Oil price falls on doubts over Saudi-Russia supply deal

Simply sign up to the Oil & Gas industry myFT Digest -- delivered directly to your inbox.

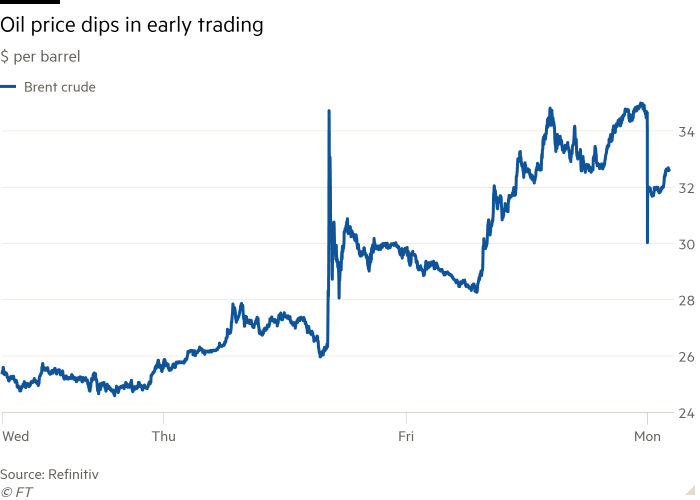

Oil prices fell 12 per cent when markets reopened for the week before paring some of those losses in volatile trading that reflected investors’ doubts as to whether Saudi Arabia and Russia can reach a supply deal to repair some of the damage to the sector of their price war and the coronavirus pandemic.

Brent crude fell in early trading to just over $30, losing more than $3 a barrel but holding on to the bulk of the gains made last week when Donald Trump, the US president, sparked a rally after suggesting that Saudi Arabia and Russia would agree to remove 10m-15m barrels a day of oil supply.

Crude prices then recovered to change hands at around $33 a barrel by late afternoon in London on Monday after Dan Brouillette, the US energy secretary, said Saudi Arabia was trying to convene a G20 meeting on Friday to discuss new production cuts. US benchmark West Texas Intermediate was trading at more than $26 a barrel, down almost 7 per cent for the session.

But producers remain far apart. Opec’s meeting with Russia, initially scheduled for Monday, was postponed until Thursday as a war of words between Moscow and Riyadh deepened over the weekend, with both accusing each other of sparking the price war to hurt the US oil sector. Brent prices still remain down by more than half since January.

Coronavirus business update

How is coronavirus taking its toll on markets, business, and our everyday lives and workplaces? Stay briefed with our coronavirus newsletter.

The Kremlin on Monday stressed that any deal would require the participation of countries that had not previously taken part in any co-ordinated cuts with Opec, in an obvious reference to the US.

“In order to stabilise the market, it will also require the participation of those countries that did not previously participate in co-ordination,” Dmitry Peskov, spokesman for Russia’s president Vladimir Putin, said. “Indeed, those who are now in working contact are talking about this.”

But Mr Putin did not plan any discussions in the near future with Mr Trump or King Salman of Saudi Arabia, Mr Peskov said, and had delegated to his energy minister any consultations with Russian oil companies.

Saudi Arabia moved to flood the market last month after Russia refused to make further cuts to production, before the extent of the demand collapse from coronavirus lockdowns was fully known.

Mr Trump’s comments over the weekend, saying that he preferred the “free market” to resolve the price collapse, but hinting that the US could impose tariffs on Saudi Arabian and Russian oil supplies, also weighed on prices as traders discounted rumours that Texan oil producers might formally join Opec cuts.

Mr Trump said on Sunday: “I would do tariffs, very substantial tariffs, because we’re independent and we want to have our own oil. And if I did the tariffs, it would make sense, it would be saying we don’t want foreign oil.”

Mr Brouillette confirmed to Fox News on Monday that the US was studying the possibility of applying tariffs to foreign oil imports and said President Trump had also asked him to find additional capacity to store more US oil.

Crude demand has fallen by roughly a third because of the coronavirus pandemic, the biggest drop in history, with the loss of more than 30m barrels of day of global demand threatening to quickly overwhelm the industry’s ability to store it.

Saudi Arabia has called for a host of western oil-producing countries to co-operate in output curbs. Norway and Alberta, Canada’s largest oil-producing province, said they would participate in the Opec meeting.

The Financial Times also reported on Saturday that US and Canadian officials had discussed imposing tariffs on Saudi oil imports to North America to press the kingdom to abandon its price war and boost prices.

Mr Trump said on Saturday that he would do “whatever I have to do” to protect the US industry, which is facing the prospect of mass job lay-offs and production shut-ins, especially in the local shale sector.

He has also hinted that US military aid to Saudi Arabia could be on the line, reflecting the depth of the schism with one of its closest allies in the Middle East.

“The opening move down reflects the reality that even if there was to be a deal, which now seems to be postponed, the overwhelming loss of demand will keep driving prices lower until storage is full and production is shut in,” said Andrew Gillick, energy sector strategist at consultancy RS Energy Group in New York.

Comments