Fears of financial instability keep demand for banknotes strong

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

Money doesn’t grow on trees, but in the middle of a forest deep in the Bavarian countryside it comes pretty close. An hour’s drive south of Munich hidden by spruces is Louisenthal, the mill and printing presses that help produce banknotes for about 100 currency zones.

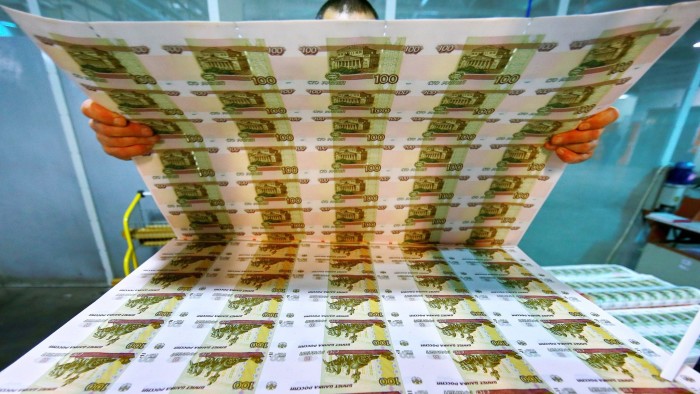

Giesecke & Devrient, owner of Louisenthal, is one of a few companies competing to make the 160bn banknotes printed each year. While the world’s central banks usually hold monopoly licences on printing local currencies, up to 70bn banknotes are printed on material produced in the private sector.

Although people are becoming comfortable with paying for goods and services electronically, banknote production is thriving.

One reason for the enduring appeal of cold, hard cash is the global economic downturn. Giesecke & Devrient expects banknote production to rise by 5 per cent a year for the “foreseeable future”, despite projections of double digit increases in the use of cards and other forms of electronic payments.

“Cash is 100 per cent reliable in times of crisis. It’s in periods of panic where a solid financial system has to prove itself,” said Ralf Wintergerst, a Giesecke & Devrient board member. “In a crisis situation, the demand for cash typically rises sharply. The reason for this is trust in real currency.”

The turmoil in Greece, which not only sparked speculation of a return to the drachma but also led to a surge in demand for cash, is a case in point.

The number of banknotes in circulation in Greece was €45.2bn at the end of May: a level last seen in June 2012, the last time fears of a Grexit sparked a bank run. In 2012, the ECB had to fly additional supplies of banknotes to Athens from around the region. The €45.2bn amounts to a little over €4,000 for every Greek.

European Central Bank data also show leaps in the demand for banknotes following the collapse of Lehman Brothers, the US investment bank, in 2008. Most of this increased demand was for higher denomination notes such as the €200 and €500 bills: a clear sign the leaps were down to hoarding by anxious savers.

The enduring appeal of banknotes is not just down to the financial crisis. More than half of payments in stable, advanced economies such as Germany’s are still made in cash, while globally the figure is about 80 per cent. Notes also need to be replaced frequently, with low value bills such as the €5 bill taken out of circulation as often as once every six months.

One of the reasons people flock to notes during financial panics and natural disasters lies in the way they look and feel. The desire to store your wealth in a physical object increases as the world around you becomes more uncertain. Though banknote producers can charge as little as €25 for 1000 notes, the difficulties in replicating their design and their status as legal tender create intrinsic value. Of the more than 17bn euro notes in circulation, less than half a million were counterfeits, according to ECB figures.

In the Louisenthal plant security is tight — you must show your passport, then leave it and any mobile phones at the door. Once you have passed the airport-style double-door entrance to the building the smell of the solvent, used to build up the notes’ multiple layers, hits visitors.

Some of the factory presses are as much as 30 metres long, and 5 metres high. Workers have largely been replaced by whirring machines. These reel out reams of rainbowed security foil that will feature on banknotes for an African country or paper that will later be used to print the 20 euro note, pocked with the mark of a shield to be replaced with a transparent window.

The €20 note is the most counterfeited in the single currency area, accounting for more than half of all fakes recovered in the first half of this year. The hope is that a new design will prompt a drop in the number of fakes of what is by far the eurozone’s most common note.

Notes’ designs are inked on the paper separately. Once completed, notes are sent via central banks and so-called commercial cash centres to bank branches around the 19-member region and loaded into the region’s 3m cash machines.

Comments