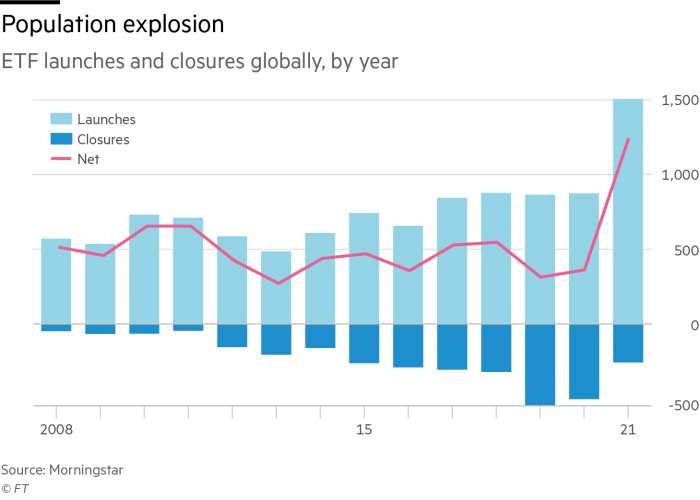

Net growth in ETF numbers almost doubles to a record 1,239 last year

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

The global exchange traded fund industry not only attracted record inflows it also racked up extraordinary growth in the breadth and depth of its offering last year.

An overall total of 1,503 ETFs and exchange traded commodities were launched, far ahead of the previous record of 873 recorded in 2018, according to data from Morningstar.

Just 264 ETFs were liquidated or merged out of existence, down from 510 in 2020 and the lowest figure since 2014, when the industry was a fraction of its current size. The low closure rate meant net growth in the ETF count of 1,239 was almost twice the previous record of 656, set in 2010 when the industry was just getting into its stride, Morningstar’s data suggest.

The expansion comes as ETFs attracted more than $1tn of fresh cash in a calendar year for the first time in 2021, taking total assets to more than $10tn, according to ETFGI, a data consultancy.

“The market and the [ETF] structure just seems to be getting hotter as a destination for money,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence.

“[In the US] flows were 80 per cent beyond their old record last year and launches 60 per cent. That is definitely correlation/causation,” said Balchunas, who argued that the strength of both flows and net ETF launches were driven by strong financial markets.

However, Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said the drivers of launches were different in each market.

“In Europe most new launches have been ESG [environmental, social and governance] and/or thematic. In the US, the story is different where more than half of launches have been active ETFs.”

The impact of robust markets was perhaps felt most keenly in the paucity of fund closures.

Recent years have seen a steady rise in the number of ETFs being culled, a trend that was increasingly seen as inevitable as the industry matured. The more ETFs there are, the more that will be liquidated every year if a fixed percentage fail to meet the $50m-$100m asset threshold typically needed to be profitable.

Yet closures slowed to a trickle in 2021, particularly in the second half of the year, when just 102 ETFs bit the dust.

Balchunas said this was a byproduct of the market being “so agreeable last year, borderline utopia”, with the S&P 500 rising 27 per cent.

In the US, 70.4 per cent of ETFs took in money in 2021, according to Bloomberg data, the highest percentage in the modern era.

“It wasn’t just the one thing that was working,” Balchunas said. “It was almost like the fish were jumping into the boat last year. It was just such a favourable year that there was no reason to close anything.”

Peter Sleep, senior portfolio manager at 7 Investment Management, said last year’s strong backdrop “potentially turned marginal funds into profitable funds,” with market gains attracting inflows “as money chases performance”.

Those funds that were pulled included a number of eurozone government bond ETFs, where yields have fallen to exceptional lows, said Sleep.

Among the 144 equity ETFs that drew their last breath were 15 domiciled in, and investing in, China. This tally included six that were only launched in 2020 and, extraordinarily, three that debuted in June or July 2021, only to be liquidated in November or December, demonstrating the often fickle, short-term nature of Chinese investors and fund managers.

When it comes to launches, Sleep pointed to the proliferation of ESG versions of pre-existing investment themes, as well as an increasing taste for thematic investment, as factors behind the upsurge.

Of last year’s new ETFs, 131 expressly included “ESG” in their name, while 21 claimed to be “sustainable” and a further eight “Paris-aligned”.

In the US, launch activity was turbocharged by mutual fund managers taking advantage of the relatively new freedoms to launch portfolio-shielding semi-transparent or non-transparent ETFs, enabling them to run actively managed vehicles without revealing their “secret sauce”.

“There is a big structural change that is driving activity in the US, with active managers relaunching the same, or a similar strategy, in a different wrapper,” argued Lamont, who said 60 per cent of US launches last year were actively managed.

He also noted that, in an industry traditionally concentrated on North America, Europe and Japan, “developing markets are also responsible for many of the new launches”.

“China in particular has seen a large number of new ETFs coming to market, the majority of which are highly targeted sector or thematic exposures, which hints at how ETFs are being used there,” Lamont said.

Morningstar’s data point to 281 equity ETFs being listed in mainland China last year, all of which invest domestically. The vast majority target specific sectors or themes, ranging from robots and virtual reality to livestock breeding and comics and games.

However, Sleep forecast that one trend in launches in 2022 could be for ETFs that allow foreign investors to steer clear of the Chinese stock market, an option that proved popular last year for the few funds that facilitate it.

Sleep also predicted the launch of more carbon offset, battery and green bond ETFs this year.

“We have seen lots of ESG equity but, as firms issue more green bonds, we could see more ESG green bond ETFs,” he said.

Balchunas foresaw the launch of more ETFs aimed at “older investors who are a little bit uneasy about how much the market is up,” such as buffered funds that offer some downside protection in exchange for capping the potential upside.

He also expected to see more ETFs focused on attempting to protect investors from the ravages of inflation.

“I think we will see about 20 this year,” he said. “We had 18 last year and every one saw inflows. That is unheard of.”

Click here to visit the ETF Hub

Comments