Opinion today: the mystery of why bankers earn so much

This article is from today’s FT Opinion email. Sign up to receive a daily digest of the big issues straight to your inbox.

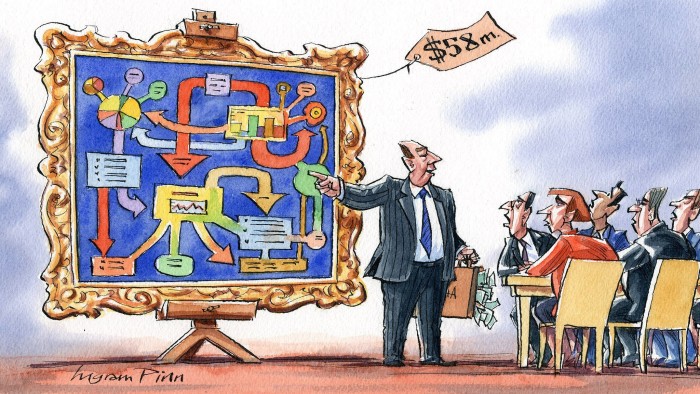

Goldman Sachs will be paid $58m by 21st Century Fox for the advice it is offering on Fox’s planned sale of assets to Walt Disney. What is the investment bank doing to earn so much?

According to John Gapper, the answer lies in a kind of alchemy. The secret to extracting a whopping "success fee" from giving advice on a merger or acquisition, John argues, is less to ensure the best possible deal for the client than to make them believe they are getting it.

Many industry observers think M&A advice is overpriced. The solution? Tie those swollen fees more closely to whether a deal succeeds in the long term.

Janan Ganesh argues that while liberals worry about the US Supreme Court overturning Roe v Wade and a panoply of social rights, conservative justices are quietly dismantling economic protections.

Sara George writes that financial regulators should stop going after junior staff while letting senior managers go free.

Frederick Studemann discovers that German business leaders are tiring of Angela Merkel.

Martin Weale , formerly of the Bank of England's monetary policy committee, warns that the BoE should be wary of making promises on interest rates that it will not be able to keep.

What you’ve been saying

Only Remain expresses the national interest — Letter from Paul Serfaty:

Brexiters know they hate the EU, but they are quite incapable of delivering a common and agreed vision of post-Brexit Britain. The xenophobic element in the Conservative party, long numerous but relatively powerless, is now allied with the ultra free marketeers in hatred of the EU. Throw in Labour socialists for whom the EU is an anti-worker corporate conspiracy, and you have a three-way alliance that agrees on one thing only: the EU is the devil. But each of the three disagrees on why, and what should follow Brexit.

Comment by Karl M on The shame of my very low Uber rating:

There is a point at which society has to ask if monopoly type businesses should be able to identify, track and rate customers in a way that can result in denial of service. Uber, Amazon, Facebook, Google and Netflix all want to become essential monopolies and yet they want to retain the kind of freedom to keep tabs on customers that only a small 'mom-and-pop' outfit could. Use of customer ratings and service denial should be grounds for antitrust investigations.

Oops . . . Rees-Mogg slips on a banana Peel — Letter from Mark Bearn:

Benjamin Disraeli once remarked that William Gladstone’s speeches and articles about the Balkans were, “of all the Bulgarian horrors, perhaps the worst”. One begins to feel much the same about the Brexiters, and their shockingly perfidious claims to be the proponents of the national interest, economic good sense and, more trivially, party loyalty.

Today’s opinion

Angela Merkel is losing the support of Germany’s business leaders

The chancellor grasps the rational case for free markets, but believes in state power

Could spotting the difference win the World Cup?

Penalty unpredictability deemed crucial to tournament success

The Bank of England cannot make promises about interest rates

People’s fear of an uncertain future puts pressure on the Monetary Policy Committee

Economic rights are being eroded under US liberals’ noses

Supreme Court rulings on deregulation tend to pass without much fuss or attention

Regulators’ pursuit of junior staff and not managers is a travesty

Chief executives are able to hide behind the figleaf of collective decision-making

Violence on television stokes fears in America’s divided society

The US is going through a nervous breakdown and the media are making it worse

Free Lunch: Let unions erode at your peril

Social institutions can combine egalitarianism with efficiency

FT Alphaville: Building a blockchain Britain in Bloxwich, because . . .?

It is a mystery why bankers earn so much

M&A advisers are paid millions for making boards of directors feel comfortable

FT Magazine: The shame of my very low Uber rating

‘Once, as the customer, you were always right. Now you have to watch your back’

Donald Trump’s ‘ultimate deal’ in the Middle East bodes ill Israel is pleased the US president is surrounding himself with hardliners

EM Squared: Gulf states tipped for inclusion in EM bond index Green light into JPMorgan benchmark would pave way for ‘at least $45bn’ of inflows

Markets Insight: Investors rightfully worry about threats to global growth Hedging portfolios via diversification is becoming harder to achieve

FT View

The FT View

China faces a tough test stabilising the renminbi Weaponising the currency would court mutually assured destruction

The FT View

Poland’s supreme court purge is a challenge to EU values Reforms mark a creeping takeover of the justice system

The Big Read

The Big Read

Why water is a growing faultline between Turkey and Iraq Upstream projects will produce energy and jobs, but Iraq fears for livelihoods downstream

Comments