Hopes high for return of foreign investors to Italy

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Italy is poor at attracting foreign investment. But that may be about to change if the country succeeds in pushing ahead with the largest programme of reforms and public spending in its modern history.

A lack of interest from international businesses has meant missed growth opportunities. Foreign investors, an important source of jobs, innovation, higher wages and economic growth, have largely neglected the eurozone’s second largest manufacturing producer.

However, some experts say there are reasons for optimism in the €205bn investment from the NextGenerationEU recovery plan that Italy could receive over the next five years to build a greener, more digital and more sustainable economy.

With reforms planned over the next five years, “foreign investors will come back,” reckons Emma Marcegaglia, chair of the B20 international business summit, a G20 business forum.

She says foreign investment in Italy has been low because the country’s civil justice system is inefficient, there is too much red tape, and the fiscal situation is unattractive — contributing to a poor reputation overall.

All of these problems are now being addressed under the recovery plan and with the leadership of Mario Draghi, the former president of the European Central Bank.

Italy’s Resilience and Recovery Plan, which pairs funds from the EU with structural reforms, “has the potential to put its economy on a higher growth trajectory, therefore resulting in a much better environment for foreign investors,” says Nicola Nobile, an economist at forecasting company Oxford Economics.

The chances of implementing the reform plan successfully are now “greater than on previous occasions,” according to the latest OECD assessment of Italy, reflecting the fact that the EU money is conditional on achieving targets — creating unprecedented incentives and a stronger political consensus to complete key reforms.

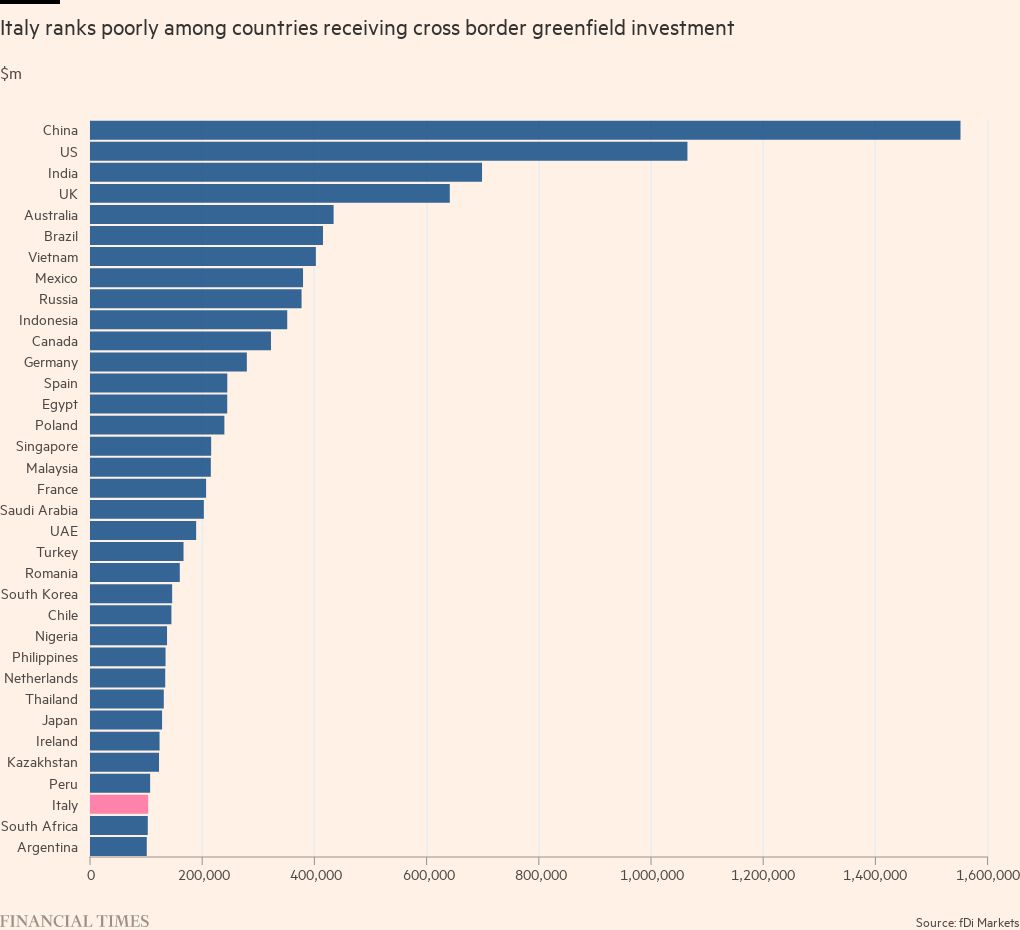

But the gap with other advanced economies remains wide. Italy ranks only 33rd among the most-invested-in countries since 2003, below Germany, France, Spain, Romania and the Netherlands, according to data from fDi Markets, an FT-owned company that tracks greenfield investment.

Greenfield investment projects are those where a company creates or expands a business in another country, rather than buying one. As such, they are considered more important for economic growth and job creation.

Italy’s low ranking is a poor result given that the country is the eighth largest consumer market in the world, the seventh largest manufacturing producer, and can boast a diversified economy and skilled workforce.

With an improved business environment, foreign investors could discover that “there are a lot of good companies in Italy and high savings,” notes Marcegaglia.

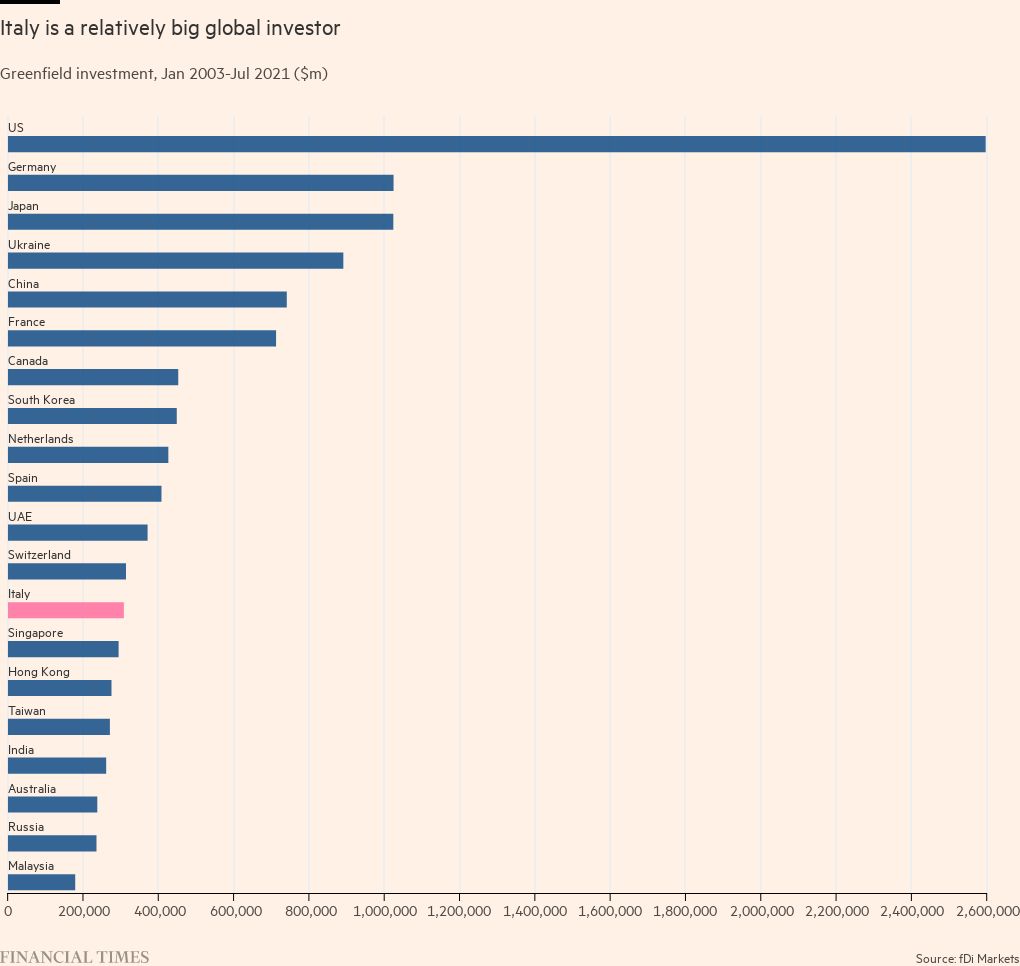

Poor inward investment is also at odds with Italy’s key role as a global investor. It ranks 13th in outward greenfield investment since 2003, largely reflecting the appetite of Italy’s utility companies for both traditional and renewable sources of energy.

Even combined with mergers and acquisitions and portfolio investment, the stock of FDI into Italy accounts for about 22 per cent of GDP, the second lowest proportion after Greece among developed European countries, according to the UN Conference on Trade and Development (Unctad), an international agency that tracks global FDIs.

Italy’s attractiveness has improved over the past decade, though. The country has climbed the FDI Confidence Index compiled by management consultancy Kearney, reaching eighth place globally this year. It did not make it even to the top 25 a decade ago.

Last year, accountancy firm EY’s annual foreign investment attractiveness survey registered an annual 5 per cent increase in the number of foreign investment projects, in stark contrast with a drop across Europe.

Nearly half of international investors said they would like to invest in Italy and nearly two out of three expect Italy’s attractiveness to increase in the next three years, EY data showed.

“These are positive signs for Italy,” says Massimo Antonelli, CEO of EY Italy — although he adds that the gap with other countries is still large as, despite the uptick, Italy attracted only 2 per cent of European incoming investment projects in 2020.

The low value of greenfield FDI is partially explained by a concentration in the richer north. On its own, the wealthy region of Lombardy secured a quarter of all foreign capital invested in Italy’s 20 regions between 2003 and July 2021, fDi Markets data shows. That is similar to the amount invested in the whole of Norway.

“Foreign investors have targeted Italy’s innovative industrial districts in the north of the country,” says Antonelli.

The nearly 1,000 investment projects in Lombardy since 2003 have created about 42,000 jobs. This is a precious source of employment for a country where the unemployment rate is still above 9 per cent, the third highest in the EU after Greece and Spain.

By contrast, Italy’s impoverished south — where unemployment is three times higher than in the north — accounts for only one-tenth of Italy’s foreign investment inflows, despite having one-third of its population.

That largely reflects a smaller industrial base and poorer institutions. In the latest European Quality of Government survey, compiled by the University of Gothenburg, Italy’s southern regions and some areas in Romania and Bulgaria rank among the worst of more than 200 EU regions tracked.

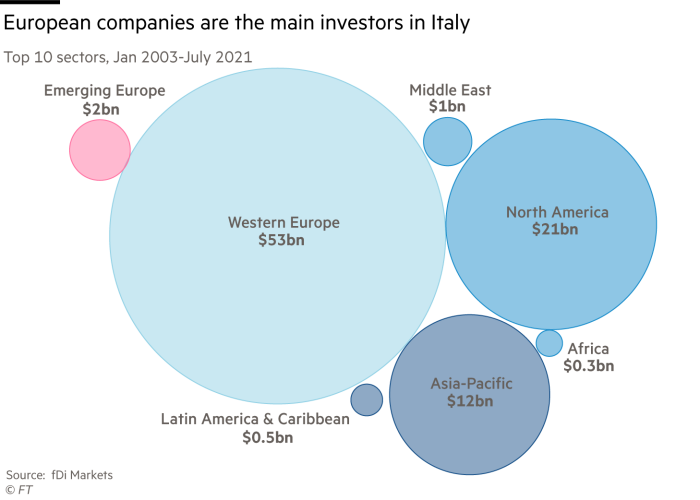

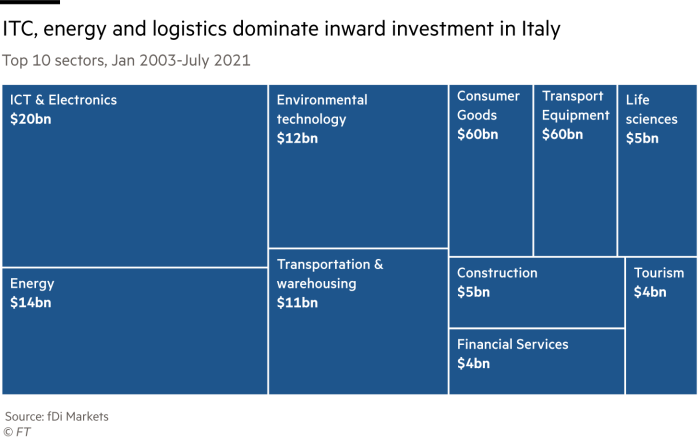

Those businesses that do invest in Italy are mainly from western Europe with a focus on logistics, traditional and renewable energy, and information and communication technology.

Semiconductor producers and multinationals such as Amazon, Vodafone, Ryanair and the energy company Eon are among the top investors in the country, according to fDi Markets data.

Of those investment projects for which fDi Markets gathers data on reasons for investing in Italy, nearly half cited the domestic market’s potential. The skilled workforce, the clustering of industry, the infrastructure and the quality of life were also among the top reasons to start or expand a business.

Boosting foreign investment is important for the country’s economic growth prospects. Foreign companies tend to be more productive than domestic businesses, pay higher salaries and often spur wider technological advancement than national companies.

That could help turn the tide on decades of economic stagnation that have resulted in Italy’s living standards falling below the EU average over the past decade.

Italy’s poor economic performance has also weighed on the country’s public finances, pushing the debt-to-GDP ratio to above 155 per cent, the second highest in the EU after Greece.

The government’s latest macroeconomic projections predict solid growth, with falling debt and shrinking unemployment. But that level of progress depends on how convincing Italy’s economic “renaissance” turns out to be for foreign investors.

Nobile thinks that the success of the reforms and spending plans “represents an upside scenario”, with the risk that they will be derailed in the years ahead by future governments, which may be less interested in reform than the Draghi administration.

Nick Andrews, an economist at investment research company Gavekal Research, says that “there is still a lot to play for” before it will be possible to assess the effectiveness of the recovery plan.

But he adds that “for the first time in decades, Italy does look to be headed the right way.”

Comments