FT 1000 retailers take clicks-and-bricks approach

Simply sign up to the Retail sector myFT Digest -- delivered directly to your inbox.

A shop is no longer a shop. Or at least the traditional idea of one — a static space with large plate glass windows, a checkout and shelves of shiny products — is on the wane as big-name retailers try creative ways to get consumers through the door.

Apple stores offer coffee, Patagonia hosts yoga classes and Nike lets you try trainers out on their in-store basketball court. As Roelant Prins, chief commercial officer at global payment company Adyen, put it in a recent sector report: “In a world where anything can be a shop, and a shop can be anything, how do you evolve to serve today’s shoppers?”

If this year’s FT 1000 ranking of Europe’s fastest growing companies is anything to go by, the answer lies online, or with a calibrated mix of web and bricks-and-mortar sales.

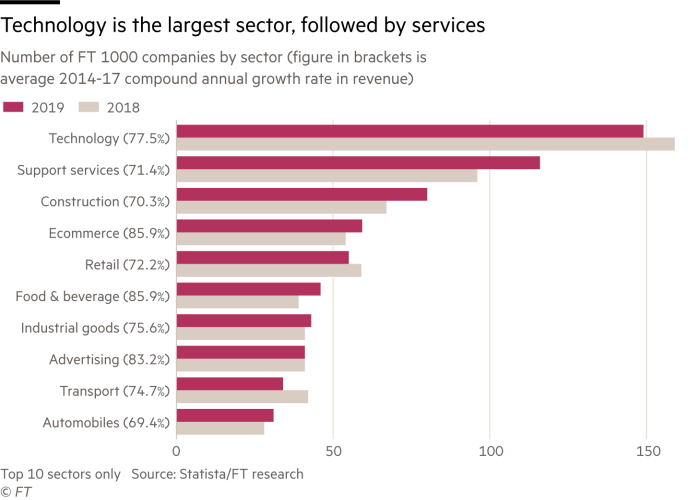

Despite concerns about consumer spending, the number of companies in the list defining their business as either ecommerce or retail was remarkably consistent at 114, compared with 113 last year. Tellingly, perhaps, slightly more of these plumped for being described specifically as ecommerce rather than retail ventures. Taken together, they were second only in number to technology and services.

Nearly all had an online operation, with popular products including clothes, ecigarettes, health and cosmetics. The biggest FT 1000 retailer by revenue is online fast-fashion retailer Boohoo. Adam Tomlinson, a retail sector analyst at Liberum, says the key to Boohoo’s success is speed and focus on one niche of customer — 16-to-30-year-olds.

“They source close to home, which gives them quick lead times,” he says. “They can pick up on a trend and have a product on their website in two to four weeks, rather than the traditional retail model where you buy six to 12 months in advance and get stuck with loads of stock.”

Websites can also be a “capital-light” way to test a market before opening a physical store, says Mr Tomlinson. But expanding turnover quickly is not without hazard. “You need to manage growth. When you’re growing that fast, risks can be exacerbated. You need to get your suppliers to grow with you.”

The fastest growing retailer on the FT 1000 list this year was Tantal, an organic cosmetics ecommerce company based in Leonberg in southern Germany. The business, which has tapped into the vegan and wellness trends via its Talea brand, enjoyed a compound annual growth rate in revenues of 220 per cent between 2014 and 2017. In that time, it also opened its first physical shop in Stuttgart.

“The organic cosmetics market is growing fast,” says Jessica Aldinger, manager and member of the retailer’s founding family. “People have become aware of what they are treating their skin, face and bodies with.” Organic cosmetics ban things like aluminium from antiperspirants.

Another popular consumer trend which has held onto a physical presence is ecigarettes. Experts in the sector see physical retail outlets as presenting those new to vaping with a chance to learn about the product.

France’s Le Petit Vapoteur has taken advantage of this. The business started in the small guest room of two ex-smokers, Olivier Dréan and Tanguy Gréard, in 2012 and now receives around 5,000 orders a day. The first shop opened in Cherbourg in 2013. Today there are 12 vape shops and a warehouse for its web operation.

Claire Brault, the company’s communications director, attributes its revenue growth to the advice it gives its customers, and the “vintage . . . pin-up look” of its website, styled on early 20th-century advertising posters.

Social media is an important engagement channel. To the more than 8,000 followers of its Instagram account, the company posts pictures and slow-motion videos of chic French twenty-somethings puffing on ecigarettes.

The maturing ecommerce market has meant the execution of online shoppers’ orders is a vibrant subsector where service is key. James Hyde, co-founder of James and James — an order fulfilment business that made this year’s FT 1000 list — realised this in 2010.

He and his partner James Strachan were working at small, family retailer when one day all its orders were mistakenly printed twice, resulting in a double delivery of products. “It was a bad system. And not the service you’d expect as a customer,” he says.

The pair decided to build their own order fulfilment system based on cloud computing, the advantage being that a retailer’s inventory is updated instantly and errors are minimised. Companies that have integrated with the James and James system have cut time spent processing orders by up to three-quarters, he says, adding: “I don’t think we suspected the move away from the high street would be quite as stark as it has been.”

Comments