European value ETFs suffer record redemptions as optimism fades

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

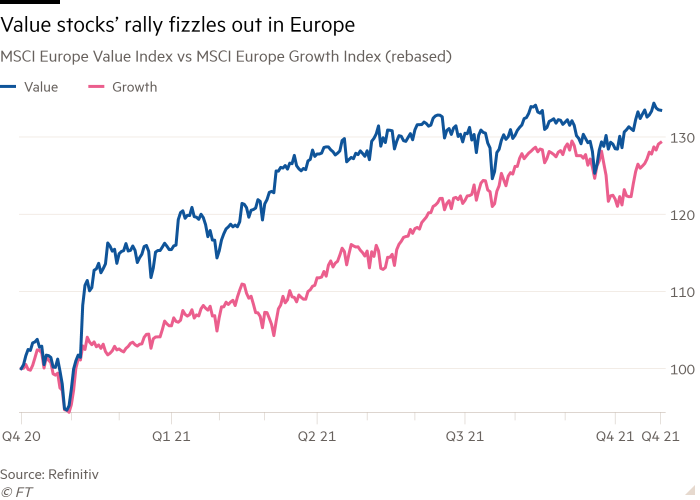

A shortlived resurgence in demand for exchange traded funds focused on “value” stocks has come crashing to a halt on both sides of the Atlantic.

Investors pulled a record net €3.7bn from European value ETFs in the three months to September, according to data from Morningstar Direct.

This was well above the previous record quarterly outflow of €1.3bn seen in the first quarter of 2020, when markets were shaken by the start of the Covid-19 pandemic and there was net selling across the board.

The heavy outflows follow a nine-month period in which European investors poured a net €12.3bn into value ETFs in the hope that they might finally shine after many years of underperforming the wider market.

In contrast, ETFs focused on “growth” stocks — the polar opposite to value stocks, and which trade on higher price-to-earnings or price-to-book-multiples — attracted €120m in the three months to September, their strongest quarter since 2015.

A similar trend has unfolded in the US, where net inflows to value ETFs slowed to just $1.5bn in the third quarter, having topped $62bn in the previous nine months.

In contrast, growth ETFs took in $9.4bn in the most recent quarter, the second strongest quarter on record, and reversing the $8.5bn of net outflows the sector suffered in the previous 12 months.

“It’s a classic case of people chasing performance,” Peter Sleep, senior portfolio manager at 7 investment Management, said of the sharp turn in investor sentiment.

“We had this Covid/Pfizer rally that started in November [last year] when they announced they had a vaccine and all those [value] stocks, the banks, airlines, oil, metals and mining companies had a historic rally that lasted four or five months.

“Then it ran out of steam and the market rotated back into more traditional, growth stocks.”

Value stocks have historically outperformed the wider market over the economic cycle. However, since the global financial crisis of 2008-09 this pattern has broken down, with value investing performing poorly, leading to waning interest in the concept.

The optimism over the imminent rollout of Covid-19 vaccines late last year led to hopes of a rebound in global economic growth, a backdrop that should, in theory, be good for value stocks.

However, the long-awaited value resurgence may have petered out already. In the US, value stocks have now completely surrendered the gains they made vis-à-vis growth stocks since the start of October 2020, while in Europe they are close to doing so.

“I’m not surprised,” said Kristina Hooper, chief global market strategist at Invesco. “We saw a slowdown in economic growth in the third quarter, and historically that has meant the growth style outperforming the value style, as value is comprised of many cyclical industries and is therefore tethered to the economic cycle.”

Alongside the resurgence of Covid-19 liked to the Delta variant, which prevented some sectors such as airlines from recovering as strongly as many people anticipated, Sleep believed rising global inflation was also to blame for nipping the value renaissance in the bud.

“Disposable savings were very high, people said it was going to be the jazz age all over again. Then we had higher petrol prices, higher gas prices, increasing inflation and high labour costs, and that has taken a little bit of steam out,” he argued.

As to what happens next, Hooper sees value stocks potentially having one final brief hurrah before being superseded by growth companies once again.

“This is a slightly complicated environment, given that we are likely to see a pick-up in growth in the fourth quarter as Covid-19 headwinds have abated so value could have another bout of outperformance,” she said.

“However, we are on a march towards normalisation and that means a moderation in economic growth in 2022, back to more historical norms, so that suggests that growth will outperform value in 2022.”

Sleep said there was still an argument for value stocks, but that sectors such as airlines, bricks-and-mortar retailers, transport, holiday and hospitality companies “may have to wait longer” before seeing a meaningful recovery.

“[Value’s day in the sun] is always just beyond the horizon, we never quite get there, but it will come,” he argued.

In the meantime, Sleep said “you probably want a balanced portfolio”. He pointed out that in 1999/2000 there was a huge growth rally but it petered out and then a value rally started that lasted seven or eight years.

“But it didn’t go in a straight line and I suspect it will be something similar this time around. We have had a three or four-month breather in the value rally but that doesn’t mean it’s not going to continue once things open up a bit more.”

Click here to visit the ETF Hub

Comments