Watch out for ‘tail risk’ in Scotland

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

The prospect of Scots voting for independence in less than two weeks is a classic “tail risk” for investors and traders – an event thought to be of low probability but one that would have a big impact should it happen.

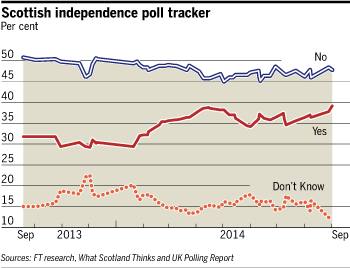

The chances of a Yes vote in the September 18 referendum on independence were not being taken seriously in financial circles because opinion polls over the summer consistently showed the No side as maintaining its double-digit percentage lead.

But such complacency was shaken this week when the latest YouGov poll for the Sun newspaper found the majority against independence had dropped to just 6 percentage points, excluding don’t-knows – down from 22 percentage points in August.

“The risk that Scotland will vote for independence is real,” says Rob Wood, chief UK economist at Berenberg, a German-based bank. “Because YouGov usually finds a larger majority against independence than other pollsters, the recent result suggests other polls could soon record a majority for independence.”

The Scottish referendum is just the first of a series of political risks facing investors in the UK. Next year will see a closely contested general election and that could lead to a referendum on the UK’s membership of the EU.

That market participants had embraced the view that Scottish independence would be rejected leads Bill O’Neill, the head of UBS Wealth Management’s UK investment office, to warn of a “ferocious and dramatic response” if the Yes side was to win.

“There would be a fall in UK growth and significant pushback of when the Bank of England could start tightening interest rates – perhaps until after the next general election,” says Mr O’Neill.

Kevin Daly, an analyst with Goldman Sachs, also believes a Yes vote could lead to severe short-term consequences, though he – like Mr O’Neill – still thinks a No vote is the likelier outcome.

Key issues that would require negotiation include whether Scotland would be able to retain sterling as its currency, and how existing UK government debt would be split between Scotland and the remainder of the UK. Separately, Scotland would have to negotiate with the EU as to whether it would remain a member.

“Because the outcome of these negotiations is unclear, one general consequence of a surprise Yes vote is that it would result in a prolonged period of uncertainty,” says Mr Daly. “This, in itself, is likely to have adverse economic consequences for Scotland and the UK.”

The strongest market reaction to the YouGov poll has been in the currency option markets, where investors rushed to buy protection against swings in the value of sterling around the date of the vote.

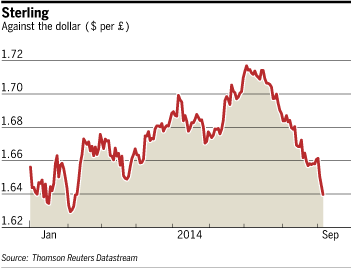

The pound has already weakened about 5 per cent against the dollar since early July, as investors begin anticipating the start of US rate rises, while the timing of the first increase in UK borrowing costs appears more uncertain.

Worries about the impact of Scotland’s referendum are likely to account for some of this weakness, but analysts expect a much sharper decline – perhaps as much as 5 to 10 per cent – in the event of a Yes vote, or if the polls start to show the independence campaign in the lead.

The clearest effect so far, however, has been in options markets, which saw one of the biggest moves in 10 years in implied volatility on the pound-dollar exchange rate. This suggests that investors do not yet see a vote for independence as the likely outcome – but they do want to buy protection against the volatility that would follow.

“It is now a risk you have to think about,” says Paul Lambert, a fund manager at Insight Investment.

FT Interactive

Scottish independence poll tracker

As Scotland prepares to vote on independence, the FT takes a closer look at polling data in an interactive poll of polls

Explore graphic

Shares in companies with cross-border exposure such as RBS, Lloyds Banking Group and SSE, the Scottish utility, slid after news of the YouGov poll broke.

But the FTSE 100 Index, which is dominated by international companies, rose marginally on that day and has subsequently touched a 14-year high, thanks to easing tensions in Ukraine and supportive central bank policies – further evidenced by the European Central Bank’s interest rate cut on Thursday.

Several hedge fund managers say they have looked at trading Scotland but are reluctant to do so because of poor visibility over how the referendum outcome will affect the gilt markets and sterling.

A global macro hedge fund manager says: “Volatility might pick up between now and the day of the vote, especially if the polls tighten. That might be tradeable. I think managers are avoiding directional trades because you’ve only got a 50 per cent chance of getting it right, given the total unpredictability of market reaction.”

Even if the No side wins, analysts believe there could still be plenty of unresolved issues for investors to ponder.

“A close vote would keep alive the chances of a second referendum in five to 10 years, so uncertainty would remain,” says Mr Wood. “A No vote would mean more devolution with additional powers for Scotland probably kick-starting changes to UK regional government.”

Additional reporting by Harriet Agnew

Comments