Retail currency traders take deep breath before EU vote

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

Charlie Burton had planned to spend Friday admiring classic cars and F1 motors at the Goodwood Festival of Speed on the Sussex downs.

But what is likely to be one of the most volatile trading days in the history of the global foreign-exchange market proved too much of a temptation for the retail currency trader with 15 years’ experience.

“I’m dipping my toe in,” says the 43-year-old of his trading strategy. “I’m keeping it fairly light until we know what happens.”

Britain’s vote on EU membership is a historic event for those who work for investment banks and hedge funds in FX trading in the City of London, which has held on to its status as the capital of the most global of financial markets.

It is also a lure — and potential hazard — that the legions of retail currency traders are grappling with. They number about 75,000 in the UK, according to Investment Trends, with another 100,000 in the US.

“I do think there are some arbitrage opportunities when there are big events like the referendum,” says George Thomson, a 25-year-old who usually trades equities but, with volatility expected whatever the outcome of the referendum, intends to take the plunge into FX. “You can profit from that.”

You can also lose money in markets that even some of the world’s largest currency traders, such as Swiss bank UBS, have warned may lose liquidity as the result emerges. Brokerages that also cater to retail traders such as PhillipCapital UK have increased margin requirements — the collateral traders have to post to back their bets.

Many retail currency traders were badly bruised in January 2015, when the Swiss National Bank shocked markets by lifting the franc’s cap against the euro and unleashed mayhem across the foreign-exchange market.

And Paul Bentley, a retail trader who begins trading every weekday morning at 6:30am by studying the hourly FX charts, will break with his usual routine on Friday to take his 80-year-old stepmother shopping.

“I will be out because . . . as much as you think you can make fortunes, I am thinking the other way,” he explains. “The way to succeed in trading — look at risk first and profit second.”

The 51-year-old, who describes himself as a “lifestyle trader” because his FX profits allow him to pursue his real passion — managing the Raynes Park Vale football club, a semi professional football side in south London — is wary of jeopardising that.

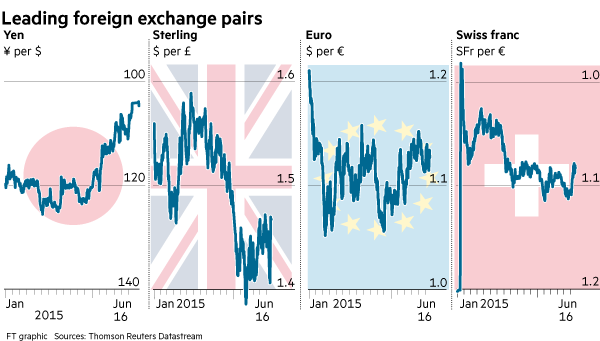

Risks for traders are sharpened by the binary nature of Thursday’s vote and the task of judging how the currency markets will react should a major member of the EU choose to leave — an event without precedent. Currency strategists at banks forecast the pound could slump below $1.30 in the event of a Brexit or jump near $1.50 with a Remain result.

The cost of insuring against swings in the price of sterling have been steadily rising since the date for the referendum was announced in February, and last week — one-week implied volatility — hit a record high.

And there are signs that retail traders have been taking cover.

David Rodriguez, senior currency strategist at FX broker FXCM, says that “on balance people have been closing out existing positions”. So-called open interest in the pound against the dollar is 20 per cent lower than its 12-month average, and 26.5 per cent lower in the pound against the yen.

However, retail FX brokers FX Pro and eToro are both expecting trading volumes to rise once there is a clear result.

That recent retreat is in contrast to a spike in trading of pound futures contracts on the CME exchange in early June and the sharp rise in people betting on the outcome.

“Political punting has captured the public imagination,” says Peter Spencer of Betfred. The UK bookmaker Ladbrokes expects the referendum to be “the UK’s biggest political betting event ever”, surpassing the £100m wagered on the UK general election last year, which was more than double the amount bet on the 2014 Scottish referendum.

Talking while driving his London black cab, John Walsh says the vote will be “business as usual” for his trading. He will look at his charts on Thursday night after driving the capital’s streets and “react to what is happening”. While worried about a knee-jerk panic in markets, Mr Walsh also believes if there is a Brexit there won’t be the “Armageddon people think it is going to be” and that much of the impact “could be baked in already”.

Maybe. But Mr Burton, who competes in currency trading competitions, is not so confident. “There will be a lot of tears at bedtime.”

Comments