Oil’s climb towards $100 a barrel tempts US shale companies to shed restraint

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Oil’s vault above $95 a barrel is tempting US shale energy executives to fire up drilling rigs in search of more crude, risking the wrath of Wall Street in the process.

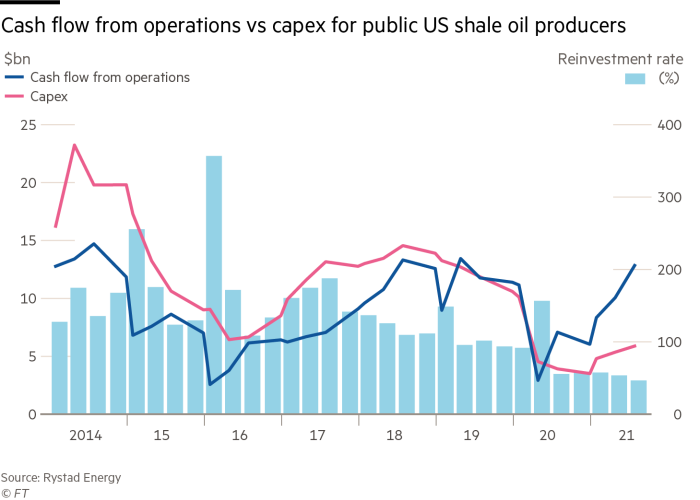

A sector once known for debt-fuelled production binges that made the US the world’s biggest oil supplier has largely embraced financial discipline, with executives pledging never again to outspend cash flow and burn through capital on costly projects.

But the rebound of oil markets to the highest levels since 2014 is challenging that resolve. The response from shale companies will determine the path of US oil output that is languishing well below its pre-pandemic peak.

“In the back of everyone’s minds is, ‘When is it going to be [production] growth? . . . We have investors saying ‘My gosh, if not now, when?’” Rick Muncrief, chief executive of Devon Energy, said in an interview.

“But for every one saying that, there’s at least one other if not two others waiting to say, ‘Gotcha! We knew that discipline would be shortlived.’ We have learned our lesson,” said Muncrief, whose Oklahoma City-based company is one of the biggest producers in the US shale patch.

The big public independent companies, such as Pioneer Natural Resources, EOG Resources, Diamondback Energy and Devon — collectively accounting for about 1.4mn barrels a day of US production — have all pledged to keep a lid on capital spending.

“The capital that historically we would spend in growing the company, now we’re redeploying that in the form of share repurchases,” Travis Stice, Diamondback’s chief executive, said at an industry conference last month.

Scott Sheffield, Pioneer’s chief executive, has vowed that his company will hold production growth to 5 per cent a year — well below the breakneck pace of pre-pandemic boom years.

The commitments have pleased investors. Devon’s variable dividend and share buybacks, announced in November, helped make it the S&P 500’s best performer in 2021. The energy sector as a whole has far outperformed the stock index in the past year, albeit from a low base.

But the capital spending commitments were made in the wake of a crash in 2020, when oil prices plunged well below those needed by shale producers to turn a profit.

West Texas Intermediate crude settled at $95.46 a barrel on Monday. At that level companies could honour dividend commitments and start increasing production without damaging their balance sheets, analysts said.

Drilling has picked up, especially in the prolific Permian Basin of Texas and New Mexico, compensating for output losses elsewhere. But it has largely been led by private companies. ExxonMobil and Chevron, the two supermajors with large positions in the Permian, have also announced production increases that could total about 175,000 b/d by the end of the year.

Scott Gruber, an analyst at Citi, said he expected large listed independents could follow suit soon, with “an increasing number beginning to lean into the market”. Capital spending by this group could rise 30 per cent this year, he predicted in a recent note.

Rystad Energy, a research company, pointed to a “fundamental shift in the operational philosophy” emerging among public shale operators in response to the strong oil market.

But for now, big leaps in US oil production remain theoretical. Output over the past four weeks was just 11.6mn b/d, according to the Energy Information Administration, well below the record high of about 13mn struck before the pandemic.

Muncrief, whose company will release earnings results on Wednesday, didn’t sound ready to budge.

“Our plan right now for 2022 is, let’s just keep our volumes flat,” he said.

As a big Devon shareholder himself, Muncrief said he was earning more on base dividends than through his cash salary and cash bonus — another incentive to keep spending in check. Pioneer’s Sheffield has previously said the same.

Muncrief also wants to wait for Saudi Arabia and other Opec members to restore the oil supply they cut in 2020, and for the oil market’s backwardation structure — in which spot prices trade at a premium to future prices — to end.

Even if operators wanted to ratchet up their drilling, soaring cost inflation and longer development times would be obstacles, analysts said.

The industry faced “acute supply chain bottlenecks”, Artem Abramov, Rystad’s head of shale research, wrote in a recent note. He cited the example of sand — used for hydraulic fracturing of oil wells — as reaching “unheard of” price highs.

Deploying a drilling rig in the field may have taken four to six weeks in the past, said one consultant to shale oil companies, but could take four months now. Even without extra drilling from listed shale operators, cost inflation is running at 15 per cent, estimated Enverus, a consultancy.

“Even if we wanted to double our rig count in the Permian right now, that would be a pretty tall order,” said Mike Dionisio, Devon’s head of supply chain and marketing. He cited labour shortages and a lack of computers and equipment components among his problems.

But fear of angry shareholders remains the abiding reason to resist the temptation to launch new drilling campaigns. Another Oklahoma City-based shale driller, Continental Resources, led by Harold Hamm, said it would restrict output growth to a meagre 3 to 5 per cent this year.

“It’s small compared to what we’re used to,” Hamm said. “We have to do what Wall Street wants . . . or else your stock craters.”

Sign up to our Energy Source newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

Comments