China towns

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A game of Chinese whispers has been doing the rounds this autumn. In September, an economist claimed on television that Chinese investors are snapping up homes in east London. Two days later, an estate agent who misheard the programme declared that one-third of all home buyers in the British capital come from the People’s Republic of China. Another estate agent got into a muddle, saying one-in-three pupils starting school at Eton College this autumn is Chinese. The true figure is less than 3 per cent.

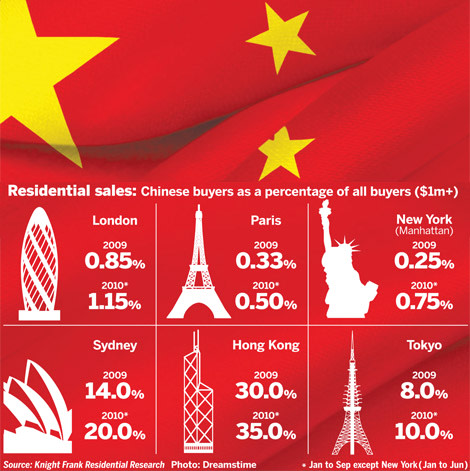

Misunderstandings aside, however, an essential truth remains: well-heeled Chinese property buyers are making their mark on housing markets worldwide. Some 475,000 Chinese have assets of $1m or more, according to the wealth management strategy firm Scorpio Partnership. This means China has the fourth-largest number of high net-worth individuals (HNWIs) in the world. More good news for estate agents is the fact that China’s HNWIs keep one-fifth of their assets in property.

Despite the size of this new property-owning class, it can appear invisible. Beijing limits its citizens to taking $50,000 out of the country each year, but many thousands of Chinese quietly skirt round these capital controls. It is tough to pin down how many buyers there are and how much they spend, because their desire to stay under the radar means they can be secretive. Most money finding its way overseas is channelled through Hong Kong, a semi-autonomous special administrative region (SAR), where Chinese can invest freely.

Not surprisingly, mainland Chinese investors are most evident in Hong Kong itself, where prices for super-luxury homes have nearly doubled in one year. Two-fifths of buyers of homes valued from HK$100m (£8m) upwards are Chinese, estate agency Savills reports. Prices for these properties, which are found in Hong Kong Island’s best areas such as The Peak and Southside, have risen 88 per cent over the past 12 months, says Peter Yuen, deputy managing director of Savills Hong Kong. Prices are rising less fast in the luxury and mass markets where a smaller proportion of buyers are mainlanders, he adds.

Chinese buyers of super-luxury homes include businessmen launching companies on Hong Kong’s stock exchange and HNWIs wanting permanent residency, which mainlanders can get by making a capital investment of HK$6.5m or more. This arrangement has led to some Hong Kong politicians wanting permanent residency rules tightened because, they say, the flood of money from Chinese investors is pricing locals out of the property market. Mainlanders are rushing to buy homes in Hong Kong before rules can be changed.

Yuen expects Chinese demand for super-luxury homes to remain buoyant. “Eighty-seven per cent of companies looking for an IPO listing in Hong Kong are from the People’s Republic,” he says, “so it will be very natural for senior staff to have their own accommodation in Hong Kong.”

In London, meanwhile, estate agencies are recruiting Mandarin-speaking staff. According to international estate agency Knight Frank, 2.3 per cent of international purchasers in London’s best districts were Chinese in the 12 months to June 2010. The agency reveals that Chinese buyers like period homes in Knightsbridge and Belgravia, and new-build schemes around Canary Wharf and Stratford, where they hope to profit from the regeneration inspired by the 2012 Olympics.

Many also buy homes to house their children studying in Britain. According to the Chinese embassy, 100,000 Chinese study at British schools and colleges. Learning English is compulsory in Chinese schools, which makes it relatively easy for students to attend British universities. A growing number attend Britain’s public schools. Eton runs a summer school in English language and culture for Chinese schoolboys.

Multi-million-pound budgets are not uncommon. Martin Bikhit, managing director of London estate agents Kay & Co, is aware of Chinese investors wanting blocks of between 10 and 50 flats in prime residential areas to let or run as serviced apartments. Guy Meacock, associate at buyers’ agent Prime Purchase, is helping a Chinese couple find a house in Knightsbridge. Their budget is £15m. She is a financial director and her husband floated his media company on the New York Stock Exchange this year. The couple are expecting a child whom they want educated in Britain. They won’t be domiciled in Britain, preferring to move between homes around the world.

In New York, Kathryn Higgins of DJK Residential says Chinese businessmen buy properties in the $1.5m to $2.5m range for investment or as second homes. “I spent yesterday with a buyer from China who wants two bedrooms, condos only, midtown location, new buildings, lots of amenities, something that will command a high rent,” she says. “The exception to Midtown is Trump Place on Riverside Boulevard.”

Patrick William O’Neill, chief executive of US developer The O’Neill Properties Group, told the South China Morning Post that many wealthy Chinese buy property in the US, Canada and Britain to get permanent residency. But it is not just Anglophone countries that are attracting investment. Chinese buyers have also appeared in increasing numbers in Paris this year, says Mark Harvey, Knight Frank’s international residential consultant, who is based in the city. Usually they want secondary market apartments for family use in the prime 7th, 8th and 16th arrondissements, priced from €3m to €6m.

Taiwan began opening up its luxury housing market to Chinese investors in 2009. Expectations that mainland buyers will flood the island following trade deals between the two countries in 2010 have encouraged a rash of speculative property investment on the island by Taiwanese.

Aided by the rising Chinese renminbi, investors are also buying property in Japan to let out to their countrymen studying there. (Yields are 8 to 10 per cent, significantly higher than the 2 to 3 per cent available in Shanghai). But what the Chinese crave most in Japan are holiday homes. “Big Chinese cities are as futuristic as anywhere else on earth,” says Liam Bailey, head of residential research at Knight Frank, yet China’s impoverished countryside affords little in the way of retreats for the rich. “Rural backwaters in Japan with excellent transport and civilised local shops and restaurants are a real novelty.”

What does the arrival of the Chinese investor mean for the rest of us? Homeowners in areas targeted by Chinese investors could find the value of their property rise, as the pool of buyers widens. And, if China experiences economic problems, Bailey believes more Chinese may invest in property abroad. “My view is that China is at risk of a bust. There is an argument that any fallout could be positive, with wealthy Chinese targeting offshore locations as their home market struggles.”

A former president of the Royal Institution of Chartered Surveyors, Nick Brooke is now chairman of Hong Kong-based company Professional Property Services, where he advises on cross-border investment in China. He believes that China’s capital controls will not stop its people from becoming the world’s biggest property investors over the next decade: “I think we are going to see a substantial increase in outward flows and this will continue to have an impact on markets and values, particularly in Asia.”

The Chinese-assisted boom in Hong Kong’s super-luxury homes market is likely to be be repeated elsewhere, Brooke says. “I see Singapore and Kuala Lumpur as potential future targets,” he says. “It is all about diversification but within an asset class to which they relate and like. The Chinese are coming.”

…………………………………………..

A trophy home by water with the auspicious number eight

Hong Kong

8 Tai Tam Road, Southside, Hong Kong Island, HK$250m

This five-bedroom house has sea views, a pool – and the lucky number “eight” in its address.

Savills, tel: +00 852 2842 4434, www.savills.com.hk

Sydney

4301/129 Harrington St, The Rocks, A$15m

Duplex penthouse with five bedrooms, cinema room, pool and roof terrace with sauna.

Knight Frank, tel: +61 2 9036 6666, www.knightfrank.com.au

London

Bolney Gate, Ennismore Gardens, Knightsbridge, £14.75m

Chinese buyers like refurbished period homes with high-tech amenities such as air conditioning. This one has a cinema and five en suite bedrooms.

Knight Frank, tel: +44 (0)20 7591 8600, www.knightfrank.com.au

New York

1281 Madison Avenue, Upper East Side, Manhattan, $1.9m

Has the lucky number “eight” in its address.

Duplex with two en suite bedrooms and 24-hour doorman.

Stribling, tel: +001 212 570 2440, www.stribling.com

Paris

Champs de Mars, €4.75m

First-floor flat in a classic Haussmann-era building facing the Eiffel Tower, with 70 sq m garden and private access to the Champs de Mars.

Knight Frank, tel: +44 (0)20 7629 8171, www.knightfrank.com.au

What the Chinese buy:

● For own use: trophy homes in desirable residential areas and close to iconic establishments such as Harrods.

● For their children’s use: flats close to where children study.

● For investment: new-build flats in areas of regeneration that are low maintenance. Also: entire blocks for refurbishment in central locations.

Cultural dos and don’ts:

Chinese buyers can be superstitious.

● Bad luck: the number “four” in an address – including a fourth-floor location; a home where somebody was murdered or committed suicide; a home by a graveyard.

● Good luck: the number “eight” in an address (including an eighth-floor location); a home next to a river, stream or harbour.

Comments