Paris exasperates Fiat Chrysler as Renault merger flops

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For John Elkann, the 43-year-old industrial scion and chair of Fiat Chrysler Automobiles, it was the straw that broke the camel’s back.

After months of meticulous preparation, a €33bn merger between Italy’s FCA and France’s Renault was tabled last week, the details ironed out over several weeks with Renault’s chairman, Jean Dominique Senard.

All that was left, a seeming formality, was for the Renault board to sign off.

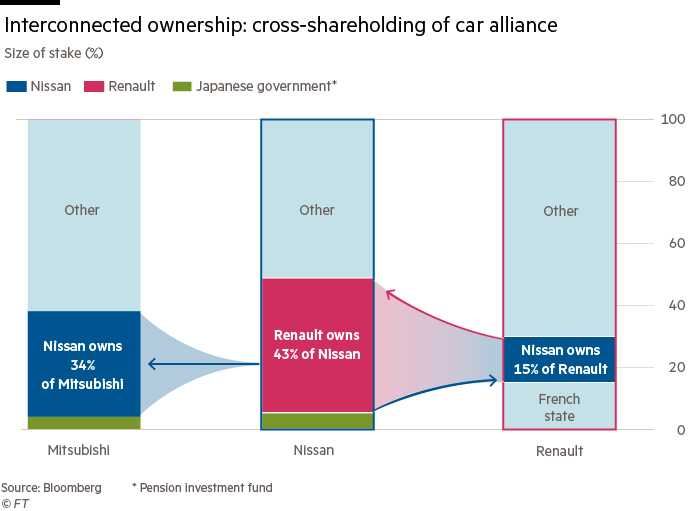

Over the course of a Renault board meeting that stretched over two days, a number of concessions to the French state, which owns 15 per cent of the carmaker, failed to win the backing needed for the deal.

A demand that French finance minister Bruno Le Maire be given time to use a trip to Japan to smooth the deal with Renault partner Nissan, made late in a meeting on Wednesday evening, was too much for FCA.

As the minutes ticked towards midnight, a call between FCA’s increasingly frustrated board members ended with a decision to call off the merger approach.

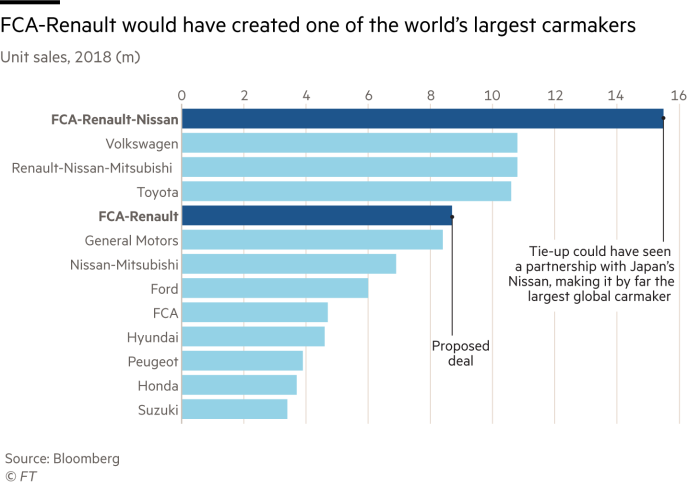

The plan to create the world’s third-largest carmaker, a titan with bases in Detroit, Europe and Asia, was dead.

In a message to his employees on Thursday evening, Mr Elkann, who controls 29 per cent of FCA through the Agnelli family’s Exor fund, said that “when it becomes clear that the discussions have been taken as far as they can reasonably go, it is necessary to be equally decisive in drawing matters to a close and returning to the important work we have to do”.

The venture had “little chance of ultimate success if its foundations are unstable”, he added.

Only hours earlier, and after days of wrangling, Mr Elkann and FCA believed they had won over president Emmanuel Macron’s government.

Job guarantees, a board seat for the French state, a four-year term on the board, a place on the nominations committee and an increased value for Renault, all agreed at an FCA board meeting at 4.30pm, were offered as sweeteners to the Renault board ahead of its Wednesday evening meeting.

They were not enough.

At 10pm, already running two hours late, the Renault board was disbanded while state representative Martin Vial contacted Mr Le Maire, further delaying proceedings.

Mr Elkann, who frequently texted Mr Senard, heard that the meeting had broken up and convened an 11.30pm call for FCA’s board members.

A phone call from Mr Senard at 11.08pm gave him the news that the French state wanted to delay Renault’s vote on the FCA merger until the following Tuesday.

It was the culmination of weeks of increasing FCA exasperation over the behaviour of Renault’s largest shareholder.

Several months earlier, when the private discussions between Mr Senard and Mr Elkann graduated from co-operation into merger talks, the French state had been deliberately brought on board, including a meeting in Paris between Mr Elkann and Mr Macron.

It is possible that more time was needed.

The merger proposal was announced last Monday, but a lack of some crucial details, such as leadership and headquarters, stood out.

One person said the process was accelerated over the weekend after the Financial Times reported on Saturday that the two groups were in talks. Once the news became public, the attitude of the French state changed, according to several people.

Questions that both sides believed were resolved were reopened, and new concessions requested.

“It was never enough, the goalposts were being moved constantly,” said one person involved in the talks.

One demand included a state veto on the new chief executive, according to two people familiar with the negotiations, which FCA was deeply uneasy about granting.

It is important, however, to try to understand the French state’s rationale.

For it, the request for a delay to win the explicit support of Nissan was a small matter in such a large merger. A signal from the two Nissan representatives on the Renault board that they would abstain from voting on the deal spurred the state to ask for the delay.

According to one government official, Mr Le Maire instructed Mr Vial not to vote if no explicit support was forthcoming from Nissan. Other government officials on Thursday said they had been surprised by the time pressure exerted by FCA.

“FCA had an agenda and a timing that was very short for an operation of this size,” said one official.

The decision of the two Nissan-nominated members of Renault’s board to abstain, said one person close to FCA and the negotiations, was the only reasonable position they could take, given the lack of information on the merger currently in Nissan’s hands and the potential conflict of interest involved in the Nissan nominees voting on a merger that would fundamentally affect Nissan’s position in their alliance with Renault.

There is also a suggestion that the French state was keen to demonstrate that it took Japan seriously as a partner after multiple mis-steps over the past few years, including a shock operation to secure double voting rights spearheaded by then economy minister and current president Emmanuel Macron in 2015.

More recently, the push for a full merger between the two partners and the arrest of alliance-architect Carlos Ghosn in November has seen the relationship between Paris and Tokyo plumb new lows.

The problem was that the French state wanted Nissan’s backing, while the Japanese remained wary about French dirigiste tendencies, according to one person close to Renault.

The French state was also keen not to shut the door on FCA. On a call between Mr Le Maire and Mr Elkann on Thursday morning, Mr Le Maire stressed that all doors to a deal remained open.

“I don’t know if they will come back . . . but for today the door has been shut, for Renault and for FCA,” said one person.

The failure of the talks will reverberate throughout the alliance.

For Mr Senard, the highly respected 66-year-old former Michelin boss who was parachuted in to put the alliance back on track and who spent many hours in discussions with Mr Elkann, the setback is a personal blow.

Mr Senard’s attempts to revive merger discussions with Nissan have already been rebuffed, and it is unclear how many other partners will want to link up with Renault and its main shareholder.

The deal’s failure also raises questions about the future of Mr Senard, who is regarded in both Turin and Tokyo as having lost credibility.

At Nissan’s headquarters in Yokohama, said people close to the Japanese carmaker, there remains a suspicion that FCA’s withdrawal was part of a strategy and that its merger proposal, whose benefits Nissan could appreciate, still has a faint chance.

Senior Nissan executives are expected to meet over the next 48 hours to refine their company’s strategy, with some people close to the company speculating that one possible outcome of Wednesday’s debacle is that FCA at some point approaches Nissan for talks about a potential partnership.

In informal contact between Nissan and people close to FCA, senior executives of the Japanese carmaker jokingly welcomed FCA to the “club” of those that had found out the hard way how difficult it is to predict and negotiate with the French government and Renault.

The word Nemawashi, the Japanese term for gathering consensus before making a big decision, was bandied around among people across both alliance companies.

FCA, which has been searching for a partnership for several years, was acutely aware of the potential pitfalls of working with the French state, but believed its endeavour could be the exception.

Doing another deal is definitely an option, but FCA will need some time to re-evaluate the chess board.

PSA, a long-mooted partner, is not seen as a possibility because its shareholder register includes the French state.

“Asia is where FCA might make its next move,” a person close to FCA said, suggesting that it could do a deal in China or South Korea.

For Renault’s part, it was more worried about Italy’s populist government as an obstacle than Mr Macron, given the French president’s pro-business reputation and personal history as an M&A banker.

“We were worried that the deal would be brought down by some trick from [deputy prime minister Matteo] Salvini. Instead, it was all a Macron thing,” said a person close to Renault.

“This deal will hurt the credibility of Macron in Europe and globally,” said a person close to FCA.

“This was his chance to play Europe’s kingmaker. Instead, he made everything harder. If he was hoping to lift France’s image as a place to do business, that’s over.”

Additional reporting by Rachel Sanderson

Comments