Deflation and the price of money

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It took the arrival of deflation in the eurozone, in the form of falling prices in December and January, finally to push the European Central Bank into full-blown quantitative easing. The last set of US inflation data showed deflation, just — but talk is of when the first US rate rise will come.

The difference in approach is no mystery. Europe, with sky-high unemployment, is worried about deflationary expectations taking root. The US, close to full employment, can look past falling prices induced by cheap oil.

But both central banks work on the same assumption: deflation is bad. After all, the two most famous periods of deflation in history are the Great Depression in the 1930s and Japan’s lost decade after its bubble burst in 1990.

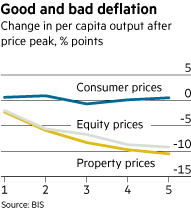

But they may be looking at the wrong set of prices. New work by Claudio Borio and co-authors at the Bank for International Settlements concludes that the consumer prices measured by inflation statistics have little relevance for future growth. Instead, it is asset price falls that really matter, housing in particular. As an aside, he points out that Japan’s growth was not that bad.

Close observers of international monetary policy may be cynical. The BIS is sceptical of QE, and Mr Borio has long pushed central banks to pay more attention to asset prices.

Still, the study makes pretty clear that consumer price deflation in itself is not usually associated with slower growth (the Great Depression was an exception).

Unfortunately for policy makers, even if they bought into the conclusions, it would make their lives no easier. Six years of easy money have pushed asset prices to very high levels, particularly in the US. Neither bonds nor equities offer much in the way of future gains above inflation if valuations and profit margins return to normal. But getting rid of the Fed’s bonds or raising rates quickly would shock investors and surely prompt a big market sell-off — which Mr Borio’s research suggests would hurt growth.

Central banks are in a tricky position. Mr Borio and sympathisers say they should never let asset prices get stretched in the first place, as the one thing essential for a crash is the boom which comes beforehand. The Fed now has the tough task of taking away the boom’s monetary fuel without creating a 1937-style economy-sapping bust.

Comments