Iran nuclear deal primes market for rising oil exports

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The nuclear agreement between Iran and world powers could lead to a burst in its oil exports and open the way for international energy groups to return to the country after a five-year absence.

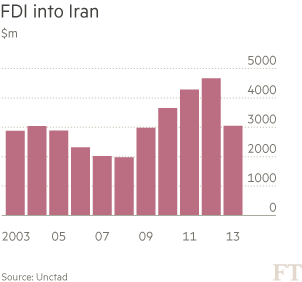

Tehran is desperate to revive its oil and gas industry and attract foreign investment after Anglo-Dutch group Royal Dutch Shell, Spain’s Repsol, Statoil of Norway and France’s Total pulled out in 2010.

Iran is expected soon to start preparing the ground for new contracts with western companies. Total and Italy’s Eni are thought likely to be among the first to sign up.

The outlines of last week’s nuclear agreement in Lausanne still have to be fleshed out before a comprehensive accord can be reached in June. But Iran has moved a step closer to achieving its goal of restoring oil production and exports.

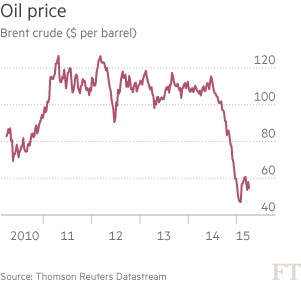

Sanctions aimed at reining in Iran’s nuclear activities have reduced its crude output to about 2.8m barrels a day, from 3.6m b/d in 2011. Exports from the Opec producer stand at about 1.1m b/d, half their pre-sanctions level.

However, some observers say export volumes could recover within months. About 30m barrels of crude stored onshore and on tankers is primed to make its way to market. In addition, Facts Global Energy, a consultancy, says any lifting of sanctions could boost Iranian oil production by 500,000 b/d in three to six months and 700,000 b/d within another year.

Obama defends ‘once in a lifetime’ Iranian nuclear deal

Continue reading

Others disagree. Ed Morse, head of commodities research at Citigroup, says it is “highly unlikely” that Iran would be able to lift output until 2016, in part because of the time required to implement any accord and check Tehran’s compliance. This would impact flows.

George Booth, oil and gas lawyer at the firm Pinsent Masons, says: “This is just the start of the process and it will take time to unravel the complex web of restrictions on trade that have been in place for several years.” Even if Iran does raise output and exports, maintaining higher levels of production and sales would be a considerable challenge. To realise its ambitions of a sustained return to 4m b/d, its ageing fields, now in long-term decline, will need western technology and expertise.

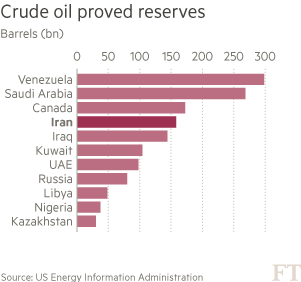

Iran is an enticing prospect. It has the world’s fourth-largest reserves of oil and second largest gas deposits.

Some 40 per cent of its 187 existing fields and discoveries have yet to be developed, according to IHS Energy, a research group. The National Iranian Oil Company (NIOC) has, optimistically say some, outlined plans to raise output capacity to 5.7m b/d by 2018, focusing on fields that overlap with Saudi Arabia and Iraq, such as Yaran and South Azadegan. It also wants to double output at its South Pars offshore gasfield.

However, foreign investors will want a clearer understanding of the state of Iran’s fields and the rehabilitation needed before deciding on any investment — which they must acquire from a standing start.

US and European oil groups have been careful to keep their distance from Iran over the past five years. Apart from a closed doors meeting at last year’s World Economic Forum in Davos between Hassan Rouhani, Iran’s president, and executives from BP, Eni, Shell and Total, high-level contact has been minimal.

Moreover, while groups see long-term promise in Iran, in a world of sharply lower oil prices and fierce cost-cutting by companies, the terms on offer will need to be more attractive than in the past for them to return. One oil executive commented: “This depends on the Iranians. We would look at the opportunities and, if it was possible legally and the terms were attractive, we would go in.”

David Kirsch, managing director of research and advisory at Energy Intelligence, pointed out that oil groups were also eyeing other opportunities. “Companies are looking at Iran and saying: ‘Yes, we like the potential resource base it has, but financially I have got a much better investment opportunity in Mexico’.”

With tens of billions of dollars in projects identified, Tehran wants to generate maximum interest. So, although a return to production-sharing contracts, preferred by the majors, is seen as unlikely, it appears ready to cede ground.

Bijan Zanganeh, Iran’s oil minister, has signalled that any new contracts will be more competitive than the widely disliked “buybacks” negotiated with western groups in the 1990s and early 2000s. Under these fixed, fee-based agreements, foreign investors bore the brunt of any cost overruns and enjoyed little upside.

A more flexible fee structure is possible, say analysts, which would allow companies to book the economic value of crude on their balance sheets. Any new agreements are expected to run for longer than the earlier buybacks, say 10 to 25 years, and investors might be able to form joint ventures with NIOC.

“Everybody is waiting. Nobody really knows what they [Iran] are cooking,” says one oil executive.

Comments