Companies urged to issue debt in calm before US election

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The threat of a turbulent US presidential election is raising the pressure on companies to load up on cheap debt as bankers warn that disruption to financial markets could deny them access to funds on favourable terms.

Corporate bond issuance has started strongly in September after companies raised $210bn in August — a record for that month — taking advantage of ultra-low interest rates whose appeal has been augmented by growing political uncertainty.

The November 3 election is “about as clear a risk factor as you have going into year-end,” said Jonny Fine, head of investment grade debt syndicate at Goldman Sachs.

“It is not a difficult argument to make to an issuer of ‘why are you waiting, you have financing to do, you have one of the best environments right now, and you have the potential for a lot of volatility in November’.”

Companies including Nestlé, General Motors and Yum Brands have raised $46bn in bond sales so far this week. The funds raised in August were more than $60bn greater than the previous high for the traditionally quiet month.

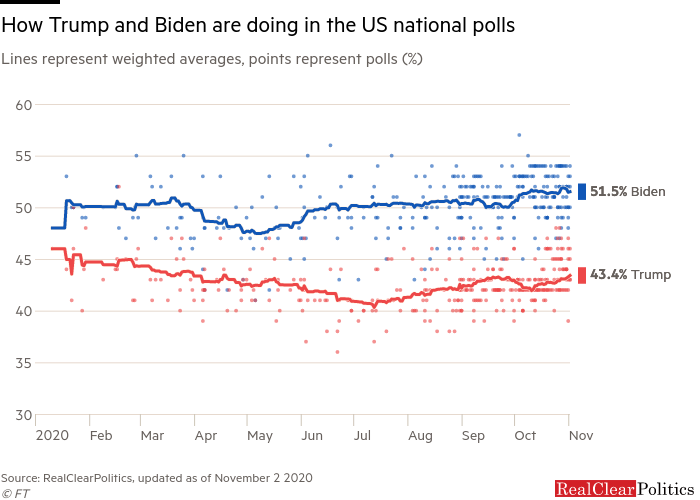

The bond binge comes as concerns mount over the outcome of the vote, with the risk of a close result in either candidate’s favour leading to a drawn-out dispute that unsettles financial markets.

Many recent corporate bond issues have been met with strong demand, lapped up by investors seeking higher returns after the US Federal Reserve slashed base interest rates to alleviate the economic effects of the Covid-19 outbreak. The central bank has also boosted confidence in some of the market’s more precarious issuers by committing to buy bonds and exchange traded funds.

Investors have put money into funds that invest in top-quality US bonds every week except one since the end of March, when the Fed said it would begin buying corporate bonds, according to data from EPFR.

That firepower has helped to improve funding conditions for companies, with a host of recent deals marking record-low borrowing costs.

“It is hard to advise someone that they should be waiting [to issue],” said Andrew Karp, head of global investment grade capital markets at Bank of America.

Issuers are also concerned that the colder winter months could lead to a resurgence in coronavirus cases, shocking markets and making debt deals more difficult, said bankers.

“It feels to us like there is an acceleration of activity in this current window,” said Mr Karp.

The surge in bond issuance since March has been welcomed by investment banks, which raked in record fees over the first half of the year for their advice to companies on mergers and fundraising.

During the last US presidential election in November 2016, yields on investment grade corporate bonds rose sharply in the aftermath of the contest — implying steeper funding costs — as investors began to account for the possibility of stronger growth and higher inflation under a Trump presidency.

“In 2016 issuers brought bonds before the election, rather than taking the risk of finding yourself in an environment that is not as favourable as it is now,” said Dominique Toublan, head of US credit strategy at BNP Paribas.

A similar strategy should pay off this time, he added.

Comments