Investors may face painful adjustment to era of ‘spend but don’t tax’

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is a financial journalist and author of ‘Surviving the Daily Grind: Bartleby’s Guide to Work’

It is now clearer than ever that we have entered a new era of financial and economic policy. In this new period, governments are far less willing to incur the unpopularity of raising taxes or cutting spending to keep their budgets in check.

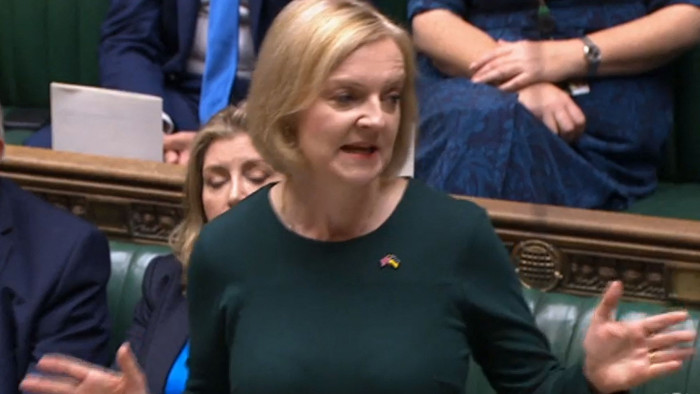

There could be no better symbol of this change than the sight of a British prime minister, who campaigned for a smaller state, announcing a huge intervention in the energy market to cap prices, at a cost that may reach £150bn.

By the same token, western governments adopted a “shock and awe” approach to fiscal policy in the face of the Covid-19 pandemic. Budget deficits passed 10 per cent of gross domestic product in several countries, including the US and the UK.

Governments felt free to borrow this much because, in most cases, the markets placed no apparent constraint on their deficits; interest rates and bond yields stayed very low.

The response to the 2008 financial crisis was rather different. True, there was a brief period of Keynesian fiscal stimulus in the immediate aftermath of the crisis. But austerity programmes followed when deficits grew so large that politicians became nervous, especially when the bond markets’ willingness to finance Greece’s deficit evaporated in 2010.

Central banks bore the brunt of supporting the economy in the 2010s, just as they had in much of the period since 1980. This was the dominant trend in what was often dubbed the “neoliberal” era.

In theory, neoliberalism was about open markets and a smaller state. In practice, states didn’t shrink that much. In 1980, the average OECD country spent 14.5 per cent of its GDP on social spending. By 2019, this average had increased to 20 per cent, with the US and Britain matching the global trend. The more striking thing about the past 40 years has been the dominance of monetary policy and the low levels of inflation and interest rates. This era was, by and large, very good for risky assets and those who trade them.

When the 2008 crisis hit, central banks felt obliged to break an old taboo, using newly created money to buy government bonds — so-called quantitative easing. The experience of monetary financing of government spending in Germany in the 1920s was so calamitous that it had become anathema until that point. When the rules of the euro were set up in the 1990s, the German authorities tried hard to rule out monetary financing.

QE did not involve the direct financing of governments by the central bank; the bonds were bought in the secondary market. But the distinction was fairly technical, especially once central banks started returning the interest on their accumulated bond piles to their respective Treasuries.

Hyperinflation did not occur, as some feared, and QE appeared to be the only means of keeping the developed economies from a deflationary slump. But the habit was hard to break. Only now, after more than a decade, are central banks starting to unwind their accumulated bond portfolios. And politicians have got used to cheap finance and have come to believe that deficits don’t matter. This view has seemed all the more pertinent since 2016 when the election of Donald Trump as US president seemed to show that voters were tired of “orthodox” economic policy.

Conservative politicians may mouth the mantra that cutting tax rates will lead to increased revenues. But look what happened after the Trump tax cuts of 2017, which focused on business and the wealthy. In 2016, under Barack Obama, the US budget deficit was $587bn or 3.2 per cent of GDP. By 2019, before the pandemic, the deficit had risen to $984bn or 4.6 per cent of GDP. The Republican party stopped talking about balancing the budget.

Rightwing politicians criticise their leftwing rivals for “tax and spend” policies but their alternative seems to be “spend but don’t tax”. There is no appetite for renewed austerity and any political leaders who shift in that direction may soon find themselves out of office.

But if politicians are relying on central banks to keep supporting them, they may be disappointed. Inflation is now well above target and central banks are tightening policy quickly. Nor are central banks likely to return to QE.

So instead of tight fiscal policy and loose monetary policy, financial markets may face an era of the reverse. This may mean higher interest rates and lower valuations for risky assets. The adjustment may be extremely painful.

Letter in response to this article:

America has to end its toxic tax debate / From J Paul Horne, Alexandria, VA, US

Comments