Coronavirus: what employers need to know about Sunak’s worker rescue plan | Free to read

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

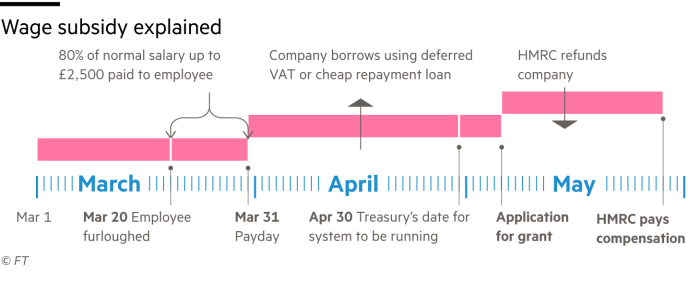

Rishi Sunak’s plan to avoid mass redundancies by offering to cover 80 per cent of workers’ wages was a central part of the chancellor’s “unprecedented” package of measures, designed to tackle the potential economic damage caused by the coronavirus.

But with the Treasury dreaming up the scheme to help furloughed employees in little over two days last week and the mechanics unlikely to be operational until late April, questions have been mounting over how generous the package is and how it will work in practice.

How should companies claim their grants?

The Treasury and HM Revenue & Customs are still working this out and officials will put all confirmed details on a coronavirus business support website.

Importantly, the government has pledged to cover the employment costs of furloughed workers backdated to March 1. This, they hope, will encourage companies to not lay off staff, but instead claim for the period since workers were told to go home.

Many employers have reacted positively to this commitment. Peter Cheese, chief executive of the CIPD, the trade body for HR professionals, urged companies to “hold their nerve while funds arrive”, adding that Mr Sunak’s wage support promises showed the government was “backing the nation’s workforce” at a critical time.

Companies with employees on zero hour contracts can use the monthly pay in February as a benchmark for each person’s pay when furloughed. If any employee did not work in that month, they should claim universal credit, the Treasury said.

Companies with staff who have to stay at home to look after young children are likely to be allowed to claim compensation if they furlough these workers because the government prefers this solution to people being made redundant.

Do companies have to pay 20 per cent of workers’ wages?

No. Having been written in such a hurry, the chancellor’s announcement last Friday was unclear on this point. Treasury officials were horrified at the weekend to find that many companies were still planning to lay off staff because they thought they would still have to pay 20 per cent of wages.

Instead, companies should pay 80 per cent of workers’ wages up to £2,500 a month once they have been furloughed, officials said, and they will retrospectively be able to claim for that amount. They should do this using normal payroll systems, deducting tax and national insurance under the pay as you earn (PAYE) system.

If employers want to top up pay levels, they can, but will not be able to claim for more than 80 per cent of £3,125, equivalent to a gross salary of £2,500.

The big outstanding issue is what happens to employers’ national insurance contributions, which amount to about 13.8 per cent of the majority of a worker’s salary. This has not been decided yet.

Questioned about this, a Treasury spokesperson said: “We are working on getting some more detailed guidance out there as soon as possible on NICs.”

How can companies without cash flow pay their workers’ wages?

Officials expect companies to borrow in the short term to fund the wage package until the job retention scheme is running and companies can claim for the wages paid.

The main source of funds for this will be the deferral of value added tax payments for the quarter until June 2020 which do not have to be paid until March 2021.

Again, information on this on the government support website is sparse, but officials told the Financial Times that there would be no interest payable on these VAT deferrals. There will also be no late payment charges, so the £30bn tax deferral should be seen, officials said, as providing the funds to pay employees.

If tax deferrals and other measures announced by the chancellor such as business rate relief in some sectors are inadequate, the Treasury wants companies to borrow in the short term. Officials said that to do this they should look at the business interruption loans it launched on Monday for smaller companies, or the Bank of England’s commercial paper facility, which is suitable for the largest investment-grade companies.

There are some big gaps, however. Larger companies without a credit rating fall between the two lending schemes. Smaller companies with direct debits to pay VAT to HMRC will also need to cancel these immediately otherwise the money will be deducted automatically. The Treasury said it could not cancel them unilaterally.

Richard Asquith, an indirect tax specialist at the consultancy Avalara, said the VAT holiday was a “huge relief”, but worried that many companies would fall between the cracks.

Will the job retention scheme lead to fraud?

Officials have prioritised supporting companies more than preventing fraud. They say that companies will not be able to claim too much because they can cross-check the applications for grants against PAYE records for each company.

Companies will be required to make one claim for the entire workforce, record how many workers are covered and will need to keep records.

Coronavirus business update

How is coronavirus taking its toll on markets, business, and our everyday lives and workplaces? Stay briefed with our coronavirus newsletter.

An alternative fraud will be much harder to catch, however. Peter Doyle, a former senior IMF economist, worried how HMRC would enforce the rules. “What is to stop a perfectly fine firm from declaring that it put half its workforce on furlough even as they work like mad and collect the grant?” he asked.

Officials said it would be easy to monitor large companies and they hoped that unions and employees would blow the whistle on some others practising such fraud. They recognised that it would be harder to police in smaller companies, especially family businesses.

Is there any benefit for the self-employed?

Not in the job retention scheme because, according to the Treasury, it is impossible to know whether they have lost income, what a normal income for self-employed people is or whether self-employed people also have jobs. Officials are very concerned about fraud in this area.

This will disappoint many, such as Mervyn King, former governor of the Bank of England, who said on Monday: “The government needs to announce that it will compensate all business and all self-employed for a very large proportion of the incomes which they could reasonably have expected.”

The Treasury has promised to think again, but currently officials say the significant improvements in the generosity of universal credit will offer almost as much support as the job retention scheme. Having removed the minimum income floor, self-employed people will be able to get full universal credit.

Officials also pointed to the delay in self-assessment income tax payments from July to January 2021 and help with mortgages. They pledged that there would be further announcements in due course.

Read more about the impact of coronavirus

- The latest figures as the outbreak spreads

- Containing coronavirus: lessons from Asia

- How dangerous is the coronavirus and how does it spread?

Subscribers can use myFT to follow the latest ‘coronavirus’ coverage

Comments