A guide to the global trading day after the UK referendum

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

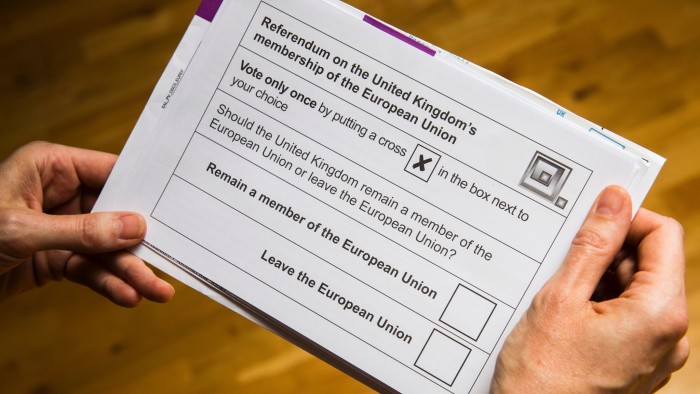

Britain’s referendum on EU membership has global markets bracing for tumult as investors rush to get on the right side of the Brexit trade.

UK markets will be shut by the time voting ends on Thursday but global markets, notably foreign exchange, never sleep — there is always somewhere open to make money.

If you plan to join bankers, traders and the rest of the City of London in pulling an all-nighter on June 23 then these will be the markets to watch:

10pm — Polls close — Forex markets trading

Once voting stops, attention will turn to exit polls. No formal poll has been commissioned so traders will have to rely on their own private polls to make investment decisions.

The outcome is likely to have the biggest impact on currency markets and the value of sterling. In the UK, Europe and US, the trading day is already over while in Asia it will not begin for a few hours, which means global currency markets — open 24 hours a day — will be the focus of investor reactions.

Sterling has rebounded sharply and is near its high for the year as traders anticipate a Remain verdict. A climb to $1.50 is expected should we see UK vote to stay, while there are predictions of a fall to $1.20 — the lowest level in decades — in the event of Brexit.

Gold, settled physically, is traded 24 hours around the world, while Comex gold futures is traded on the CME in New York between 11pm London time to 10pm the next day.

11pm — Votes are counted — US futures market opens

The first results are still an hour away and most developed stock markets remain closed. New Zealand equities are trading but the market is too small and domestic-focused to reflect global investor sentiment towards the referendum.

Instead, the earliest indications of trading momentum are likely to come from the US futures market in Chicago, which reflects investor sentiment towards major global stock indices, interest rates and gold prices.

The world’s largest forex listed derivatives market will reopen after a one-hour shutdown along with the gold futures market and eurodollar futures market — a proxy for changes in short-term global interest rate expectations.

Broadly, haven assets such as gold and government bonds are going to be in demand if the UK opts to leave the European Union, while riskier investments such as equities will get a boost if the Remain camp wins the day.

1am — First results in — Asian markets open

Results will be trickling in from some of the UK’s smallest voting regions after midnight, with Gibraltar and the Isles of Scilly the first due, followed by Sunderland and Swindon.

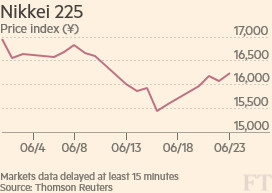

Sydney and Tokyo stock markets could be the first equity indices to reflect these early results as investors consider the impact on Asian operations in Europe.

However, a more interesting market to consider will be ICE Futures Europe’s FTSE 100 futures and options market, which should provide the first inklings of where UK markets will open on Friday. Short-term euribor trading — an indicator of sentiment for eurozone interest rate moves — will also restart on ICE.

Chinese gold bugs can turn to the Shanghai Futures Exchange to trade the yellow metal. It has three sessions — 2am to 4.30am, 6.30pm to 8am and 2pm to 7.30pm.

3am — Turnout results due — Volatility trading

By now the level of voter turnout should give a good indication of the final outcome of the referendum.

Young voters — those not at Glastonbury Festival — could be crucial to the result as they are the most pro-EU and the least likely to vote. High turnout is expected to benefit Remain while low turnout could favour Leave.

Forex markets will still be the focus of investor reaction to incoming results, with a swing towards Leave expected to resonate not only in sterling but in the Japanese yen and Swiss francs as investors seek out havens to shelter from expected market volatility.

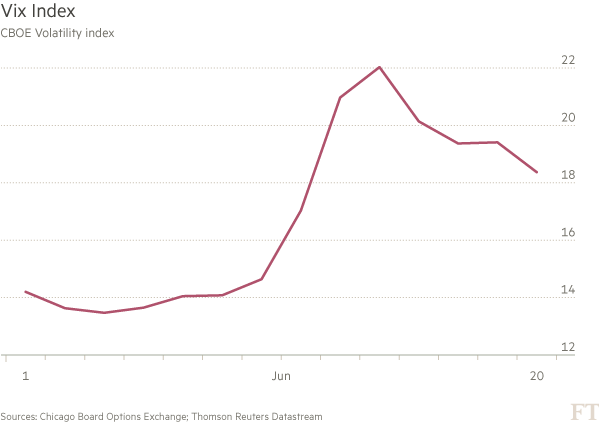

The Vix volatility index, aka the “fear gauge” tracking implied volatility of the S&P 500 stock index, will also be open throughout the night. In spite of narrowing opinion polls, a Leave vote would still come as a surprise to markets, and could result in heavy volatility.

4am — Voting reaches halfway point — Bond market opens

The final result should be clear as traders lucky enough to have left their desks on Thursday begin to arrive at offices in major European financial centres in time for over-the-counter derivative and bond markets to begin electronic trading.

Tradeweb, which facilitates trading in European government bonds, US Treasuries and interest-rate swaps, plans to open early to accommodate a possible surge in early morning action. Bonds sold by the US, UK and Germany will be in demand if the UK looks set to leave the EU and have already reached multi-low yields in the last week. If there is no Brexit, major developed bond markets may sell off amid a rally in riskier securities in Europe such as Portugal and Spain.

7am — Last results due — European futures market open

The south-east, north-west and east of England are some of the last areas expected to declare their votes as futures markets in Europe begin trading.

At half-seven the ICE sterling futures market opens — offering an idea of where investors think UK interest rates may go. A vote to Leave could result in the Bank of England cutting rates to support the economy while Remain could speed up the BoE’s interest rate rise plans.

US Federal Reserve chair Janet Yellen has also warned that a Brexit vote could push back the next US rate rise and could undermine the global economic recovery.

8am — Referendum outcome announced — UK markets open

There are no plans to open equity markets early, meaning the London Stock Exchange and other European bourses will open as usual at 8am GMT, after the result has been declared.

If the UK votes to stay in the EU, expect to see a rally in sterling and European stocks as investors make use of the cash they set aside during the referendum run-up.

In the event of Brexit, housebuilder and bank stocks in the UK are likely to be hit hardest amid a general sell-off in equities. UBS thinks the FTSE 100 index could fall to its lowest point since 2011, dropping below the 5000 mark if the country votes to leave the EU, which would make it one of the biggest one-day moves in a decade. If the swings are excessive, markets are designed to pause automatically.

A rush for havens such as UK government bonds could send the yield on 10-year debt below last week’s record low of 1.07 per cent while equivalent Japanese and German bond yields may also beat recent record lows.

Comments