its sale price.)

E-cigarettes could prove the tobacco industry’s salvation in advanced economies. While cigarette sales in emerging markets are growing, anti-smoking policies in the developed world mean that sales have fallen.

Although some small players, hoping to be bought out, see the increased presence of tobacco companies as potentially highly lucrative, others fear the increasingly aggressive tactics. Earlier this year, Hon Lik’s company, now owned by Imperial Tobacco, filed a lawsuit in California against nine e-cigarette rivals, alleging they had violated its patents. The case is expected to drag on for years. While large tobacco companies are used to – and can afford – expensive legal fights, the smaller independents are unlikely to survive against such firepower. Nor are the tobacco companies taking a big financial risk by entering the market: the cost of buying a small e-cigarette company and its intellectual property is dwarfed by the billions earned by the industry each year.

But the e-cigarette market is seen by some as a ruse by tobacco companies hoping to improve their public image at the same time as generating profits from sales of conventional cigarettes. The first retail customer for Imperial Tobacco’s e-cigarette, which launched in February, was Boots, the chemist founded by Quakers.

More important is the prospect of e-cigarettes being classed as medicines – or aids to help smokers quit – in the UK when planned regulations come into practice in 2016. By bringing e-cigarettes in line with nicotine patches and gum, the Medicines and Healthcare Products Regulatory Agency will apply rules around, for example, the purity of the nicotine in e-cigarettes. This will have the strange effect of tobacco companies producing a medically approved product and supplying the National Health Service. This, in turn, will be likely to mean that only those with serious financial firepower – such as BAT and Gamucci, which has its own factory and patent – will be able to afford to meet such regulations.

The public health debate

Corporate Accountability International (CAI), a US non-governmental organisation which runs high-profile public health campaigns, has spoken out against the tobacco industry for two decades. Its efforts – together with those of other anti-tobacco campaigners – helped bring about the World Health Organisation Framework Convention on Tobacco Control in 2003. This was the world’s first health treaty, and has now been signed by 168 countries, all agreeing to a ban on tobacco advertising and sales to minors, to restrictions on lobbying and to clear warnings on all cigarette packaging.

CAI sees e-cigarettes as a way to keep people hooked on the real thing. “We increasingly refer to and treat e-cigarette companies as the tobacco industry, because they have the same interests and tactics as the tobacco industry,” explains John Stewart, director of the group’s Challenge Big Tobacco Campaign in an email.

He says that the makers of e-cigarettes and tobacco products want to delay regulation and “confuse public perception”, by marketing e-cigs as both a cessation product and a “trendy new consumer product” that gets round smoking bans.

CAI also accuses the industry of glamorising cigarettes. E-cigarettes, it says, are being marketed using the same messages that tobacco companies used to sell conventional cigarettes in the 1950s and 1960s. In the US, Blu has been criticised for running print adverts that echo the rugged Marlboro Man, invoking the same types of images that were once used to portray smoking as cool.

As for the health benefits of e-cigarettes, Martin McKee, a professor of public health at the London School of Hygiene and Tropical Medicine, is clear: there aren’t any. He believes the devices are renormalising smoking and providing tobacco groups with a way to buy credibility and access to politicians. “This is not a respectable industry, and the WHO Framework Convention on Tobacco Control is very clear that governments should not be having discussions with the tobacco industry.”

Anna Gilmore, director of the Tobacco Control Research Group at Bath University, says: “If e-cigarettes are to work for public health by reducing smoking of tobacco, then they need to compete with cigarettes – impossible to achieve if the same companies are selling both products. Tobacco companies do not want e-cigarettes to cannibalise their existing cigarette market. Instead, they want dual use of cigarettes and e-cigarettes, which has no public health benefit.”

There have been no long-term health studies on the risk of these nicotine delivery devices because they have not been around long enough. McKee, however, does not think they are the great aid to quitting smoking that they are proclaimed to be. Many smokers are also buying e-cigarettes, he says, conning themselves that they are giving up but in fact are using both e-cigarettes and cigarettes, upping tobacco companies’ profits.

Not everyone in the health community agrees. The leading UK charity Action on Smoking and Health (Ash) says that e-cigarettes can help people quit tobacco. Clive Bates, a former head of Ash, who helped devise the WHO’s Convention, believes the scepticism is in large part ideological rather than evidence-based. “There is an unfamiliarity and suspicion of anything market-based,” he says. “The public health establishment has quite a strong command-and-control mentality. Its bread and butter is prohibition, coercion, taxation.”

The debate among health advocates is often vociferous. When researchers from the University of California’s Center for Tobacco Research and Education produced a report saying that using e-cigarettes increased the likelihood of experimenting with traditional cigarettes and a large number of vapers engaged in dual use, Bates called the report “false, misleading” and said that it had “damaging conclusions”. He also labelled the research group a “slurry gusher of black propaganda”.

The battle over e-cigarettes isn’t being fought solely between public health campaigners and big tobacco. When McKee wrote an article in the British Medical Journal, criticising the product placing and marketing of e-cigarettes and calling for their advertising to be banned, he was roundly attacked by vapers. He was shocked by the rapidity, hostility and scale of their reaction to the article when it was posted on the BMJ website. One vaper even created a web page with a picture of him framed to look like a Soviet leader.

Vapers fight back

Some of those who are devoted to e-cigarettes have become proselytisers for the products and how they have changed their lives. A small but especially passionate group of them can be found at vaping meet-ups, such as the one that happens on Saturday nights in the Star of Kings, a pub in King’s Cross in north London. When you enter, the smell is sweet: a mix of custard, crème brûlée and bubblegum. Tucked in the corner is the source of the aroma – a dozen vapers.

What brings them here is their shared enthusiasm for vaping and their curious, often home-made devices. These e-cigarettes look nothing like cigarettes, or even cig-a-likes. One middle-aged man in a baseball cap inhales from a modified 1980s Nintendo video game controller.

When it comes to regulation, the conversation soon becomes technical. The vapers are fearful that regulation going through the European parliament would dilute the concentrate of liquid nicotine in the cartridges used in their home-made contraptions to such a degree that the experience would be meaningless. Many enthusiasts such as these are so worried that they have become active in lobbying European politicians.

Social media campaigns have been fierce. In December last year, as The X Factor final approached, a Twitter campaign helped get the #EUecigban briefly to overtake #xfactor in the number of hourly tweets. The swell of protests by grass-roots lobbyists as well as the slicker lobbying pressure exerted by tobacco and e-cigarette companies helped to derail EU proposals for tight regulations of the products.

“If something is under threat, you go out and learn about it,” says vaper Sarah Jakes. She and her peers are impassioned because they say that without their electronic substitute they would not have been able to quit real cigarettes. Rebecca Taylor, the Liberal Democrat MEP for Yorkshire and Humber, took up the issue after being repeatedly pestered by vaping constituents. Along with a group of other MEPs, she managed to get the EU to water down regulations.

“I wrote a blog asking people what they thought. Within a month, I had 80 comments. I normally have about three.” Vapers are more vociferous than usual constituents, she admits, “but to say it’s an orchestrated campaign is absolute rubbish.”

Gilbert, meanwhile, fresh from a cruise celebrating his 83rd birthday, is working on a new project. He is helping John Cameron, the brother of film director James, to create a new brand of e-cigarette called Emperor. He has no truck with those who believe that they are the same as conventional ones. Although it was a long time coming, he could not be happier that his invention has finally come of age: “I can’t tell you how satisfying it is to see how many lives have been saved through e-cigarettes.”

——————————————-

Regulation: tobacco or medicine?

Regulators view e-cigarettes either as a health threat or a cure – some want to regulate them as medicines, others to classify them as tobacco products with all the restrictions that this implies.

The UK has chosen medicinal regulation, meaning that any e-cigarette on sale from 2016 has to be approved by the Medicines and Healthcare Products Regulatory Agency, like any other drug. This has not stopped regulators in Wales from proposing a public “vaping” ban.

The EU, originally poised to go down the medicine route, has since opted for a mixed approach. There will be restrictions on ingredients and the strength of the nicotine. But advertising will also be restricted, as it is for tobacco products.

Meanwhile, documents seen by the Financial Times reveal that the World Health Organisation is pushing to regulate e-cigarettes as tobacco, which would curtail advertising and lead to heavy taxes. Other countries, including Brazil and Australia, have banned e-cigarettes entirely.

Regulation in the US – the largest market – varies. On a federal level, the Food and Drug Administration is yet to decide how to classify e-cigarettes. But local regulators in cities across the US are considering following the example of Los Angeles and banning “vaping” in public places, just like tobacco.

Emma Jacobs is a feature writer for the FT’s Business Life. Duncan Robinson is UK companies reporter for the FT.

This article has been amended to reflect the fact that Los Angeles has banned vaping in public places and is no longer only considering it.

To comment on this article please post below, or email magazineletters@ft.com

Comments