William D Cohan on Wall Street whistleblowers

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

Whistleblowing is not for the faint-hearted – and especially not on Wall Street.

On Wall Street, as everyone now knows, wrongdoing by bankers, traders and executives led to disaster in 2008 after they were rewarded for taking risks with other people’s money. Leading bankers and traders were motivated – by the hope of getting large bonuses – to package up mortgages into securities and then sell them off as AAA-rated investments all over the world. This happened even though one damning email after another makes clear they knew some of the mortgages would probably default and that the securities should never have been sold in the first place. But some people did try to blow the whistle – the problem is they were not listened to. Worse than that, they were treated in a way that would discourage anyone from following in their footsteps.

I interviewed three whistleblowers – from different periods of the recent crises that have befallen Wall Street. All three of them made allegations of wrongdoing at their banks, made strenuous efforts to report what they had discovered through internal and external channels and all three were either fired from their jobs after trying to share the information they had stumbled upon or quit in frustration.

Their testimonies and the details of what happened to them are important. Not only do they illustrate the existential risks that whistleblowers take when they attempt to point out wrongdoing that they uncover at powerful institutions. They also matter because their stories show just how uninterested these institutions genuinely remain – despite the lip service of internal hotlines and support groups – in actually ferreting out bad behaviour. The stories of these three whistleblowers reveal, too, how little the regulators charged with keeping watch over the Wall Street banks seem to care about holding them in any way accountable. Often the regulators seemed to be willing to ignore the allegations presented to them.

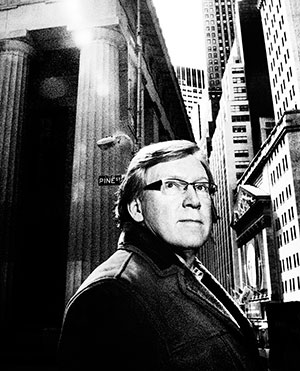

None of this surprises the experts who have tracked whistleblowers across a variety of industries, including Wall Street. Eliot Spitzer is the former governor and attorney-general of New York state, once known as the sheriff of Wall Street. (He resigned as governor in 2008, following a prostitution scandal.) When he was attorney-general, between 1999 and 2006, he prosecuted wrongdoing on Wall Street and won billion-dollar settlements from many banks. Among the purported crimes were “spinning” – when favoured clients received hot, pre-IPO stock and sold it after the price rose when trading began; “laddering” – when preferred clients received hot, pre-IPO stock from banks who knew they would sell the stock into a rising market and then buy more; and “late trading” – when hedge funds were allowed to trade in shares of mutual funds after trading had closed for the day. Spitzer also won settlements from banks after discovering that research analysts were positively tailoring their reports about a company’s prospects in exchange for investment-banking business.

“The pushback against the status quo in any context is extraordinarily difficult,” says Spitzer. “It is not merely Wall Street. It is a phenomenon that exists within large institutions that have significant power – Wall Street, government, among them. There is this overwhelming rigidity in organisations that makes them hesitant to believe. When money is involved, the powers are very, very significant. Those people who pushback on Wall Street are often made to pay a penalty. They’re fired. They’re blackballed. It is a cultural issue which we have to deal with.”

Spitzer recalls how, when he was working at CNN a few years ago, he invited on to his show three whistleblowers from the National Security Agency, each with more than 20 years of experience. “Highly regarded, well-respected individuals who alleged that the NSA was collecting data – metadata, as they referred to it – that related to all phone calls being made around the country,” he explains. “They were fired, drilled out of the agency and disregarded, maligned.” Of course, he notes, the three men were absolutely right in their allegations. Thanks to Edward Snowden, we now know that the NSA has been collecting and analysing data about individual Americans, and others, for years.

Prosecutors often need whistleblowers to come forward in order to make a substantive case of illegality. They play an essential role in keeping Wall Street’s collective feet to the fire by exposing wrongdoing when it occurs. “Very few prosecutors would claim that they could make great cases without individuals on the inside,” Spitzer says. “We cannot make the complicated cases or begin to see the difficulties there without people who come forward to discuss what is going on that’s improper. So we desperately need them and we’re going to continue to apply pressure to ensure that Wall Street and the other major institutions live by the rules.”

The 2010 Dodd-Frank financial reform law, which was supposedly designed to try to prevent the kind of economic meltdown that occurred in 2008, contains a number of new provisions that provide whistleblowers with protection and financial rewards – known as “bounties” – for bringing wrongdoing to light. Occasionally whistleblowers actually receive those rewards. But, Spitzer notes, there remains a high degree of treachery to contend with for anyone who chooses to buck the social norms and report questionable behaviour. “I don’t want to discourage people from being whistleblowers but on the other hand there are significant challenges that await them down the road,” he says. “The momentary reduction of angst they get from the media [when a whistleblower goes public] is often outweighed by the significant problems they face after and often personally in the environment in which they had lived before they were a whistleblower.” That is clearly the case for Eric Ben-Artzi, Peter Sivere and Oliver Budde – the whistleblowers profiled in these pages – all of whose Wall Street careers were curtailed in one way or another by what they discovered and then reported.

Beatrice Edwards is the director of the Government Accountability Project, a leading Washington-based public-interest law firm that represents and advocates the cause of whistleblowers. She notes that while the Dodd-Frank law created new paths for whistleblowers to report wrongdoing to both the Securities and Exchange Commission – for securities violations – and to the Commodity Futures Trading Commission – for commodities-related violations – she fears that the SEC’s “bounty programme” is not working as she hoped it would. In 2013, she explains, whistleblower reports to the SEC increased 8 per cent on the year before and such reports to the Department of Defense rose 125 per cent between 2009 and 2013. However, she says that while the SEC’s reward programme was slow to get going, the pace of payouts has picked up in the past year or so. Nevertheless, “whistleblowers are still paying for their disclosures with their jobs, in general,” she adds. “What we see when people come to us is they’ve already been subjected to retaliation, and the retaliation in banking does seem to be very fierce. People aren’t just transferred or demoted, they’re dismissed.”

As a further harbinger of danger, Edwards points to the secret $14m award the SEC made recently to an anonymous whistleblower at an unnamed financial institution. The SEC didn’t even reveal the nature of the wrongdoing the whistleblower uncovered, so both the company’s shareholders and the public remain in the dark about what was specifically uncovered and where. All that is known is that the SEC did bring a major enforcement action against a financial institution that resulted in a large penalty and the corresponding $14m award to the whistleblower. “If you allow this – that the award can be made without naming the company or the type of fraud – it’s really nothing more than hush money,” she says. “How is it different? The SEC of course defends itself by saying, ‘We’re not revealing the name of the company or the nature of the fraud because we’re protecting the identity of the whistleblower.’ But the SEC is a disclosure agency, so they should have to establish that [not revealing the information] is really required in order to protect the whistleblower, if they’re going to in a sense subvert their mission . . . They really are not able to justify why they are silent about the name of the company or the nature of the fraud.”

She believes the SEC’s failure to release publicly the details of the $14m reward sends precisely the wrong message. “The one effect obviously it has is that it protects the reputation of the fraudulent corporation,” she adds. “[Reputational damage] is probably the main deterrent in cases like this, since there have been really no prosecutions of senior managers for fraud over a period of time on Wall Street. If even the name of the company is withheld by the SEC when it makes a bounty award, there’s no reputational risk, either. What’s the downside of trying to get away with it?”

Dennis Kelleher, a former attorney at Skadden, Arps and now the CEO of Better Markets, Inc, a Washington-based non-profit organisation that is a leading advocate for tough banking regulations, says that the architects of the Dodd-Frank law – of whom he was one – were trying to balance the need for disclosure about financial wrongdoing with provisions to protect the whistleblower from public humiliation and retaliation. “The most important thing is to incentivise whistleblowers to come forward, and all the incentives previously were dramatically stacked against whistleblowers, and it’s still an incredibly high-risk action,” he says. Although critics remain, he thinks the new whistleblower provisions in Dodd-Frank strike the right balance. “I would be significantly more likely to encourage a whistleblower post-Dodd-Frank than pre-Dodd-Frank,” he says.

Jordan Thomas, a former senior enforcement official at the SEC and now a partner at the law firm Labaton Sucharow, where he leads the firm’s whistleblower practice and represents Eric Ben-Artzi, agrees with Kelleher. He believes the fact that Dodd-Frank allows anonymity for whistleblowers facilitates the reporting of wrongdoing while offering them protection from retaliation, which is the point after all. “Essentially most whistleblower horror stories start with retaliation,” he says. “And to be retaliated against, you have to be known. The genius of Dodd-Frank was it created a way for people with knowledge to report without disclosing their identity to their employers or the general public. That has been a game changer because now people with knowledge are coming forward with a lot to lose, but they have a mechanism where they can report this misconduct without fear of retaliation or blacklisting.” He says the fact that the SEC could award $14m to a single whistleblower whose identity has remained unknown, despite efforts by the media to uncover it, sends a powerful message that whistleblower identities will be protected.

Maybe so. But then there is the message being sent by prosecutors who allow the big Wall Street banks to pay large fines to make their troubles disappear. Bea Edwards, for one, thinks that the government’s apparent policy of permitting Wall Street banks to purge their liability using their shareholders’ money will not deter bad behaviour. The fines – she specifically cites JPMorgan Chase’s $13bn settlement last year with the government over its role in manufacturing and selling faulty mortgage-backed securities in the years leading up to the 2008 financial crisis – are merely seen as a cost of doing business, and are a major source of revenue for the US Treasury and a way for the SEC and the Justice Department, among others, to argue for a larger budget allocation from Congress.

“It’s win-win for everybody [involved],” she fears. “The calculation for the bank is going to be, ‘OK, how much money can we make by doing this [bad behaviour] before we get caught? Are we going to be able to cover the fine, at the very least, and then make a fairly substantial profit and just pay the fine?’ And that would explain why there aren’t any prosecutions, because if the DOJ starts prosecuting, then the gravy train kind of shuts down . . . Calculate how much money you can make doing ‘x’ or selling ‘y’ before getting caught at it, and what you think essentially you could settle for, and if what you can make is substantially more than what you can settle for, then you go forward. If getting caught means [there is] a whistleblower, then you just grind up that employee in the cost of doing business. If the employee whistleblower is lucky, he or she comes out of it with a successful anti-retaliation claim, three or four years after the blood was shed. Or the whistleblower, if successful, gets an amount of money that may make it possible to go on living – but it is certainly not an amount of money that caused real pain to a major financial institution on Wall Street.”

Edwards pauses, and then concludes: “It’s a cost-benefit analysis. It works because nobody’s going to jail. Jail would put a stop to it.”

…

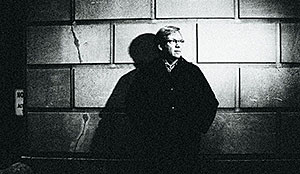

OLIVER BUDDE

Former legal adviser, Lehman Brothers

Ignored by regulators

The last place Oliver Budde expected to end up was Wall Street. After graduating from Columbia University in 1983 – the same year as Barack Obama – he took a year off to sail around the Caribbean, then spent five years as a ski bum, driving a taxi and working as a paralegal. He started his Wall Street career at the big law firm Skadden, Arps, initially through an employment agency placement. Skadden encouraged him and subsidised the cost of his law school studies. After receiving his law degree and passing the Bar exam, Budde returned as an associate but started looking for a new job in 1997 when Skadden let him know he would not become a partner. By serendipity, in December that year he ended up in the legal department of Lehman Brothers.

One of Budde’s responsibilities at Lehman was to prepare the “proxy”, an annual document filed publicly with the Securities and Exchange Commission that includes, among other information, details of shareholder ownership and management compensation. Within a month of starting at Lehman, Budde says, he could tell something wasn’t right with the way Lehman was accounting for the granting of management “restricted stock units”, known as “RSUs”. “Early on at Lehman I see this template where they’re hiding these RSU awards,” he says.

According to Budde, Lehman was awarding to Dick Fuld, the long-time Lehman chairman and CEO, large unvested stock grants and not fully disclosing them, as required by law. The rules governing the granting of RSUs are specific but generally require disclosure in the proxy. However, there was also “a loophole”, Budde says, by which if the RSU “vesting” (the moment when the stock awards can be cashed in) was dependent on a benchmark being reached – say, a return on equity ratio – the amount of the award would not need to be disclosed until then. When the amount of stock to be issued was known, then its value had to be put in the proxy.

Lehman’s plan had a performance component, Budde says. “But those goals were ridiculously low and they got over them massively. They paid themselves multiples of what the plan was supposed to pay out.”

Budde says that, although he was appalled by the size of Fuld’s RSU awards and how easy the benchmarks were to achieve, his only professional concern was the lack of adequate disclosure. “OK, this stinks,” he told himself. But he was new to the firm and didn’t want to rock the boat. “I thought, let me pick my battles.” Then he says he noticed the Lehman executives “started playing with the vesting” – pushing the dates further and further out to the end of the executives’ careers “so that they never had to show those awards”. “It felt worse and worse,” Budde remembers. “Every year at proxy time, it made me sicker and sicker.”

According to Budde, he made a point each year of asking Simpson Thacher, Lehman’s external attorneys, to verify their opinion that Lehman’s limited disclosure about the RSUs continued to be legally adequate. “And each year they came back with some tortured analysis that said, ‘Yes it is,’” he says. “In fact, they would periodically tweak the disclosure footnote: Let’s put in a little more info here and there to shore things up.” But, in Budde’s view, these incremental changes did not satisfy disclosure requirements.

What’s interesting to note, Budde says, is that when Lehman first raised the topic of the disclosure with Simpson in 1995, the law firm agreed with Budde’s analysis that the RSU awards required a full-blown disclosure in a “summary compensation table”. Budde says Lehman’s files include a letter from Simpson Thacher stating its view that the full-blown disclosure advocated by Budde was legally required. And yet, according to Budde, after “pushback” from Lehman executives, the law firm somehow found a way to agree to the executives’ preference for limited disclosure concerning the RSUs. A spokesperson for Simpson Thacher declined to comment on Budde’s description of events.

Budde says he considers that there were other transgressions, too, including by Lehman executives who sold stock in the middle of a corporate acquisition, as well as the decision to create a tax scheme to move Lehman’s medical liabilities off its balance sheet. By the beginning of February 2006, Budde had had enough. “I can’t continue to take the money,” he thought. “I’m doing too many things wrong here.” He collected his bonus for 2005 and, on February 1, wrote a letter of resignation. “I have to acknowledge, after a number of years more or less howling at the moon,” he wrote to his boss, “that my view of things seems to find very little purchase inside Lehman. Result? Extreme career dissatisfaction.” His colleagues at Lehman thought he was “nuts”, he recalls. “It was no mystery . . . I said fairly freely that I was concerned about the tone of this firm and the ethics of the place.”

Budde decided he needed a change and spent two years travelling back and forth to Germany to care for a sick relative. “I wanted to take a couple of years off, just get rid of the stink,” he says. “I had a big pile of winnings [the years of the after-tax proceeds of his bonus cheques] and I was going to relax . . . Just get back to the guy that I was.”

Around the time that Budde quit, the SEC changed the required disclosure for RSU awards. “This was like a gift from the gods,” he says. “I thought, now they’re going to have to disclose these awards.” Back at his home in Vermont, Budde opened a copy of Lehman’s March 2008 proxy. For the first time, he expected to see a summary table similar to what he had long advocated and the back-up for all the RSU awards that Lehman had granted Fuld and other top executives. “At least I’d have the satisfaction that that s*** that had been bothering me for years was now at least out in the open,” he recalls.

But there was no new disclosure. Budde believes Lehman had made a decision that since Fuld’s RSU awards had more or less vested, or would soon do so (ie they could be cashed in), they would simply not disclose them – as if they were saying: “We’re just not going to count them and we’re not going to show them to you.” That broad assumption, he says, eliminated the disclosure of $264m of Fuld’s RSUs. Instead of showing $410m of RSUs in Fuld’s name, the proxy showed $146m.

At that moment, Budde knew that he had to go to the SEC. “I just felt like someone’s got to tell,” he recalls. But he was not naive.“Whistleblowers have a hard time,” he says, but he decided, “No, I’m going to double down on this.”

At almost nine o’clock on the night of April 14 2008, Budde sent an email to the SEC’s enforcement division in which he outlined how Lehman had misled its shareholders and employees by failing to properly disclose the extent of the RSU awards that Fuld and other top executives had received over the years. He included detailed charts analysing Fuld’s compensation and a full explanation of the scheme.

Budde thought that this was certain to capture the SEC’s attention. What happened? “Zip. Zero. Nada,” he says.

He wrote to the SEC again in June and July, on September 11 – four days before Lehman Brothers blew up – and again on September 13 when he informed the SEC that he had sent a letter to Lehman’s non-management directors apprising them of a “laundry list” of “issues and concerns and potential liabilities” going well beyond the proxy disclosure issues he had already shared.

On October 6 Richard Fuld testified before the powerful House Committee on Oversight and Government Reform. During his testimony, Fuld sparred repeatedly with Henry Waxman, the committee chairman, about how much money he had made at Lehman. Waxman released a chart showing that Fuld had made $484m from 2000 to 2007. Under oath, Fuld denied he had made that amount and said he had received closer to $310m. Later in the hearing he conceded that it might have been closer to $350m.(A subsequent analysis by Harvard law professor Lucian Bebchuk and colleagues concluded that Fuld had made $522.7m between 2000 and 2007.)

Budde was incensed. He believed from his own calculations while he was at Lehman that Fuld had made $529.4m, a figure that was never disclosed. “When the tone at the top is ‘anything goes’, anything will go,” he says. “Anything will happen, inevitably . . . If Dick Fuld was willing to lie about his compensation, he’s willing to lie about anything.”

Still, Budde tried to work within the system, without airing his concerns publicly. He contacted the FBI, Waxman and two state attorneys-general. He wrote to the New Jersey Bureau of Securities. He also wrote to Edolphus Towns, who had just replaced Waxman as the chairman of the oversight committee. He contacted the SEC’s inspector general. But, essentially, he says, “to this day I have never heard from anybody at the SEC”.

In April 2010, Budde got in contact with James Sterngold at Bloomberg Businessweek and shared his story about Fuld’s compensation and his campaign of obfuscation. A few other journalists, including me, picked up on Budde’s story while writing about the Lehman Brothers collapse.

When I contacted Fuld’s attorneys Allen & Overy regarding Budde’s statements, they replied: “This set of allegations surfaced several years ago, and at the time we issued the following statement. We will have no further comment. ‘The allegations by Mr Budde were previously raised with Lehman Brothers Holdings Inc and its non-management directors in the spring of 2008. After being vetted by legal counsel, they were determined to be without merit. In 2006 there were amendments to the SEC regulations for disclosure of executive compensation. Lehman Brothers complied with the amended SEC regulations.’”

Budde now spends his time writing a book about what he witnessed at Lehman and about his failed efforts to be a whistleblower. He also provides a few clients with legal advice. He hopes his book will appeal to ordinary people, curious about how without ethical leadership at the top of a bank, disaster is inevitable. “It’s just a question of time,” he says. “These guys run the banks like they’re in Das Boot: ‘Give me 110 per cent of reactor power.’ ‘But we could blow.’ ‘I don’t care.’ They think: we’re cashing out all along. What’s the worst that could happen?”

…

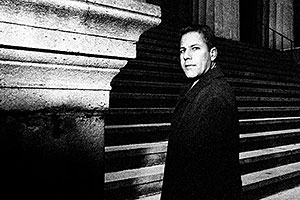

ERIC BEN-ARTZI

Former analyst, Deutsche Bank

Still fighting for reinstatement

Eric Ben-Artzi, like another whistleblower featured here (Peter Sivere), didn’t talk to the press until his employer, Deutsche Bank, had fired him.

“I never wanted or expected to be a whistleblower,” he says. “I reported internally first – and extensively, in accordance with bank policies and procedures. But as the problem was not acknowledged or corrected, I felt compelled to inform the law enforcement authorities. Unfortunately my family and I are paying a heavy price for doing the right thing.” Ben-Artzi alleged that, during the financial crisis, Deutsche Bank had overstated the value of more than $130bn of collateralised debt obligations or CDOs (securities containing different pieces of debt) on its balance sheet, to the tune of $12bn. If true, this would mean that Deutsche Bank had misstated its financial performance and its officers had signed off its financial statements illegally. The Financial Times first reported many of Ben-Artzi’s concerns about Deutsche Bank in December 2012.

Ben-Artzi’s saga began in June 2010 when, after stints at both Citigroup and Goldman Sachs, he was hired by Deutsche Bank as a quantitative analyst and a vice-president in its Legal, Risk and Capital division, based in New York. His first assignment was to create a “stress test” for Deutsche Bank’s bespoke credit derivatives portfolio, the purpose of which was to analyse what the potential losses, or “tail risk”, would be if, say, the big Wall Street banks experienced a series of financial events similar to those in 2008. This was not just a theoretical exercise but a calculation required from banks by the SEC.

The bank itself had pegged the potential losses – in its bespoke portfolio and also in one tied to indices – at about $1.6bn but after applying his own judgment to the calculations Deutsche had made, Ben-Artzi believed that this could not be right. The methodology, he thought, was flawed. He recalled that at Goldman the models had suggested the tail risk could be as much as 8 per cent. This would put Deutsche Bank’s exposure closer to $10.4bn than $1.6bn.

Ben-Artzi decided to raise his concerns with his Deutsche Bank colleagues. “I didn’t like the answers I was getting,” he says. When he spoke with the risk manager in charge, he became doubly worried. “Initially he said he didn’t know what I was talking about,” he recalls. “After that he said, ‘Those are worthless,’” meaning there should be no potential liability embedded in the CDO portfolio as opposed to the billions of dollars that Ben-Artzi had calculated. To check the mathematics properly required complex modelling but Ben-Artzi says that despite his efforts to pursue the matter he couldn’t get anyone at the bank to allow him to do it.

In March 2011, after two months of growing frustration, Ben-Artzi made two phone calls. The first was to the SEC, which eventually initiated a still-pending investigation. Four days later he called the internal Deutsche Bank Hotline, which is intended to allow employees to report wrongdoing or concerns without reprisal. “There are credit derivatives trades that I think are overvalued,” Ben-Artzi told the hotline, while declining its offer of anonymity. He says he went to the SEC first because “there were sufficient red flags” and he also wanted to give the SEC “a tip” in case he was fired after going to the hotline. He thought that “I could be terminated instantly, without any access to any information, so then essentially there would be no protection for me.”

A few days after his hotline report, Ben-Artzi says he was summoned to a meeting with Robert Rice, the bank’s head of governance, litigation and regulation in the Americas. Rice told him he thought the SEC was already aware of the internal disagreement about how to value the credit-derivatives portfolio and that an outside attorney, William Johnson, a partner at the Wall Street law firm Fried Frank Shriver & Harris, was investigating it. Ben-Artzi would be asked to meet him.

Toward the end of March 2011, Ben-Artzi had a two-hour meeting with Johnson and Rice. Ben-Artzi says he was informed Deutsche Bank was aware of the problem of properly valuing the “gap option” – which allows a counterparty to unwind the transaction under certain circumstances, putting a portion of the cost of the trade back on Deutsche Bank – and was told that the bank had decided to take an across-the-board 15 per cent “haircut” (or discount) to the derivatives, which resulted in a reduction in their value in the millions of dollars. (This was well below the billions of dollars, however, that would have been required in Ben-Artzi’s reckoning.) Finally, he was informed, a “reserve” – an accounting provision – had been taken on the trades but that was not the same as valuing the “gap option” properly, either.

Ben-Artzi says he had not been aware of these valuation efforts but that in his opinion it all seemed like obfuscation. “What they were trying to do was to be able to establish that I didn’t have all the facts, and therefore I didn’t know what I was talking about,” he says. Robert Rice and William Johnson did not respond to requests for their comments on this meeting. (Robert Rice no longer works for Deutsche Bank and is now general counsel to the SEC chairman.)

For weeks afterwards, Ben-Artzi heard nothing. Frustrated, he informed his boss that he had also discussed the situation with the SEC. Within an hour, he says, Rice called him back to his office. “It’s not my place to discourage you from going to the SEC, of course, but have you gone?” Ben-Artzi says Rice asked him. Ben-Artzi told Rice he did not want to discuss it as he was worried about retribution. Rice arranged for Ben-Artzi to meet with senior managers in New York, including top risk management executives. At these meetings, Ben-Artzi says his judgment was questioned and he was asked why he knew better than the smartest people at the firm who had not been able to come up with a viable model to value the gap option. He mentioned his Goldman findings. “Their response was, ‘If we used a gap option model, that’s the kind of thing that requires a bailout,’” because the potential losses would be so great that accounting for them could vastly diminish Deutsche Bank’ s equity account, he recalls. “They accused me of trying to bring down the bank.” (A spokesman for Deutsche Bank declined to comment on the internal meetings between Ben-Artzi and bank executives.)

Between late June and mid-October, Ben-Artzi took extended paternity leave. He worked remotely and gave serious thought to moving to Berlin to work in a related part of the bank. Then on November 7 2011 he was summoned to a conference room at Deutsche Bank in Wall Street and fired. He says he was told his job had been moved to Berlin and he could not have it. He was also told his termination was not related to his job performance. Ben-Artzi did not believe it. “I can’t see any other reason other than retaliation,” he says. At the end of the meeting, he was escorted out of the building. He received about $30,000 in severance pay and would have received more had he signed away his right to sue the bank. But he did not sign.

Three days before he was fired, Ben-Artzi filed a confidential “whistleblower” complaint with the SEC against Deutsche Bank, then another one with the Occupational Safety and Health Administration (OSHA) seeking reinstatement and payment of lost wages. Neither Ben-Artzi nor his attorney would disclose the SEC complaint, which is still being investigated.

In response to a request for comment, Deutsche Bank issued the following statement: “Issues about the credit correlation book were initially raised and self-reported to the SEC by the Bank in 2010, prior to Eric Ben-Artzi’s employment at Deutsche Bank. The Bank continues to co-operate with the investigation.”

While awaiting the outcome of his legal battles, Ben-Artzi started looking for a new job. At first, he tried to find a position on Wall Street. He had a few interviews but they went nowhere. He and his family then moved to Seattle, where Ben-Artzi hoped to find a job in the technology sector. But Seattle didn’t work out either. Recently, he was hired to teach finance and applied mathematics at Ohio State University.

He believes there is a chance he will succeed with the OSHA lawsuit and be reinstated at Deutsche Bank but he is still angry. “Obviously I’m not too happy but I’m forward-looking,” he says. “I have a lot of faith in the Department of Labor. I want to have faith in the SEC investigation . . . I think there are a lot of forces that are working in the right direction, so I hope these things will right the wrongs.” He is currently writing a book about his experiences.

Like the other whistleblowers featured here, Ben-Artzi has no regrets. “I think I did do the right thing,” he says. “I just think of the alternative of not doing anything . . . There aren’t a lot of people who were in a position to understand what happened, and a lot of people relied on me. I don’t think I could have or should have done anything else.”

…

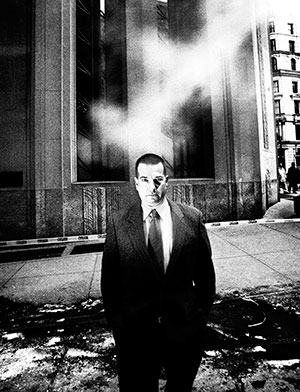

PETER SIVERE

Former compliance officer, JPMorgan Chase

Now believes he was “naive”

Towards the end of 2003, Peter Sivere, a mid-level compliance officer at JPMorgan Chase, blew the whistle on the Wall Street behemoth. In the course of his job, he had found emails and documents relating to a subpoena from the SEC, which was investigating “late trading” – Sivere believed the bank had failed to turn them over. In October 2004, he paid for his “insubordination”, as JPMorgan Chase executives referred to it, with his job and nearly with his career. It’s an old story that has happened repeatedly on Wall Street and in other industries: someone sees wrongdoing, tries to alert his or her superiors, as well as the authorities, and the thanks they get for trying to do the right thing is their notice and an overwhelming feeling of helplessness.

Although the events occurred nearly 10 years ago, Sivere still feels their effects. “Immediately after I was let go, you feel the emotions that you would [expect to] feel – let down, rejected,” he says. “You felt like if you did the right thing, the firm would stand up for you. That didn’t happen.”

He concedes, looking back, that he could have been more alert to the warning signals. Soon after he first raised his concerns, he was demoted and forced to report to people he once supervised. “Being demoted was humiliating,” he says. “But I [also] found it strangely exhilarating because it taught me how a corporation can bully a person to keep others in check.” He remained emboldened to keep trying to report the bank’s actions. “When I first asked my own compliance department to alleviate the concerns that I had and they didn’t, I was suspicious,” he continues. “Most people would have let it go but I couldn’t. I felt I did the right thing, escalating my concerns to my superiors, and when they were dismissive I felt I did the right thing by going to the SEC.”

Eventually, JPMorgan Chase dismissed Sivere. “You knew what was coming. One morning I came in and I couldn’t access any of my [computer] applications. Then security came to my desk and escorted me out.” He was dumbfounded and depressed by the melodramatic firing. He had trouble paying his bills, drained his savings and sold his New York apartment. The strain on his new marriage was almost overwhelming. “I had lost my job and now I was at risk of losing my marriage,” he says. “Coming to the realisation that I may not be able to provide for my family was by far the worst single moment: it played in my head every minute of every day.” He continues to find the topic very difficult to discuss with his two boys. “To this day my wife Krissy still feels sad hearing me try to explain to my sons Mickey and Bodie [aged 10 and seven] when they say, ‘Dad, why were you fired from your job for doing the right thing?’ Such a simple question and yet so painstaking to answer because it exposes what people are capable of doing to other people when one person’s ‘right thing’ is another person’s ‘wrong thing’.”

He has no regrets about becoming a whistleblower. But he still wonders why JPMorgan Chase did not support him. He quotes – with some irony – an expression used by Jamie Dimon, the bank’s chairman and CEO, in a 2009 speech to the Harvard Business School in which he said, “Do the right thing, not the expedient thing.” According to Sivere, “I had no reason to believe what I did was contrary to what senior management would expect from me and any JPMorgan Chase employee. You are taught at a young age right from wrong. Yet as we grow older and have our own self-interests in sight many of us lose that feeling of right and wrong.” (I have some personal experience myself of losing a job at JPMorgan Chase, as I have written elsewhere, though not as a whistleblower. I formerly worked for the bank, lost an arbitration case against it for wrongful dismissal after being laid off in 2004 and am currently in dispute with it over money it claims I owe it regarding an investment fund.)

The ordeal taught Sivere much about the way the world works and the powerful forces aligned against whistleblowers. He ticks off a list of what would have been nice to know before he embarked along this path: “I wish I had known about the revolving door between Wall Street and Washington. I wish I had known how ruthless external counsel for a corporation could be. I wish I had known that even if company policy may indicate it does not tolerate retaliation, retaliation may be in the eye of the beholder. I wish I had known how in bed the [Wall Street regulators are] with the firms they regulate. I wish I had known that the compliance department is mostly there for window dressing and is really not supposed to find anything. I wish l had known that at the end of the day compliance will be silenced by other forces. I wish I had known that the house always wins. I wish I was not so naive.”

JPMorgan Chase declined to respond to Peter Sivere’s description of events.

——————————————-

William D Cohan’s latest book is ‘The Price of Silence: The Duke Lacrosse Scandal, the Power of the Elite, and the Corruption of Our Great Universities’ (Scribner, $35). To comment on this article please post below, or email magazineletters@ft.com

Comments