The exclusive world of high-end investment clubs

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

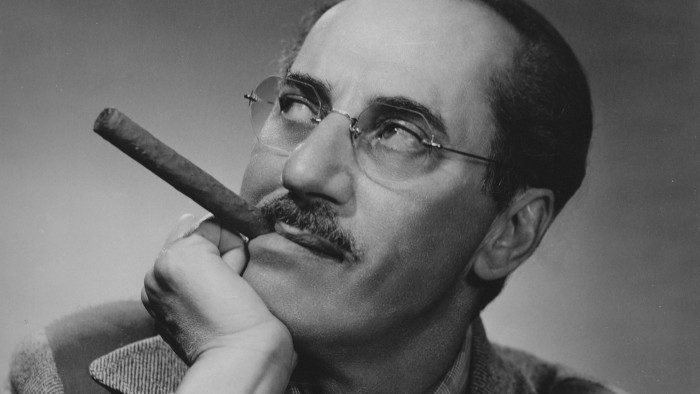

Groucho Marx, the US comedian, claimed to have no time for glitzy clubs. He made only sporadic visits to the Hollywood branch of the Friars Club — a regular haunt of Al Jolson, Jack Benny and Frank Sinatra’s Rat Pack — before deciding it wasn’t worth it. In fact, it inspired his two-liner: “Please accept my resignation. I don’t want to belong to any club that will have me as a member.”

He did have time for risky investments, though, before his death in 1977. He would visit his broker’s office almost every day when in Long Island, as historian Nathan Miller noted, and his holdings were worth about $2.6m in later life.

All of which might have inspired a rather different line, had he been alive today: “I do want to belong to a club that won’t have me as a member.” This is because a relatively new membership organisation for wealthy investors has spread across the US — but requires minimum investable assets of $10m.

The Investment Group for Enhanced Results in the 21st Century — or Tiger 21 as it is better known from Los Angeles to New York — describes itself as “the premier peer membership organisation for high-net-worth wealth creators and preservers”.

Founded in 1999 by property entrepreneur Michael Sonnenfeldt as a way of seeking advice from other wealthy individuals, it now has almost 600 members who meet in 25 cities across the US, Canada and the UK. It has just set up a group in Switzerland.

Like the Friars Club, it aims to maintain an exclusivity that might have challenged Groucho. While he was proud to admit, “I worked my way up from nothing to a state of extreme poverty,” Tiger 21’s invitation-only membership consists of those who have “created, built and sold their own businesses” — as well as chief executives and real estate investors. Between them, they have personal assets of $60bn and no qualms about Tiger 21’s $30,000 annual membership fee.

In return for this, they attend 11 meetings a year, to “improve each member’s investment acumen through peer feedback and critique”, plus “headliner events” where the headliners have included financier George Soros and activist investor Carl Icahn.

In keeping with Groucho’s ideology, it is a club that can conceive of no other that members might want to join.

As founder and chairman Mr Sonnenfeldt says: “There is no one organisation that remotely combines the intimate and confidential setting that Tiger 21 provides with the network that we’ve built out globally.”

Members of BConnectClub might disagree. It is a membership organisation for “ultra-high-net-worth families and single family offices”, launched last month by the creators of the Family Bhive social network and the events group Bespoke Connections.

Unlike Tiger 21, BConnectClub admits there are plenty of other investment clubs around the world that members could instead choose to join. So it has openly declared an aim of bringing individuals together to do deals, rather than invest conventionally.

“There are a significant number of high-end investment clubs around the world,” says founder Caroline Garnham. “Institutions see them as a threat to their business.”

Rather than charge a membership, BConnectClub uses its digital platform to track member introductions and charge commissions on deals, as well as allowing luxury brands and professional advisers to pay to be featured on the platform.

That means both clubs are potentially profit-making ventures. Tiger 21’s annual revenue, if all 600 members pay $30,000 a year, is $18m.

From this, it must pay the costs of vetting members, setting up meetings, training facilitators and paying guest speakers. Notably, its spokeswoman says, in a Groucho-esque triple negative, “no, Tiger 21 is not a non-profit”.

In some ways, then, Groucho might have preferred to be an investment club founder, rather than member.

As he said: “The secret of life is honesty and fair dealing. If you can fake that, you’ve got it made.”

Matthew Vincent is the FT’s Lombard columnist

This is one of a series of articles published in advance of the appearance of the May 4 edition of FT Wealth.

Comments