Market volatility brings vintage hedge fund strategy back to the fore

Simply sign up to the Hedge funds myFT Digest -- delivered directly to your inbox.

One of the hedge fund industry’s oldest — and often least loved — strategies is making a comeback, helped by this year’s market turmoil.

Convertible arbitrage, the strategy on which billionaire traders such as Ken Griffin and Michael Hintze cut their teeth, is delivering healthy returns for managers once more. Hedge funds attribute the revival to a surge in market volatility since the coronavirus crisis began, and a flood of new bond issuance from embattled companies such as Carnival and Southwest Airlines.

Convertible bonds allow their owners to convert their holdings into a pre-determined number of the company’s shares — effectively a call option on, or the right to buy, the shares. While some traditional investors just buy and hold the bonds, hedge funds buy the bonds and then hedge their position by shorting the shares, or betting they will go down. They aim to profit from the stock’s volatility, which increases the value of the option embedded in the bond.

It has become this year’s best-performing hedge fund strategy, gaining 6.9 per cent on average to August, according to data group eVestment. This compares with 2.2 per cent across the broader hedge fund sector.

“Convertible arbitrage has been fantastic,” said Kevin Russell, chief investment officer at UBS’s hedge fund unit O’Connor, which tripled its exposure to the strategy over the course of March and April.

This trading strategy “is what I grew up with. It hasn’t been like this for many years,” he said.

Cedric Vuignier, head of alternative investments at SYZ Capital, increased his portfolios’ exposure to the strategy by about 2 to 3 percentage points to 10 per cent this spring. “It’s a great strategy,” he said. “This will be the best period for [convertible arbitrage managers] since before 2008.”

There is a second way that the strategy benefits from big price swings. Because managers constantly have to hedge and rehedge their positions as the stock price changes, they effectively end up buying more stock when the share price falls and selling when the price is higher. That automatically generates a profit.

And it has been a rocky year for stocks. Cboe’s Vix index of equity volatility topped 80 in March, almost reaching the intraday high set during the 2008 financial crisis, as fears over the effects of the pandemic reached their peak. The Vix remains above 20, much higher than average levels of recent years.

“It’s a perfect environment,” said a person close to New York-based Linden Advisors, a convertible arbitrage specialist that has gained more than 12 per cent so far in 2020.

Context Capital Management is up almost 18 per cent, meanwhile, according to numbers sent to investors. The firm declined to comment on its own performance but manager Charlie Carnegie said higher volatility is helpful for such funds.

Man Group’s GLG Global Convertibles fund is up 7.8 per cent this year. And London-based LMR suffered large losses in March’s sell-off but has since clawed back ground, helped by gains in its convertibles trading, said a person familiar with its positioning.

Issuance of convertible bonds has been a popular form of financing this year, particularly for companies badly hit by coronavirus. The debt typically comes with a lower coupon than traditional bonds — meaning lower borrowing costs for the issuer — while the dilution to the equity is likely only if share prices rise much further. Issuance this year has reached $131bn, already the most for a calendar year since 2007, according to Refinitiv.

Trading convertibles can be hazardous, though, even in times of volatility. Convertible arbitrage funds lost 33.7 per cent in 2008’s market chaos, ranking it among the hedge fund industry’s worst-performing strategies, as traders who had been using high levels of leverage to fuel returns had to slash their positions.

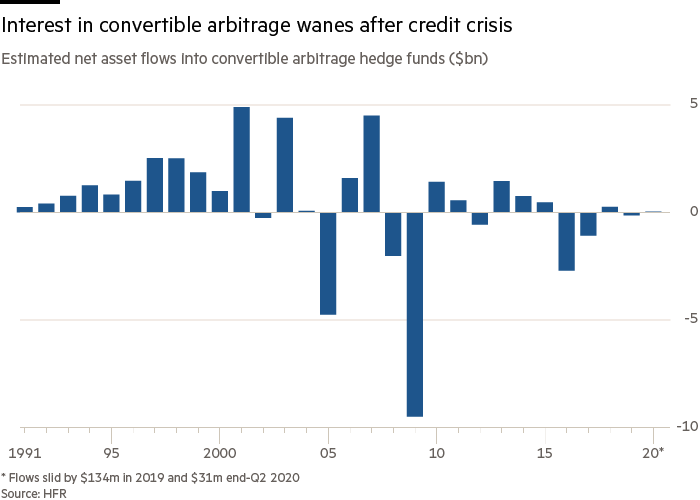

Interest in the strategy has waxed and mostly waned since then. Since the start of 2008 investors have withdrawn more than $11bn from convertible arbitrage hedge funds, according to HFR.

Convertible arbitrage’s position as a backwater for the past decade means little research coverage is now available, in some cases less than before the financial crisis. Traders say that creates opportunities for those prepared to do their homework.

Oliver Dobbs, a convertible arbitrage veteran who worked under Sir Michael at Goldman Sachs about 30 years ago, said fewer service providers now supply electronic copies of companies’ convertible bond prospectuses than before the financial crisis. His Trium Credere fund is up 7.2 per cent this year.

Options prices suggest investors expect markets to remain jumpy in the run-up to November’s US presidential election.

“The thing that makes us money is volatility,” said Odell Lambroza, chief investment strategist at New York-based Advent Capital, whose Global Partners fund is up 5.1 per cent this year. “I think that’s here to stay for a while.”

Comments