Living wage: Seattle’s wage rise could sting in recession

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In downtown Seattle on a Wednesday morning, diners at Miller’s Guild, an upscale eatery, are quietly choosing between breakfast dishes like smoked salmon torta and bavette with eggs.

But in a few months another item will start showing up on diners’ bills: a mandatory service charge of 18 per cent, which the restaurant is using to help offset an increased minimum wage.

Seattle, a city of 650,000 that is home to Amazon and Starbucks, has become a testing ground for one of the world’s most ambitious minimum wage hikes, and an example to the UK, which introduces its own minimum wage experiment on Friday.

Seattle’s plan, passed in 2014, will raise the minimum hourly wage by 50 per cent in just two years, with the minimum wage reaching $15 per hour next year for large businesses.

A growing number of US cities and states are following suit. California Governor Jerry Brown announced on Monday that state legislators and labour leaders had agreed on a $15 minimum wage bill — the first of its kind in the US — which will be voted on by the state assembly. Cities including San Francisco and Portland are phasing in $15 hourly wages.

Seattle is still seen as a special test case. “You can think of this as kind of the ideal conditions in which to raise the minimum wage,” said Jacob Vigdor, a policy professor at the University of Washington. “Seattle has a booming labour market, and a booming real estate market. There is a lot of wealth in Seattle.”

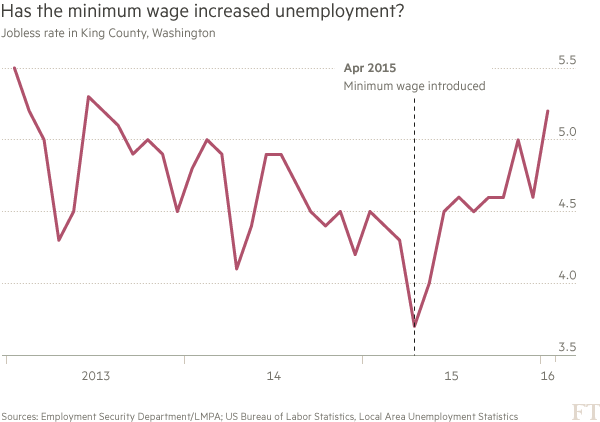

When the first wage hike took effect last April, unemployment stood at a seven-year low, at 3.7 per cent, in King County, which includes Seattle.

Unemployment has ticked up since then, reaching 5.2 per cent in January, but economists caution against reading too much into the numbers because they are not seasonally adjusted.

Mr Vigdor is leading a research team commissioned by the city of Seattle that is studying the wage increase, and said it could be “another couple of years” before the impacts are fully understood.

At restaurants like Miller’s Guild the impact is much more immediate. “That hit is huge to the bottom line,” said Jason Wilson, the owner and executive chef at Miller’s Guild. The change will mean a 50 per cent hourly raise for servers, who also make tips.

Mr Wilson’s answer is the mandatory service charge, which will replace tips and be distributed between wait staff and kitchen staff.

In the kitchen, the staff are already paid more than the minimum wage because of the tight labour market (although they do not make tips).

Even a dishwasher makes $14 per hour — and Mr Wilson said these jobs are hard to fill. “We see it as a big gap in the labour pool right now,” he said, adding that the construction boom in downtown Seattle has made it harder to fill entry-level kitchen jobs.

Many other restaurants are simply raising prices to deal with the shift. A recent survey found that this was the most common response — for businesses whose clientele can afford it.

Not all businesses have that option. Miller’s Guild sits in Seattle’s bustling business district, just a stone’s throw from the Amazon campus, and Mr Wilson is optimistic that its mandatory service charge will not scare customers away. But the southern half of the city is poorer than the northern half; and business owners are more likely to reduce worker hours in response to the wage increase.

“It is a different story in the south side of town,” said Mr Vigdor. “Businesses there report that they are less confident they will be able to pass costs along to customers.”

One other question facing Seattle is what happens when the boom times end. “When there is this next recession, do we see a greater degree of unravelling in Seattle versus elsewhere?” Mr Vigdor said. The minimum wage may have one impact when the economy is booming, and a different one when it is not.

Comments