Digital scheme pays Venezuela health workers from frozen funds

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

As Covid-19 spread across Venezuela last year, politicians opposed to Nicolás Maduro’s authoritarian government wanted to help health workers who were battling the pandemic in dire conditions, often without protective equipment or disinfectant.

There was little they could do. Maduro had tightened his grip on the country’s purse strings; tough US sanctions had exacerbated an already dreadful economic crisis; and neither the government nor the browbeaten opposition could spare any cash for doctors and nurses.

But the president’s opponents had one potential weapon: access to Venezuelan state funds frozen in US bank accounts.

Ever since Venezuelan congressman Juan Guaidó launched his audacious attempt to unseat Maduro in 2019, the US government has recognised him as the legitimate president of Venezuela. Washington argues, therefore, that Venezuelan state money seized by US authorities belongs to Guaidó’s administration — not Maduro’s de facto government.

Guaidó’s people figured that, if they could persuade the US Treasury to release the money, they could pay health workers a bonus. They asked US law firm Sullivan & Cromwell to help.

Sergio Galvis, head of its Latin America practice, led a 14-strong team including experts in “a huge range of disciplines — banking, cyber security, sanctions, payment systems and foreign exchange controls”, he says.

Sullivan & Cromwell’s first job was to convince the Treasury’s Office of Foreign Assets Control (Ofac) to release the funds. “It was very, very important to Ofac and the US government that the money was really going to the intended recipients,” Galvis says.

The next hurdle was to find a way to send the money to Venezuela securely, without it being intercepted by the Maduro regime or the many creditors suing for compensation for broken promises and assets expropriated during the past 22 years of revolutionary socialist rule.

That meant sending money through the Venezuelan banking system was not an option. So Sullivan & Cromwell joined forces with tech businesses, including digital currency company Circle, to funnel the money to Venezuela via other means.

“We were able to put in place an aid disbursement pipeline that leveraged the power of USDC — dollar-backed, open, internet-based digital currency payments — to bypass the controls imposed by Maduro over the domestic financial system,” Circle says on its website.

The money was deposited in digital wallets created by online payment platform Airtm. Doctors and nurses had to register on the Airtm website to receive payment.

This caused some problems. Guaidó’s team says the Maduro regime blocked Airtm, forcing recipients to use VPNs (virtual private networks) to access payments. Canadian VPN company TunnelBear provided free access to its services for a while, arguing that “healthcare workers deserve the benefits of an open and uncensored internet”.

Once the recipients had the money in their digital wallets, they could spend it online, transfer it to local bank accounts in the Venezuelan currency, bolívars, or send it to other Airtm users.

In all, Guaidó’s team says the scheme channelled $18m to more than 60,000 doctors and nurses. The payments were set up as $300 per person in three monthly instalments of $100. In a country where the official minimum wage is less than $3 a month, it was appreciated at a time when healthcare workers, including doctors and nurses, had to survive on little.

Did the system work? Generally, yes, says Mauro Zambrano, a union representative for Venezuelan health workers. “There were some problems, and some workers only received two of their three payments, but a lot of people got the money and it made a difference,” he says.

Guaidó, Ofac and Sullivan & Cromwell might regard the money transfers as a noble enterprise but, to Maduro, they were theft. From his point of view, the US had stolen Venezuelan state funds and handed them to a puppet administration led by the unelected Guaidó, which in turn disbursed them to selected health workers without proper oversight.

For Galvis, though, the legal case is watertight. He says his firm’s client “was a government recognised by the US, operating in compliance with US law, which is pretty clear on this”. Once the US secretary of state “has designated ‘X’ as the recognised government of a country, that is binding on all arms of the US government”, he adds.

Galvis explains the essence of what Sullivan & Cromwell was trying to achieve: “We had to come up with a system that complied with US sanctions rules and could lawfully get money into the electronic wallet of a nurse sitting in Caracas so she could go to the supermarket and buy milk.”

Case studies

Rescue, restructuring and recovery; dispute resolution. All case studies researched, compiled and ranked by RSGI. ‘Winner’ indicates the organisation won an FT Innovative Lawyers 2021 award

Rescue, restructuring and recovery

WINNER: Milbank

The firm implemented a novel financing structure that enabled carriers American Airlines, United Airlines, Delta Air Lines, Air Canada and Spirit Airlines to raise capital during the coronavirus pandemic. Milbank acted as legal counsel to lead underwriters in these transactions.

The airlines used their frequent flyer loyalty programmes as investment assets, turning them into separate subsidiaries. The financings last year — $6.8bn for United, $10bn for American, and $9bn for Delta — were among the largest in the industry’s history. Their structure provides a model for other loyalty programme financings for airlines globally.

Akin Gump Strauss Hauer & Feld

In collaboration with the National Independent Venue Association (NIVA), which represents more than 3,000 music clubs and performing arts venues in the US, the firm ran the Save Our Stages campaign, which lobbied the federal government for Covid relief funding for venues. The firm secured bipartisan support by focusing on economic arguments. The Save Our Stages Act was signed into law in December 2020, securing $16bn in emergency funds — equivalent to nearly half of the venues’ revenues in 2019.

Bracewell

The firm secured an order from the federal energy regulator to secure $800,000 owed by Gulfport Energy Corporation to its client, the Rockies Express Pipeline, before Gulfport filed for bankruptcy. This order stated that Gulfport was not allowed to cancel contracts unless it was in the public interest. The firm had to secure this declaration before the bankruptcy was filed because automatic stay, which halts certain actions against the distressed party in a bankruptcy, would have prevented the regulator from acting.

Hogan Lovells

The firm advised the republic of Ecuador on the restructuring of $17.4bn of the country’s external debt. The firm used a collective action clause, which is uncommon for a restructuring of this size. To persuade a large and disparate group of international investors to accept the terms, the clause allows a supermajority of bondholders to enforce a legally binding restructuring on all holders, including those that vote against it. The firm has since been approached by the city of Córdoba in Argentina to restructure $150m of debt using the same approach.

Kirkland & Ellis

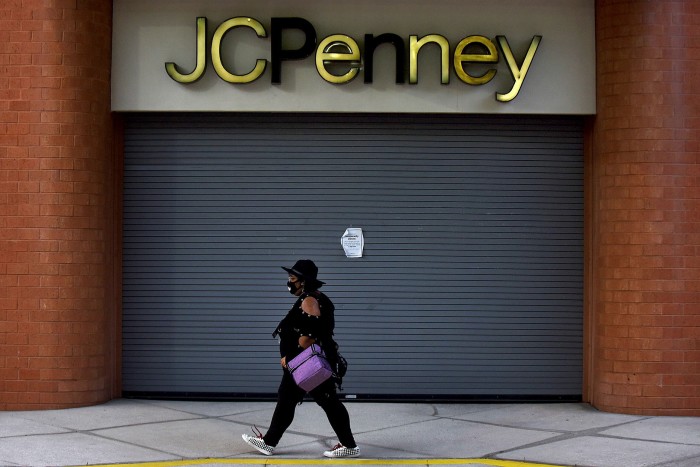

The firm represented US department store chain JCPenney in its bankruptcy proceedings. The company was split into an operating company, which manages the business, and a property company — a holding company that owns the property. Under this arrangement, the operating company leases the real estate from the property company. The firm brought in an external consortium led by real estate investors Simon Property Group and Brookfield Property Partners, which owns malls that house JCPenney stores, to buy the operating company. The restructuring preserved 60,000 jobs at JCPenney, two-thirds of the workforce. Commended: Josh Sussburg

Milbank

Representing the first lien holders in the JCPenney bankruptcy proceedings, the firm worked with creditors to identify attractive assets for the department store chain’s property company. The retailer had acquired hundreds of properties over many decades, held in different legal entities, which the law firm organised into the property company — a single legal entity leased to Simon Property Group and Brookfield Property Partners, owners of the operating company. The opco-propco structure could be replicated for other distressed retailers.

Morrison & Foerster

The firm structured the California Rebuilding Fund to help small businesses in the US state weather the Covid-19 pandemic. The fund acquires capital from private, philanthropic and public sector resources, and provides loans to businesses. It does this through community development financial institutions, such as development banks, which underwrite the loans. The fund has raised more than $100m to date and has received applications from more than 3,000 businesses.

Sullivan & Cromwell

The Venezuelan opposition, led by Juan Guaidó, wanted to use assets frozen under international sanctions against the Nicolás Maduro government to provide financial support for the country’s healthcare workers during the Covid-19 crisis. The law firm designed the legal framework and secured licences, allowing frozen assets held by the US to be released. Funds were transferred to healthcare workers’ mobile phones using blockchain platform Circle, to be spent as cash via Airtm, a digital payments platform.

Weil, Gotshal & Manges

AMC, one of the world’s largest cinema chains, capitalised on the boom in retail share trading in June by relying on at-the-market equity offerings to avoid an in-court restructuring. At-the-market offerings are a way for companies to raise money by incrementally selling newly issued shares, or shares they already own, on the secondary trading market — normally a risky way for a company facing bankruptcy to raise capital. The firm worked with the US Securities and Exchange Commission to gain regulatory approval for the plan and negotiated significant concessions from the cinema chain’s landlords.

White & Case

The firm advised car rental company Hertz on its restructuring of $19bn of debt. Securitisation was the principal source of exit financing from the bankruptcy — a first for a transaction of this size. Securitisation and an exit from bankruptcy are traditionally difficult to execute simultaneously.

The structure helped Hertz avoid funding costs, and equity investors and debt holders have both been paid in full. The company has since relisted on Nasdaq.

Dispute resolution

WINNER: Cravath, Swaine & Moore

In 2014, the US Federal Trade Commission brought an antitrust case against technology company Qualcomm for requiring buyers of its chips to pay licensing fees, as well. In August 2020, the law firm secured a final decision by a US appeals court that Qualcomm was not infringing antitrust law — persuading the court that, while customers can license Qualcomm software without buying its chips, it was fair for those that did buy chips to also license the software. This precedent gives clarity on competition law and standard essential patents, showing that cases fall under the jurisdiction of patent or contract law, rather than antitrust regulation.

Arnold & Porter

Representing medical technology company Hologic in the US Supreme Court in April, the firm established legal confirmation on the assignor estoppel doctrine, which limits the ability of a company that has sold a patent to make changes to what that patent includes. In another case, the firm secured state and federal court victories for biopharmaceutical companies Sanofi and Regeneron against biotech group Amgen, arguing for a narrow definition of what a therapeutic antibody patent covers.

Hausfeld

The firm represented the plaintiffs in a class-action lawsuit against Blue Cross Blue Shield (BCBS), a federation of some 35 health insurance companies in the US. The companies were alleged to have entered into non-compete agreements with one another. The case spanned eight years and required complex economic modelling to show the impact of BCBS’s business practices. Last year, the court granted preliminary approval of the proposed settlement agreement of $2.67bn. Significantly, the agreement demands changes to BCBS’s business practices, increasing competition in the US health insurance market.

Latham & Watkins

The firm secured victory for medical practice management software company NextGen Healthcare after an eight-year litigation. A former board member and major shareholder had claimed losses of $400m because alleged misrepresentations from the company — which had made positive statements about its financial prospects — led him to retain his shares rather than selling them at a higher price. This is the first claim of its kind tried before a jury in the US in 86 years, and a first in California, creating an important precedent.

White & Case

The firm represented health insurance provider Anthem in its litigation with fellow insurer Cigna over an unsuccessful merger. The lawyers filed a temporary restraining order to keep the merger in place within 24 hours of Cigna’s filing for a termination of the deal. This protected Anthem from immediately having to pay a $1.85bn reverse termination fee. It also bought time to find evidence that Cigna had deliberately derailed the deal, meaning Anthem did not have to pay the fee at all.

Comments