Forget Brexit and trade wars, Europe’s start-ups are thriving

Simply sign up to the Fintech myFT Digest -- delivered directly to your inbox.

Amid talk of trade wars, Brexit fallout and an economic slowdown, there is one encouraging business counterpoint: the fastest growing companies in Europe continue to thrive.

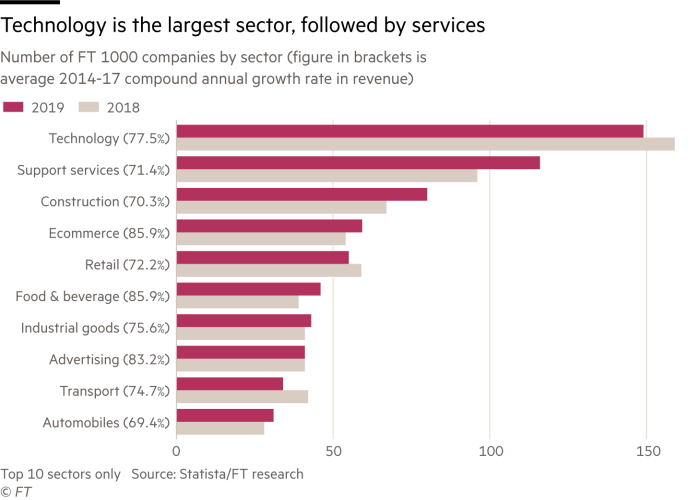

Today, the FT publishes its third annual ranking of Europe’s fastest growing companies — judged by their revenue growth rate between 2014 and 2017. The FT 1000 list is compiled with Statista, a research company.

Many entries are start-ups developing technology to disrupt established industries from financial services to healthcare. This year’s list suggests they are forging ahead. The lowest ranked company to make the list had a compound annual growth rate in revenue of 37.7 per cent, up from 34.6 per cent last year.

Toby Coppel, partner at Mosaic Ventures, a London-based venture capital firm, says there has never been a better time to build a start-up.

“The European start-up ecosystem continues to mature,” he says. “There are many more successful companies like Spotify where the next generation of founders are trained and then leave to start-up the next company, often with former colleagues [to start something new].”

A decade ago, entrepreneurs would have felt the need to go to San Francisco to grow, says Ophelia Brown, founder of Blossom Capital. But that is no longer the case, she argues, as the success of previous start-ups is encouraging new generations in cities across Europe. “Founders are more ambitious than ever before.”

The top two companies in the list reflect the region’s established strengths in fintech and consumer services — Blue Motor Finance, a car finance group, followed by food delivery operator Deliveroo. But this year’s FT 1000 also shows emerging areas of growth. The top 10 includes cancer gene therapy specialist PsiOxus and cyber defence company Darktrace. The latter’s tech has helped companies detect everything from hacks to secret bitcoin mining, co-founder Poppy Gustafsson told the FT last year.

Not to mention drones: the full list includes distributors of the unmanned aerial vehicles, as well as MC2 Technologies, a France-based manufacturer of devices that can jam their signals.

European cities are achieving maturity as start-up hubs after a decade trailing rivals in the US, with a growing number of so-called “unicorn” businesses worth more than $1bn. Brent Hoberman, British entrepreneur and executive chairman of the global Founders Forum, counts 36 new unicorns in Europe and Israel last year, underlining the vibrancy of these regions.

Saul Klein, co-founder of venture fund LocalGlobe, says the UK has led the way in the fashion and retail industries — Boohoo is among the largest companies by revenue on this list — as well as financial services, where companies such as TransferWise, Atom and Monzo are breaking into the mainstream.

However, the number of companies from the UK and Ireland in the FT 1000 has dropped over the course of its three years, and Brexit is prompting companies to seek licences and open offices elsewhere in Europe to offset the risk of a disruptive no-deal departure from the EU.

“The Brexit impact will be people,” says Philippe Botteri, of venture capital fund Accel, pointing to the need to hire the region’s best programmers and designers. “Can start-ups still attract talent from continental Europe?”

Mr Hoberman agrees that London’s position cannot be taken for granted given an “arms race for talent across Europe”.

Others are bullish about the future after Brexit. Mr Klein expects access to funds to increase, pointing to UK government plans to encourage growth. “We’ve never had it so good. After the Bay Area [of San Francisco] and China, London is the greatest producer of billion-dollar companies on the planet.”

This year, cities such as Milan and Berlin have increased their representation on the list. Germany remains the top country base, with two of its start-ups — Delivery Hero and Hello-Fresh — in the top three by revenue size.

The challenge for many groups is to become pan-European in scale. This is a shift that would be helped, experts say, if European regulators formed a coherent plan around a digital single market. A next step was taken in February with a proposed modernisation of copyright rules.

But there are still concerns over the so-called “techlash” by regulators seeking greater oversight and control over technology companies that are being criticised for their handling of personal data. Mr Coppel says that “rules are going to change and start-ups need to get ahead of that”. Privacy may become a feature to trumpet rather than a problem, he adds.

Oscar Berglund, chief executive of Swedish fintech Trustly, at rank 482, also worries about where regulation is heading, particularly for financial services. But securing funding is not currently a problem for companies, he says, with more potential partners than five or 10 years ago eager to invest and based in Europe.

In fact, after a year in which many publicly listed companies began to flag concerns — from the slowdown in retail to the threat of UK’s planned departure from the EU — founders and funders alike say that capital for growth has never been easier to find. The pool of venture capital funds has meant groups can stay private for longer, rather than risk the greater scrutiny of the public markets.

Evidence of an economic slowdown in some countries in Europe has yet to visibly affect the FT 1000. The disrupters on the list are better protected. Mr Botteri argues that such companies will thrive even if economic conditions deteriorate, given that many are set up to take market share from incumbent businesses. “They are disrupting existing businesses.”

Mr Hoberman points to the growing use of big data in fintech and healthcare, and he expects new efforts bringing together robotics and food delivery. Mr Klein thinks the next wave of innovation will come in AI and quantum computing.

Mr Coppel flags continued innovation in mobility and location services — “software is ‘eating’ cars, trucks, scooters and drones, enabling smarter, autonomous applications that will rewire cities”, he says. He also points to the opportunities to use big data and machine learning to discover new drugs and treat complex diseases.

Comments