Big data analysis to transform insurance industry

Simply sign up to the Property sector myFT Digest -- delivered directly to your inbox.

Big data analysis has revolutionised many areas of modern life — from healthcare, to politics, to sport — yet not so far the property insurance market. That looks set to change.

“The insurance industry has been a little of a hold out,” says Lori Sherer, head of the advanced analytics practice at management consultancy Bain, but “is now on the brink of innovation”.

More executives at property insurers — who worry about tight profit margins and growing competition — plan to take advantage of the potential benefits of the increasing amounts of captured data.

From weather patterns to social media, new sources of data could help them streamline costs, be more targeted with the risks they want to underwrite, identify new customers, predict fraud or identify which claims have the potential to become very expensive.

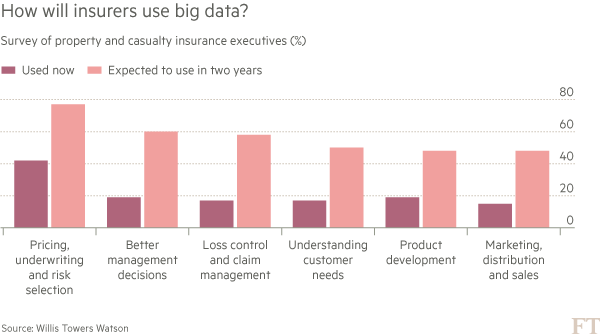

Property insurance executives have “fairly aggressive plans” for developing big data analysis over the next couple of years, says Klayton Southwood, director of risk consulting at Willis Towers Watson. He cites the results of a survey the consultancy conducted in the US last year.

If what the executives say in the survey holds true, the property insurance industry is soon to be significantly changed by its approach to big data.

For example, fewer than half of the property and casualty insurance executives who took part in the survey reported that big data and the analysis of it help them now with pricing, underwriting and risk selection. On the other hand, just over three-quarters of the survey respondents expect big data to help them in this area in two years’ time.

The survey suggests more management teams expect to gather data from a greater number of sources. These include data generated through website use, email and phone calls — and social media.

One emerging area of increasing interest to property insurers for generating data and serving customers is the smart home. This refers to household devices and systems — from doorbells to air conditioning — that produce data and can be controlled from anywhere by computer or mobile device.

Two US-based providers, Liberty Mutual Insurance and American Family Insurance, have partnered with Nest Labs, the smart-home tech company that Google acquired in 2014, to offer its smoke alarm and carbon monoxide monitor, Nest Protect, to customers for free. As part of the deal, customers can receive a discount from the insurers on their premiums and the insurers in return receive data from the device.

The data shared with the insurer are limited and include the status of batteries, sensors and internet connection as well as the location of the house and the room in which the device is located.

Data produced by customers are already used in other areas of insurance, such as car coverage, where telematics that monitor driving style help cut premiums for safe drivers. They are also used in retail, where supermarkets issue loyalty cards and offer discounts in exchange for data on customers’ shopping habits.

John Davies, managing director of risk finance at broker Marsh, says customers will typically give up personal information under two conditions: if it is easy to do so and if they receive something in return. “In the insurance industry,” he says, “it’s still not easy.”

Some information can be gathered without customers knowing and social media have made this much easier. Using sites such as Facebook and Twitter, insurers can get a better understanding of their customers’ behaviour and risk profile.

The more insurers mine and use data, the more likely it is to become an area for regulators to address. Officials at the Switzerland-based International Association of Insurance Supervisors are discussing how insurers are using data in order to determine if the organisation should provide guidance.

In November, the UK’s Financial Conduct Authority requested information on how insurers are using big data. It aims to publish its findings by mid-2016 and reveal its plans on what response it will make. This could include “a market study, adjustments to policy or guidance or another form of intervention,” according to its website.

Data protection laws in many countries put some limit on what insurers can do. That does not mean, however, that insurance executives are paying attention as much as they might.

“There are differences at different companies with how seriously they take data protection,” says Emma Bate, partner at international law firm DAC Beachcroft. “This needs to be discussed at the board level.”

Regulatory and legal risks aside, one of the biggest challenges facing property insurers is making sure they have the right people with the right skills to capture and analyse big data properly. Respondents to the Willis Towers Watson survey ranked this as the top big-data challenge.

“Big data can be paralysing,” says Helen Gemmell, catastrophe modelling manager at Liberty Specialty Markets. “Asking the wrong questions of it or using the data in isolation can lead to poor decisions.”

Comments