Has GDP outgrown its use?

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

What do the price of hair-salon services in Beijing and sexual services in London have in common? The answer is that, depending on how you measure them – or indeed whether you measure them at all – the size of the Chinese and British economies will expand or contract like an accordion.

In April, statisticians working under the aegis of the World Bank determined that China’s gross domestic product was far bigger than they had previously realised. China was, in fact, just about to overtake the US as the world’s largest economy, many years earlier than expected. The reason? Statisticians had been overestimating the prices of everything from haircuts to noodles. As a result, they were underestimating the purchasing power of Chinese people and thus the size of the economy.

Last month, British statisticians worked some magic too. They declared that the UK economy – admittedly only a fraction of China’s size – was 5 per cent bigger than previously thought. It was as if they had suddenly discovered billions of pounds in annual revenue at the back of the nation’s couch. Here the explanation was simpler. Among other tweaks to their methodology, statisticians started counting the economic “contribution” of prostitution and illegal drugs.

…

Gross domestic product has become a ubiquitous term. It is how we measure economic success. Countries are judged by how much they have of it. Governments can rise and fall according to how effectively their economies create it. Everything from debt levels to the contribution of manufacturing is measured against it. GDP is what makes the world go round. Yet what exactly does it mean? Outside a few experts, most people have only a shaky understanding. In fact, the more you delve into the whole concept of GDP – one of the most centrally important ideas in modern life – the more slippery it becomes. In the words of Diane Coyle, an economist who recently wrote an entire book on the subject, “GDP is a made-up entity.”

Coyle is a defender of GDP as a tool for understanding the economy so long as we grasp its limitations. When I spoke to her by phone, she was nevertheless amused at what she called “the regular fandango” and “public ritual” that accompanies the quarterly release of GDP data. Even though those numbers are often within the margin of error and routinely revised, we invest them with as much meaning as a priest does his liturgies.

The title of Coyle’s book, GDP: A Brief But Affectionate History, makes clear her basic allegiance to the concept. Yet, she warns, “There is no such entity as GDP out there waiting to be measured by economists. It is an artificial construct … an abstraction that adds everything from nails to toothbrushes, tractors, shoes, haircuts, management consultancy, street cleaning, yoga teaching, plates, bandages, books and all the millions of other services and products.” The people who measure GDP, then, are not involved in a scientific enterprise, such as discovering the mass of a mountain or the longitude of the earth. Instead, they are engaged in what amounts to an act of imagination.

GDP is a surprisingly new idea. The first national accounts that resemble modern ones were produced in the US in 1942. It is not particularly odd that governments didn’t bother much about sizing up their economies before then. Until the industrial revolution, agricultural societies barely grew at all. The size of an economy was thus almost entirely a function of national population. In 1820, China and India made up roughly half of global economic activity by sheer virtue of the number of people who lived there.

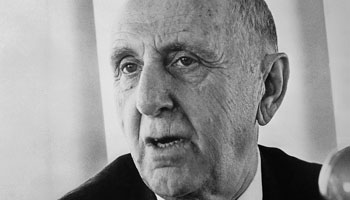

Simon Kuznets, the Belarusian-American economist often credited with inventing GDP in the 1930s, had severe reservations about the concept right from the start. Coyle told me, “He did a lot of the spade work. But conceptually he wanted something different.” Kuznets had been asked by US president Franklin Delano Roosevelt to come up with an accurate picture of a post-crash America that was trapped in seemingly interminable recession. Roosevelt wanted to boost the economy through spending on public works. To justify his actions, he needed more than just snippets of information: freight-car loadings or the length of soup-kitchen lines. Kuznets’ calculations indicated that the economy had halved in size from 1929 to 1932. It was a far more solid basis on which to act.

Diane Coyle,Economist

‘There is no such entity as GDP out there waiting to be measured’

When it came to data, Kuznets was meticulous. But what, precisely, should be measured? He was inclined to include only activities he believed contributed to society’s wellbeing. Why count things like spending on armaments, he reasoned, when war clearly detracted from human welfare? He also wanted to subtract advertising (useless), financial and speculative activities (dangerous) and government spending (tautological, since it was just recycled taxes). Presumably he wouldn’t have been thrilled with the idea that the more heroin consumed and prostitutes visited, the healthier an economy.

Kuznets lost his battle. Modern national income accounts include both arms sales and investment banking services. They don’t distinguish between social “goods” – say, spending on education – and social “bads” (or necessities) – say, gambling, repairing the damage after hurricane Katrina or preventing crime. (Countries without much crime miss out on related economic activity such as security guards and repairing broken windows.) GDP is amoral. It is defined simply as the total monetary value of everything that has been produced in a given period.

The first thing to understand about GDP is that it is a measure of flow, not stock. A country with high GDP might have run down its infrastructure disastrously over years to maximise income. The US, with its ageing airports and less-than-pristine roads, is sometimes accused of precisely that.

Neither is any account taken of depleted resources. China has been growing at 10 per cent a year for 30 years. That makes no allowance for the (presumably) finite oil and gas reserves it has been consuming. (The assumption is that technology will always come to the rescue.) Nor does it account for what economists call “externalities”, the by-products of growth, including pollution. How much it may eventually cost to clean up polluted rivers and restore denuded forests is of no concern to GDP.

Simon Kuznets,

Economist and adviser to

US President FD Roosevelt

Kuznets calculated that the US economy had halved from 1929 to 1932

Coyle told me GDP provided “no sense of the trade-off between present and future”. Innovation could help us find alternatives to finite resources, such as metals, but GDP took no account of sustainability. That left us vulnerable to “tipping points”, such as the sudden collapse of fishing stocks.

…

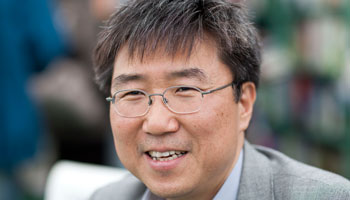

Even the mechanical business of measuring everything produced is not as easy as it sounds. Let’s take a loaf of bread, the example provided by economist Ha-Joon Chang when I went to see him in his cubbyhole of an office in Cambridge. When valuing the loaf, if we also count the yeast and flour that go into it, then we have double-counted, he said. Output is measured by value-added: we calculate the value of the bread minus the value of the intermediate inputs, produced for example by the miller. Bread is a relatively simple product. But try working out the value-added of a car or an iPhone, which rely on fiendishly complex global supply chains. No wonder the UN System of National Accounts, a how-to GDP manual, runs to more than 700 pages.

GDP is better at measuring quantity than quality, said Chang, who has recently published a book, Economics: The User’s Guide, in which he casts a mischievous glance over our treasured economic assumptions. Take a table setting of a knife, fork and spoon. In output terms, a setting of three spoons is equally good. In quality-of-life terms, clearly not. Coyle calls GDP an “artefact of the age of mass production”.

Indeed, one of the biggest failings of GDP is how atrocious it is at capturing services. That is a bit of a problem given that services now account for two-thirds of the output of many advanced economies. Statisticians are pretty good at measuring things you can drop on your foot, such as bricks and iron bars. But they struggle to measure intangibles such as landscape gardening, jet-engine service contracts or synthetic derivatives. How do you compare the output of a brain surgeon in Brazil, a mechanic in Germany and an investment banker in Nigeria?

Ha-Joon Chang,Economist

‘A society can still become ‘better-off’ without a rise in GDP’

Let’s go back to the example of the Beijing haircut. Since you can’t know the price paid for every haircut, you need to take a sample. You may determine that on average a haircut in Beijing costs half the amount of one in New York. But how do you know you are comparing like with like? Do you judge the quality of the haircut, the skill of the hairdresser, the brightness of the decor? How about the quality of the mid-snip banter? Should we judge a nurse’s efficiency by how many patients he or she sees in a day, or the quality of care provided? In strictly mechanical terms, you could increase the efficiency of a philharmonic orchestra by getting it to play concertos at twice the speed.

You could argue that this is missing the point. A service is worth what the market will bear. No one will pay to listen to a sped-up orchestra. Yet there is a more fundamental issue at stake. Is more of a given service always better? That is the clear implication of how we measure GDP. Take banking. Before the 2008 financial meltdown, the size of the financial industry in the US had risen astronomically to reach nearly 8 per cent of GDP by 2009. (That was partly the result of changes in how banking was measured.) Yet a bigger banking sector, as we subsequently discovered, was not necessarily a good thing. Much of its size owed to an increasing capacity to generate “sophisticated” products, some of which turned out to be toxic. Given the lengthy recession that followed the crash, you could plausibly argue that an expanded financial industry destroyed GDP rather than created it. If banking had been subtracted from GDP, rather than added to it, as Kuznets had proposed, it is plausible to speculate that the financial crisis would never have happened.

The medical industry is another example. The US spends about 18 per cent of GDP on healthcare. Much of that is eaten up by insurance, inflated drug costs and unnecessary procedures. Outcomes, in terms of life expectancy and years of healthy life, are not obviously better than in countries that spend half the amount. It’s worth asking, therefore, whether the US might be better off if healthcare spending contributed less to GDP, not more.

If some services are overemphasised, some are not counted at all. GDP mostly takes into account things that are bought and sold. Swaths of non-marketed activity are entirely invisible. The most obvious is housework. There is no monetary value at all assigned to cooking, cleaning, child-rearing and caring for older or disabled people at home. That is partly because such work, often done by women, is undervalued. It is also difficult to estimate. Yet not counting housework is in some ways absurd. In Japan, the government is campaigning to get more women to work in order to raise GDP. In many ways this is a good idea. Yet it’s still worth conducting a thought-experiment. Imagine that many of the nominally unemployed women are looking after children or elderly relatives. Now decree that each of those women should work in the house next door, where, for an hourly rate, they can look after their neighbour’s child or parent. Overnight, the GDP of Japan would be larger. But in terms of actual work performed, absolutely nothing would have changed. The only difference would be that grandpa would now wonder about the stranger looking after him – and the government would have found itself a new source of taxable income.

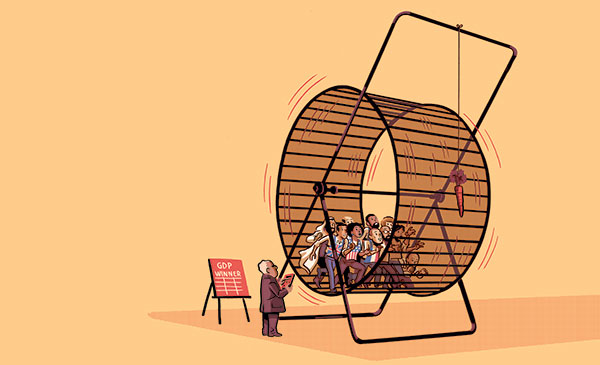

Robert Skidelsky,Economic historian

‘It’s growth without end and without purpose’

Growing inequality, a subject of sudden and urgent interest in advanced economies, is another reason why headline growth may miss the true picture. The performance of the US economy has been mostly exceptional for decades. Yet according to Robert Reich, former secretary of labour and now a professor at the University of California, Berkeley, median wages, adjusted for inflation, haven’t budged since the 1970s. Almost all the benefits of growth have gone to the top 1 per cent. If we’re not part of that elite, GDP growth has been, at best, irrelevant.

On the other hand, says Coyle, GDP is particularly bad at capturing one of the most important features of modern economies: innovation. So-called “hedonic accounting” seeks to adjust for the fact that equipment like computers is improving all the time. If you buy a computer today that has four times the computing power of the one you bought a year ago but costs the same, then in reality its price has fallen. Put another way, you are better off.

As author Jeremy Rifkin points out in his recent book The Zero Marginal Cost Society, the price of many products – online music, internet-enabled car-sharing, Wikipedia, solar energy, Skype – is tending to zero. How do we value economic activity if it doesn’t command a price? Not that long ago, millionaires died for want of antibiotics that today cost pennies. “Even if the market value of what you produce doesn’t actually go up,” Chang tells me in his Cambridge office, “if people are living better, eating better and having more leisure time, then you should say that this society has become better off.”

That raises the almost philosophical question of whether we need growth at all. The slow realisation that GDP is failing adequately to capture our economic and social realities has spawned a mini-industry in efforts to measure progress in different ways. Former French president, Nicolas Sarkozy, commissioned leading economists, including Joseph Stiglitz and Amartya Sen, to look into better methodologies. Their report, Mismeasuring Our Lives: Why GDP Doesn’t Add Up , concluded that our standard metric of economic wellbeing was not up to the job. Worse, they thought too much focus on GDP could send policy makers in the wrong direction – for example, expanding their banking industries and ignoring more basic things such as access to education or health. “If we have the wrong metrics, we will strive for the wrong things,” they concluded.

…

The best-known expression of GDP scepticism is sadly one of the most idiotic. The Bhutanese Gross National Happiness index, which purports to capture human progress in more holistic terms, doesn’t bear much scrutiny. A much better metric, the human development index, which takes into account life expectancy, literacy and education as well as standard of living, puts Bhutan 140th in the world, two up from the Republic of Congo. (Norway is top and Niger, at 187, bottom.) Bhutan’s “Gross National Happiness” looks like an attempt to cover up its poor performance.

A more serious probing of what might be called the “growth myth” – the idea that the pursuit of GDP is the be-all and end-all – was undertaken by Robert Skidelsky, a renowned economic historian. Together with his son, moral philosopher Edward Skidelsky, he wrote a book, How Much is Enough? Money and the Good Life. The question addressed is what drives people in affluent societies to seek ever more wealth when they know, intuitively, that this fails to bring them extra happiness.

The Skidelskys accept that poor countries need growth to catch up with western living standards but they wonder why affluent societies are so growth-obsessed. Their starting point is a 1930 essay written by John Maynard Keynes, Economic Possibilities for Our Grandchildren, in which he assumed that, as consumption reached certain levels, the incentive to work harder would tail off. (Another failing of GDP is that it takes no account of how many hours people work.) In the age of abundance, Keynes thought, people would naturally forego the chance to consume ever more in favour of leisure. He imagined that, by now, none of us would be working more than 15 hours a week.

Some months ago, I caught up with Skidelsky, the elder, in Hong Kong. I asked him what had gone wrong with Keynes’ theory. We were sitting on the terrace of a five-star hotel. As we talked, helicopters took off for Macau bearing gamblers to the baccarat tables, where they would try to win yet more money. Why were humans so insatiable? One reason was that wants were relative, he said. Money conferred status. So having “enough” meant having more than other people. If everyone were well off, we would all fly to our exclusive Caribbean retreat only to find the beach full of similarly well-heeled people and no one with much inclination to bring us Martinis and canapés.

Another reason was inequality. A fifth of British people lived below the poverty line, he said. Rather than redistribute wealth better, as Skidelsky advocated via a basic income, the thinking was to enlarge the pie further. That obliged us to stay on a constant growth trajectory, which put us on a never-ending treadmill. “It’s growth without end and without purpose,” he said.

The Skidelskys’ book has been criticised for assuming to know what is good for people and where the limits of their desires should be. Coyle, for one, profoundly disagrees with the thesis. The pair’s notion of the good life, she told me, came from a particular stratum of British society: “a fine glass of claret, a good book and Radio 3 on in the background”. The problem was that they didn’t allow for changing wants. Nor did they give much credence to innovation, much of which they brushed off as an illusion created by devious advertisers. Coyle thought innovation was real. “Would you give up the internet or new flavours of breakfast cereal?” she asked. “I don’t want a professor of economic history telling me what I can choose and what I can’t.”

At the heart of the GDP debate is an anxiety that our societies have been somehow hijacked by pursuit of a single data point. No one seriously imagines that simply making an abstract number bigger and bigger can be a worthy goal in its own right. Yet GDP has become such a powerful proxy for what we do hold dear that we find it hard to see past it. Few economists are blind to its many limitations. Most, nevertheless, give the impression of wishing to maximise it at all costs.

Coyle argues that we should invent new ways to reflect economic reality. She advocates what she calls the “dashboard approach”. The Better Life Index, developed by the Organisation for Economic Co-operation and Development, for example, allows users to compare the performance of countries according to 11 criteria ranging from income and housing to health and work-life balance. By plugging in the criteria you value most you can see how a particular economy performs. If, say, employment is your priority, then Switzerland and Norway are best. If, on the other hand, you’re more interested in a combination of high income and education, then the US is the place to be.

In theory, this approach would allow voters to decide what is important and politicians to craft policies to achieve desired results. In practice, the combination of multiple criteria measured according to multiple yardsticks renders the exercise subjective and fuzzy. GDP may be anachronistic and misleading. It may fail entirely to capture the complex trade-offs between present and future, work and leisure, “good” growth and “bad” growth. Its great virtue, however, remains that it is a single, concrete number. For the time being, we may be stuck with it.

David Pilling is the FT’s Asia editor

Illustrations by Lucas Varela

Photographs: Getty; Bloomberg

——————————————-

Letter in response to this article:

GDP and the trade-offs between work and leisure / From Mr Amit Singhal

National accounts are a distorting lens / From Emeritus Prof Lance Taylor

Comments