The lockdown death of a 20-year-old day trader | Free to read

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Alex Kearns was an ordinary 20-year-old. He played the trombone, studied at the University of Nebraska and, like millions of other Americans, traded stocks to pass the time or make some money when coronavirus shut down schools and workplaces. Unfortunately, his youthful dabbling ended in tragedy.

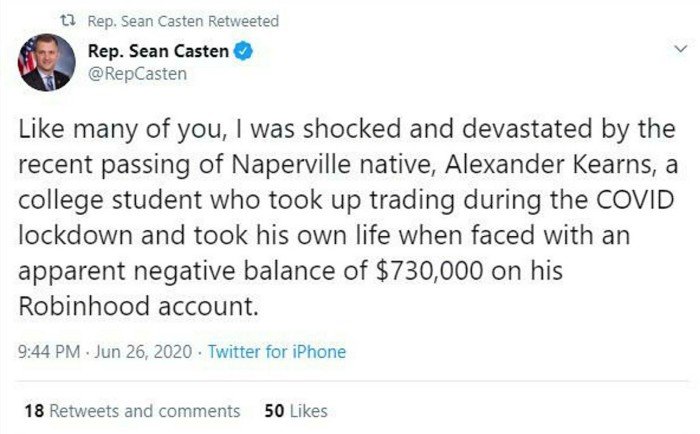

On June 12 back at home in Naperville, Illinois, Kearns took his own life, after believing he had lost nearly $750,000 in a soured options bet made on Robinhood, an online brokerage that has become emblematic of a new era in retail investing.

In a note left for his family, Kearns said he had “no clue about what I was doing” and never intended to “take this much risk”. Horrifically, it appears Kearns mistook the potential loss on one leg of an options trade for the outcome of the overall bet — wrongly believing that he had racked up a loss of $730,165. In fact, his account had a balance of $16,000.

The tragic episode highlights the dark side of the recent boom in retail trading and the offerings from online brokerages — such as free trading, options, cheap debt and the ability to buy small slices of stocks — which have lured more investors to the markets. Some observers worry the new class of e-brokers have helped turn the experience into something akin to a video game, with constant updates about profits and losses and social media fuelling the frenzy.

“The more I dug into it, the angrier I got,” says Bill Brewster, an analyst at Sullimar Capital in Chicago who is married to Kearns’ cousin and speaks on behalf of the family. “They’re almost pushing people into financial dynamite.”

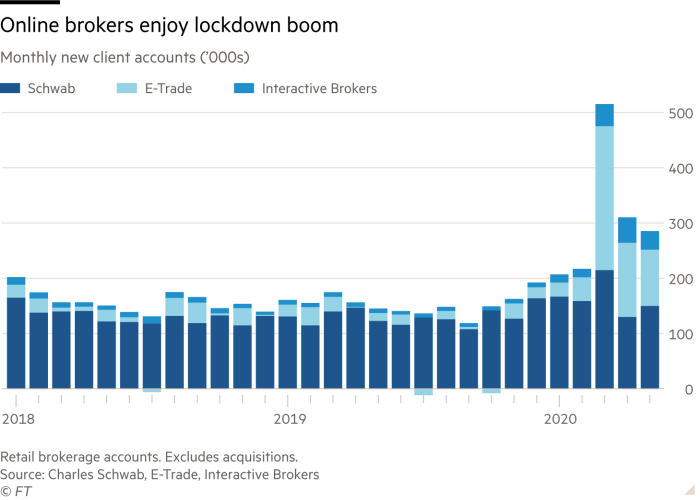

The surge in retail trading has been a boon to brokerages. Robinhood added 3m users in the first quarter, pushing its total number of users above 13m. Schwab, ETrade and Interactive Brokers together added 1.5m new accounts in the first five months of the year, nearly double the amount for the same period in 2019. TD Ameritrade, which shares quarterly data, added more than 500,000 new accounts in the first quarter — three times the amount for the same period a year earlier.

Vlad Tenev and Baiju Bhatt, the co-founders of Robinhood, said they were “devastated” by Mr Kearns’ death, and vowed that the company would expand educational resources related to options trading, tweak the app to clearly show users’ financial exposure when making options trades and would consider adding new criteria for customers to trade sophisticated options.

Congressman Sean Casten of Illinois last week raised the tragedy with Jay Clayton, the head of the Securities and Exchange Commission, who said regulators were looking at how to improve disclosure. “I read it over the weekend and it’s terrible,” Mr Clayton said. “We need to do something to make sure these kinds of things don’t happen.” Mr Casten later tweeted: “Democrat or Republican, Alex could have been any of our kids. It’s time for the Senate to act.”

Mr Brewster lauds the changes promised by Robinhood, but remains worried about how it and other platforms have transformed trading and sucked in younger, inexperienced and potentially vulnerable people.

“It’s the beginning of a long journey, not the end,” Mr Brewster says. A broad discussion is needed about the downsides of giving everyday investors unfettered access to the markets, he adds. “Have we crossed the Rubicon into dangerous territory? I think we probably have.”

Video game Icarus

Berkshire Hathaway’s famously acerbic vice-chairman Charlie Munger made his views on day traders and their enablers clear at last year’s annual meeting of the Daily Journal, the publisher he chairs.

“I regard that as roughly equivalent to trying to induce a bunch of young people to start off on heroin,” he told the attendees. “It is really stupid.”

Mr Munger was not far off. Research by neuroscientist Hans Breiter shows the same part of the brain activated by drugs like cocaine is also triggered when a person anticipates a financial gain. That has been supercharged in the new era of online trading platforms.

The neon colours and slick interface of Robinhood, as well as its pitch to users to “level up with options trading”, is a step change from the relatively sedate websites of its older rivals such as ETrade and Charles Schwab. New users are given a free stock — usually valued below $10 — to get them started, and confetti blasts across the screen when users make their first stock and option trades.

“The parallels between video games and day trading is becoming closer and closer,” says Andrew Lo, a finance professor at Massachusetts Institute of Technology. “For many gamers, particularly the younger ones who are not used to trading and don't fully understand the impact of significant losses and gains on their psychophysiology, it could have some significant adverse consequences.”

According to Prof Lo’s studies of traders, the consequences include fear, anxiety, regret, frustration and disappointment, and even symptoms of post-traumatic stress disorder for those who made large losses early in their careers.

In the past, getting signed up to an online brokerage could be fiddly and take time. But the technology has moved on and today, it can take just minutes to sign up for an account in the US. Broker approval usually takes a day, opening the door to trade in stocks and exchange traded funds. Traders can then seek approval for more advanced instruments, such as options or borrowing money on “margin”.

For example, Robinhood traders can sign up to its “gold” membership, which costs $5 a month after a free 30-day trial. This allows traders to make bigger bets with money borrowed from Robinhood. The only restrictions are that federal regulations require a trader to have at least $2,000 in their brokerage account and “a suitable investment profile in order to use margin”, which Robinhood determines with a few questions on the trader’s experience, aims and sensitivity to risk.

Analysts say the use of options can be particularly dangerous. Options are a financial derivative that can give investors far greater exposure to a stock or equity index falling or rising with an often minimal downpayment, magnifying gains but also potentially enhancing losses.

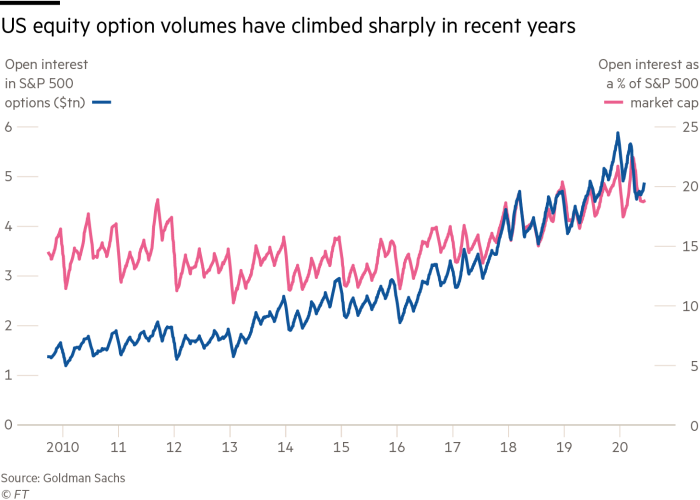

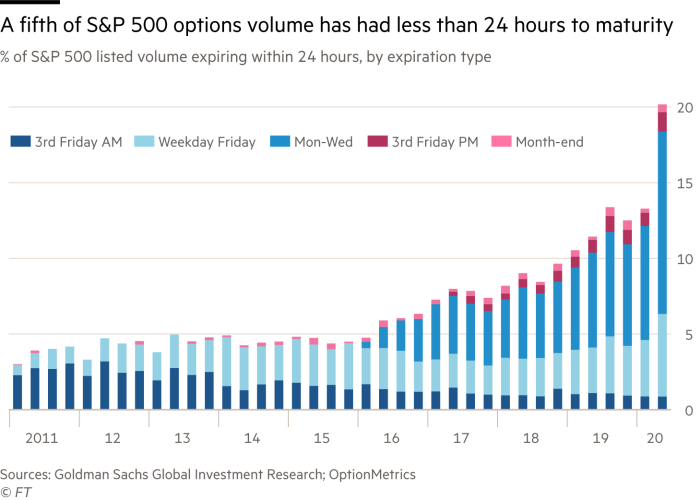

The retail trading frenzy has already helped trigger a surge in option trading this year, with the total value of contracts now at $5.2tn, roughly double the level seen five years ago, according to Goldman Sachs. That is a sum equal to about 20 per cent of the overall stock market value of the S&P 500 benchmark of US blue-chip companies.

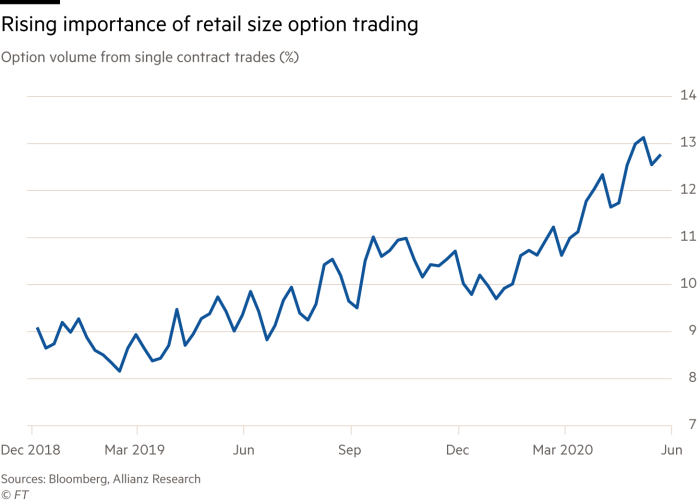

Researchers at Allianz, the German insurer, noted that single contracts — most popular with smaller individual traders — accounted for 13 per cent of S&P 500 options volumes traded since March, up from about 8 per cent a year earlier. For some stocks popular among day traders — such as Chipotle, Amazon and Tesla — single contracts account for between 20 per cent and 30 per cent of the option volume.

“One only has to spend some time on popular Reddit communities to get a broad idea of the current market hysteria and the risks that ‘new retailers’ are taking,” Allianz said in a report in June.

The e-brokers have statements stressing that options trading entails significant risk and is not appropriate for all investors, directing people who want to learn more to a 26-year-old paper — last updated in 2012 — from the Options Clearing Corporation about the potential pitfalls.

Retail brokers are required to set different levels of options trading available to customers, who apply for permission to move from one tier to another based on factors such as how long they have traded, net worth, liquid assets and age. The e-brokers typically have three or four different levels but do not disclose the requirements for each tier to avoid users gaming the system.

The brokerages are also subject to rules that require investors classed as day traders, under a regulatory definition of four trades in and out of a stock in one day across five trading days, to hold at least $25,000 in equity in their accounts. Brokers said in statements to the Financial Times that they adhere strictly to regulatory guidelines, ensure that only suitably experienced traders can get access to more complex option strategies, and provide plenty of free education for traders.

The retail trading phenomenon has been so strong that even professional investors have had to adapt to its warping effects. Max Gokhman, head of asset allocation for Pacific Life Fund Advisors, a US fund manager, says he has now been forced to consider the impact of retail trading in companies that have become popular among everyday investors — such as airline stocks and Tesla.

Mr Gokhman likened professional investors to pilots manning a jumbo jet, while the retail traders are Icarus, the mythical Greek figure with wings of wax, flying alongside. “We know we can move altitude up and down and have sophisticated systems to change our exposure,” Mr Gokhman says. “But Icarus is just getting higher and higher, closer to the sun and inevitably Icarus — in this case the day traders — will crash.”

Options risks

Even some veteran day traders are shocked at the current frenzy. Marcello Arrambide, who runs Day Trading Academy to train and funnel promising stock jocks to his trading platform SpeedUp Trader, thinks that the current market euphoria, and the day-traders it has buoyed, will end in tears.

“The barriers are now so low that anyone can come in and think they can do it. You can’t lose right now, and that’s the problem,” he says. “The amount of people that are going to get wiped out when the market does fall is going to be ungodly.”

Mr Arrambide refuses to teach traders to use options, preferring to concentrate on stocks and futures, and is in favour of restrictions on their use for retail investors, given the complexity and potential pitfalls. “But if it isn’t trading, it would be something else,” he adds. “People just want to get rich quick.”

Terrance Odean, a finance professor at the University of California at Berkeley who has studied day traders, says more education is needed. “If it’s play money and money you can afford to lose, that’s your business. But you don’t commit suicide because you lost your play money,” he says. “I would hope the vast, vast majority of investors writing unhedged calls and puts understand the risk but I assume there are some who don't . . . it wouldn’t be horrible to give people five minutes of education.”

Study after study in various countries demonstrate that the overwhelming majority of day traders end up losing money.

A recent study of retail investors in Brazil between 2013 and 2015 found that 97 per cent of those that traded for at least 300 days lost all the money they had put up. Only 1.1 per cent made more than the Brazilian minimum wage, and only 0.5 per cent earned more than an entry-level bank clerk.

The impact of trading on people’s health can also be marked. Big stock market drops are associated with worsening mental health, spikes in binge drinking and fatal car accidents involving alcohol, according to a study from the University of Chicago.

Trading may seem like a sedentary job, but the stresses can even have physiological effects, such as higher blood pressure, Prof Lo says.

“Trading is a physiologically taxing activity,” he says. “You may not think that, because what are you doing? Sitting at a desk and shouting numbers into a phone or entering orders electronically. But the amount of stress that trading imposes on the human body is very significant.”

Family left with questions

Mr Brewster says none of the family are aware of any other underlying reasons why Kearns might have chosen to take his life. He had previously known the young student as someone who would always play with everyone’s kids at family gatherings, but in March he had approached Mr Brewster to talk about stocks, the Federal Reserve and the outlook for the economy.

“It seemed like his life was in a good spot . . . It was the first time we really talked as men,” he says. “Now we’ll never be able to do it again.”

The loss has galvanised him, and he now wants to spark a broader debate about the side-effects of gamifying trading that have emerged as the dark side of “democratising” investment, as proponents frame it. The Kearns tragedy may be uniquely awful but Mr Brewster frets that the problems he faced will be far from uncommon, given the recent day trading frenzy.

“I think people are making massive mistakes and ruining their financial futures,” he says. “The societal consequences could be huge down the line.”

If you have been affected by anything in this story and need support please contact the US National Suicide Prevention Lifeline at 1-800-273-8255, a free, confidential 24/7 service for people that need help. Or in the UK, the Samaritans hotline at 116-123. More information can also be found at www.mind.org.uk, www.samaritans.org and www.save.org

Comments