UK spending review, Fed minutes, flash PMIs

Simply sign up to the Global Economy myFT Digest -- delivered directly to your inbox.

The week begins with the release of flash purchasing managers’ index data that will give investors the clearest indication of how hard the second wave of coronavirus infections and lockdowns have hit business activity across Europe.

Policymakers are preparing to relax Covid-19 lockdowns as the restrictions implemented at the end of October throughout Europe are starting to yield results, with a slowdown in new infections recorded in most countries.

This is fuelling calls from retailers to end the mandatory closures of shops deemed non-essential during the most lucrative trading month of the year.

UK prime minister Boris Johnson is on Monday expected to outline his plan for what happens after England’s nationwide lockdown expires on December 2. Mass testing is expected to play a big role to prevent a resurgence of the pandemic.

The UK has no Budget this autumn, instead Rishi Sunak, the chancellor, will be in the spotlight this Wednesday when he presents the government’s spending review. This will be accompanied by a full economic and fiscal outlook update by the Office for Budget Responsibility.

Brexit negotiations will also resume online after being disrupted last week when one of the negotiators tested positive for Covid-19.

Further reading

The US will sit down to Thanksgiving on Thursday, which for many people will be celebrated under Covid restrictions. It also kicks off the start of the holiday shopping season.

Daily coronavirus cases in the country are at record levels and the average fatality rate has reached its highest since May.

At a time of year known for bringing families together, health experts and public officials are urging Americans not to travel in an effort to stop coronavirus from spreading even further.

Further reading

The Federal Reserve and European Central Bank both have the minutes of their last meetings out this week, when investors will be on the lookout for clues as to what moves the central banks will make next.

If this email was forwarded to you, and you’d like to receive the Week Ahead in your inbox on Sundays, click here to sign up.

UK spending review

British chancellor Rishi Sunak is set to announce the government’s spending plan on Wednesday, which will cover initiatives to tackle the impact of coronavirus on the UK’s economy and protect jobs.

Mr Sunak has paved the way for big tax rises in the spring, warning that the spending review would include forecasts laying bare “the scale of the economic shock” caused by the Covid-19 crisis.

The review, which usually includes a three-year outline, has been limited to one year only due to the uncertain economic climate. The Office for Budget Responsibility will also publish its economic outlook on the same day, while the Debt Management Office is expected to make a Remit announcement.

Government borrowing has now reached £260.8bn for the period between April and October this year as the government increased its spending to finance furlough schemes and tackle the Covid-19 crisis.

The sharp increase in the total public sector net debt, which stands at £2,076bn, is likely to seriously hit public finances with the government already planning a pay freeze and award cut for the public sector, except for NHS frontline workers.

Further reading

Sunak’s public sector pay freeze risks sending the wrong message

UK government deficit soars to record high on pandemic borrowing

Companies news and earnings

Former High Court judge Elizabeth Gloster will complete on Monday a report on how the Financial Conduct Authority, the UK watchdog, handled the collapse of investment fund London Capital & Finance. The report will be submitted to HM Treasury, who will decide whether to publish the report in full.

Dame Elizabeth’s account on the mini-bond scandal, which cost investors £236m, has been held up more than once by FCA delays on disclosing information.

Investors will watch for any updates to Aviva’s new strategy, including the potential sale of European units, when the insurer reports on Thursday.

Commodities

Senior executives from some of the big miners, such as BHP, Anglo American and Rio Tinto, will take part in Australia’s biggest sector online conference Imarc, a four-day event ending on Friday. Rio Tinto’s reputation has taken a dent recently owing to the scandal over the destruction of an ancient Aboriginal site in Australia.

New green technology to drive the industry towards a more sustainable future will be a hot topic of discussion at the conference, as the mining sector fights to stay relevant in an age when investors are focusing more and more on social, environmental and governance issues.

Italian energy group Enel will present its strategy plan on Tuesday, which is set to outline its strategy to speed up the reduction of its carbon footprint. Analysts will be watching out for any plans regarding the group’s 50 per cent stake in broadband company Open Fiber.

Motor Oil publishes its third-quarter results on Tuesday together with Lukoil, while Gazprom will issue its earnings on Thursday.

Retail

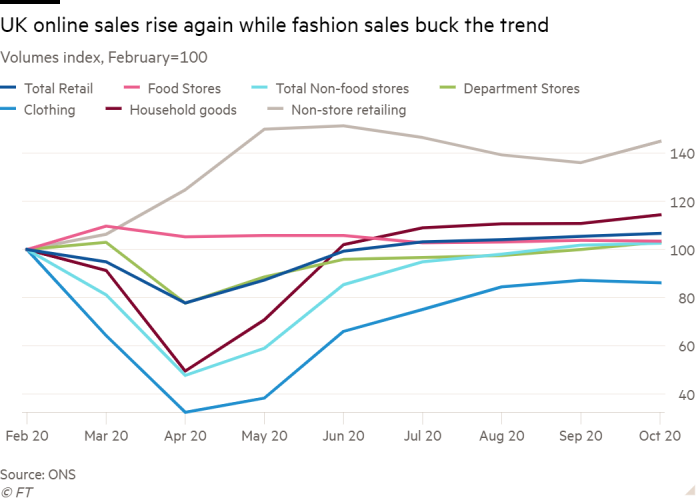

Retail sales were driven up in the UK in October as customers rushed to buy Christmas presents before the closure of non-essential shops. UK fashion retailers don’t seem to have benefited as much from the shift from services to goods in shoppers’ habits during the pandemic.

This week, Urban Outfitters reports on Monday, followed by Gap, Nordstrom and Abercrombie & Fitch on Tuesday. Ted Baker is publishing its results on Friday.

Other companies reporting this week are tractor maker Deere & Co, Chinese group Xiaomi, US electronic retailer Best Buy, US print maker HP, Warner Music, pet food producer JM Smucker, UK meat processor Cranswick, media group Daily Mail and General Trust, publisher Reach, owner of the Daily Mirror and Daily Express newspapers, and UK defence contractor Babcock International.

Central banks

The US Federal Reserve will publish the minutes from this month’s monetary policy meeting on Wednesday, giving investors a glimpse into how seriously the US central bank is considering providing further stimulus in light of the surge in coronavirus cases worldwide.

There was no policy change at its early November meeting, but chairman Jay Powell said tweaks to the asset purchase programme to provide additional stimulus were discussed.

The Fed has previously pledged to buy an unlimited quantity of US government debt, with a current monthly purchase pace of $80bn across all Treasury maturities.

One suggestion that has gained popularity among investors is for the Fed to focus most of its buying on longer-term debt.

Further reading

The ECB on Thursday publishes the minutes of its late October meeting when it pledged to “recalibrate its instruments” and investors will be looking for any further insight on the ECB’s options.

The Central Bank of Nigeria is set to begin its two-day monetary policy meeting on Monday, following a surprise 100-basis-point cut in September aimed at bolstering Africa’s biggest economy. Over the weekend the country officially entered its second recession in less than five years.

In Kenya, the central bank will probably stay put after 150bp of cuts this year, and Angola is likely to be on hold too.

Ghana’s central bank is expected to keep rates on hold on Monday at 14.5 per cent.

Analysts forecast no change for Sweden, Kenya and South Korea on Thursday, but there is a chance that Sri Lanka will drop its standing deposit and standing lending rates on the same day.

Colombia is expected to keep its rate steady at 1.75 per cent on Friday as the economy picks up.

Economic data

Flash PMIs this week will be in focus when eurozone data is expected to point to a further decline in business activity in November, as the latest restrictions imposed by many governments weigh on consumer spending and corporate investment.

The overall PMI score in the eurozone — combining both services and manufacturing — is predicted to drop to 49.3, down from 50 in the previous month, according to consensus economists’ expectations calculated by Reuters.

It would be the first time since June that the reading has fallen below the critical 50 mark that indicates a majority of businesses are reporting a contraction in activity compared with the previous month.

The data — also expected to show a continued decline in services activity and a slowdown in the manufacturing sector — will increase the pressure on the ECB to consider further monetary stimulus at the December meeting of its governing council.

It will be a little too soon to see what the effects of the latest restrictions are from Monday’s US PMIs, but the country has plenty of other data out this week.

Wednesday’s releases are set to show personal spending slowed somewhat in October and that the third-quarter gross domestic product rebound was unrevised.

On Thursday initial jobless claims are expected to fall to 730,000 for the week ending November 16, down from 742,000 in the week before when the number ticked up for the first time in five weeks.

Other reports include the goods trade balance, durable goods orders, new home sales and the final University of Michigan consumer sentiment index for November.

Export data from South Korea on Monday will provide a pointer on the health of global trade, while India releases its third-quarter GDP report on Friday.

Further reading

Correction: Elizabeth Gloster will complete her report on the FCA on Monday, but it will not be published today as stated in an earlier version of this article.

Comments