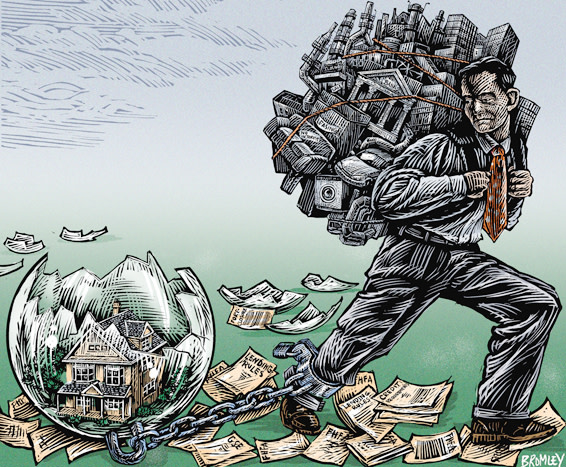

Why the housing burden stalls America’s economic recovery

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The central irony of financial crisis is that while it is caused by too much confidence, too much borrowing and lending and too much spending, it can only be resolved with more confidence, more borrowing and lending, and more spending. Most policy failures in the US stem from a failure to appreciate this truism and therefore to take steps that would have been productive pre-crisis but are counterproductive now with the economy severely constrained by lack of confidence and demand.

Thus even as the gap between the economy’s production and its capacity increases, fiscal policy turns contractionary, financial regulation focuses on discouraging risk-taking and monetary policy is constrained by concerns about excess liquidity. Most significantly US housing policies especially with regard to Fannie Mae and Freddie Mac, institutions whose purpose is to mitigate cyclicality, have become a case of disastrous procyclical policy.

Read exclusive columns on global finance, economics and politics from the world’s leading commentators

Construction of new single family homes has plummeted from about 1.7m in the middle of the last decade to about 450,000 at present. With housing starts averaging well over a million during the 1990s, the shortfall in housing construction now dwarfs the excess during the bubble and is the largest single component of the shortfall in gross domestic product.

Losses on owner-occupied housing have reduced consumers’ wealth by more than $7,000bn over the past five years, and uncertainty about the future value of their homes and the inability to refinance at reasonable rates deters household outlays on durable goods. The continuing weakness of the housing sector is a major risk for US financial institutions, raising significantly the costs of the loans they offer.

In retrospect it would have been better if financial institutions and those involved in regulating them, especially the Federal Housing Finance Agency, recognised that house prices can go down as well as up, if more rigour had been applied in providing credit, if the government-sponsored enterprises (GSEs) had been more careful in monitoring those originating and servicing loans, and if there had been more vigilance about fraudulent behaviour.

The question now is what should be done to address the housing market given the drag it represents on the economy. With virtually all mortgages in the US provided by the federal government or guaranteed by the GSEs, this is inevitably a matter of government policy.

Unfortunately past policy has been preoccupied with backward-looking attempts to address the consequences of errors in mortgage extension by addressing homeowners on a case by case basis and decisions regarding the GSEs have been left to their conservator, the FHFA, which has taken a narrow view of the public interest. The FHFA has not acted to ensure the GSEs stabilise the US housing market, and taken no account that the narrow financial interest of the GSEs depends on a national housing recovery. Instead of focusing on the stabilisation of the market, it has been reversing its previous policies heedless of changes in the environment and in treating mortgage finance as a morality play involving homeowners, financial institutions and banks rather than an important component of economic policy. A better approach would involve several changes in policy.

First, and perhaps most fundamentally, credit standards for those seeking to buy homes are too high and rigorous. This reduces demand for houses, lowering prices and driving increases in foreclosures, leading to further tightening of credit standards and a vicious growth-destroying cycle. Statistics suggest the characteristics of the average applicant in 2004 would make an applicant among the most risky today. Of course the pattern should be the opposite given that the odds of a further 35 per cent decline in house prices are much lower than they were at past bubble valuations.

Second, as Barack Obama stressed in presenting his jobs programme, there is no reason why those on GSE-guaranteed mortgages should not be able to take advantage of lower rates. From the point of view of the guarantor, lower rates are good since they reduce the risk of default. Yet, until now the GSEs have made refinancing very difficult by insisting on significant fees and requiring that any new refinancier take on all the liability for errors in underwriting the original mortgage at a cost to American households of tens of billions of dollars a year.

Third, stabilising the housing market will require doing something about the large and growing inventory of foreclosed properties. The same property sold in a foreclosure sale nets about 30 per cent less than if sold in the ordinary way and the knowledge that there is a huge overhang of foreclosed properties deters home purchases. Aggressive efforts by the GSEs to finance mass sales of foreclosed properties to those prepared to rent them out could benefit both potential renters and the housing market.

Fourth, there is the prevention of foreclosures which was the initial focus of policy efforts. The truth is it is far from clear what the right way forward is. While the Obama administration’s home affordability modification programme has been criticised for overly restrictive eligibility criteria, the reality is that a large fraction of those receiving assistance have ultimately been unable to meet even their reduced obligations. This suggests the task of helping homeowners without either damaging the financial system or simply delaying inevitable outcomes is more difficult than often supposed. Surely there is a strong case for experimentation with principal reduction strategies at the local level. The GSEs should be required to drop their posture of opposition to experimentation and move to a more constructive position.

Fifth, there were substantial abuses by financial institutions and almost everyone in the mortgage industry during the bubble. Just compensation to the victims is a legitimate objective of public policy. But allowing negotiation over the past to dominate present policy creates overhangs of uncertainty that impose huge costs on the financial system and inhibits lending. It is equally in the interests of bank shareholders and the housing market that a rapid resolution of disputes be achieved. The FHFA should strive to quickly end this uncertainty.

While the GSEs are the most important actors in the mortgage market and hence the FHFA is the most important player in housing policy, others can make a difference. Bank regulators could facilitate inevitable restructuring of underwater mortgages by requiring banks to treat second mortgages and home equity loans in realistic ways. The Federal Reserve could support demand and the housing market by again expanding purchases of mortgage-backed securities.

With a constructive approach by independent regulators, far better policies could be in place six months from now. The anticipation of a change to supportive policies could change the tone of the market even sooner. There is nothing else on the feasible political horizon that can make as large a difference in driving American economic recovery.

The writer is Charles W. Eliot university professor and president emeritus at Harvard University. He was Treasury secretary under President Bill Clinton and former director of the National Economic Council under President Barack Obama.

Comments