Brexit saps London’s appeal to tech founders

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For Rob Bishop, head of one of Europe’s fastest growing tech companies, now is the time for start-ups to relocate operations elsewhere in the EU, ahead of the UK’s departure next year.

“You don’t want to get caught out at the eleventh hour,” he says. “You can’t assume things will be fine after Brexit and then find out they aren’t.”

The managing director of London-based payments start-up Optal says it has applied for a regulatory licence in Ireland, in the event that the UK does not retain passporting rights. These currently enable fintech companies to sell financial services across the EU single market.

Mr Bishop plans to base five people in Dublin, including an executive. For now the start-up has stopped short of a wholesale relocation.

Optal is just one of several tech start-ups that have told the Financial Times they will shift staff and operations out of the UK because of prolonged uncertainty caused by Brexit.

Founders and venture capital investors describe a less attractive environment for start-ups, including a drop-off in investment from the European Investment Fund, as well as problems hiring skilled EU developers and the question mark over passporting rights.

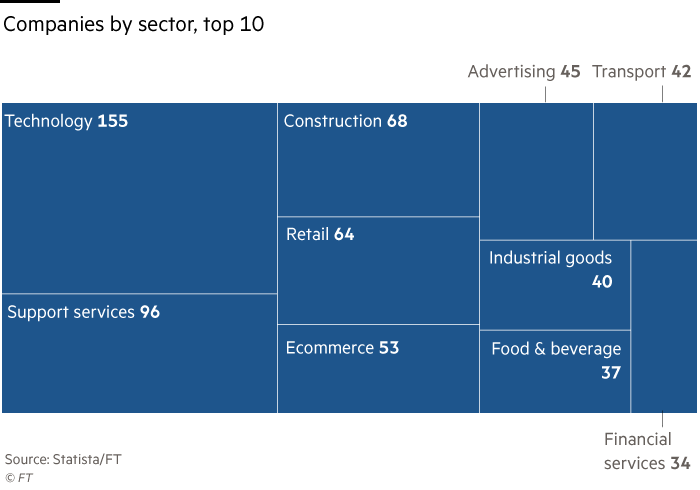

Despite these worries over London’s status as Europe’s start-up hub, this year’s FT 1000 list of Europe’s fastest growing companies — judged by revenue growth between 2013 and 2016 — finds the UK capital is home to 74 of these businesses, again more than any other city. Paris came in second with 62, up from 45 last year.

The list, compiled with research company Statista, suggests a strong environment in general for high-growth companies. The lowest compound annual growth rate in revenue was 34.6 per cent, compared with 16.1 per cent last year.

According to Mark Tluszcz, chief executive and co-founder of venture capital group Mangrove Capital Partners, the numbers for fast growing tech companies in Europe suggest a better environment for start-ups overall, without proving an advantage for any particular country.

“More and more capital is flowing into Europe and when you’re [on] top of the pile, as London has been, you will be the centre of that,” he says. “Ten years ago if you were a remotely interesting entrepreneur you would move to London.” He adds that people who at one time “may have moved from Berlin to London . . . don’t have to any more”.

The UK government has attempted to reassure the country’s tech industry about Brexit with a crop of initiatives including plans to double “exceptional talent” visas and establish a new office in the government to promote start-ups and academics researching artificial intelligence.

Recruiters and start-ups say that hundreds of developers from the EU have rejected jobs in London, however, because of anxieties about their future immigration rights, creating a vacuum in terms of skilled workers.

A fifth of tech jobs in London are filled by workers from the bloc, according to data from the Recruitment and Employment Confederation. Across the country as a whole, they hold 7 per cent of all tech roles, according to an analysis by the Department for Exiting the EU.

Data from Atomico, the venture capital group, in November showed French tech start-ups had closed the most funding deals in Europe for the first time in five years. Germany was the top destination for developers.

The FT 1000 list also suggests other countries well represented in the ranking have more developed corporate hubs outside their capital cities.

Almost half of the UK’s high-growth tech, ecommerce and fintech start-ups on the FT 1000 list are based in London. In Germany, Hamburg and Berlin together account for only about a fifth.

A view among entrepreneurs, however, is that London still leads in terms of access to investors at each stage of a company’s development.

“I would characterise the UK a bit closer to the US in terms of the way the investor scene is structured,” says Gerhard Trautmann, co-founder at Global Savings Group, a Munich-based start-up that is 10th on the FT 1000 list.

“For a company like ours, which is moving to late-stage capital, you need not just a venture capital scene but a private equity scene,” he adds. “London is definitely ahead here.”

Comments