The stock market boost from having more women in management

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is an equity strategist at Goldman Sachs

Women used to be largely absent from the higher echelons of the corporate sector. As recently as 2005, fewer than 10 per cent of board members at Europe’s top 600 listed companies were women. Now that figure is more than 30 per cent. But has this made a difference?

From a societal perspective, it clearly has. Girls today will grow up seeing more female leaders and hopefully feel they, too, can aspire to such roles. Young men and women will see women taking on the major decisions for their firms.

But what about the impact on company performance? Here there is good news. Listed European companies that have more women at senior levels have benefited from strong share-price performance, Goldman Sachs has found by crunching data for the Stoxx 600 companies since the 2008 financial crisis. Companies in the top quartile of their sectors based on the share of women on the board or female managers saw their share price outperform on average by 2.5 per cent a year compared with companies in the bottom quartile.

The numbers are less encouraging in the shorter period of the pandemic. From the end of February to the end of September, companies in the top quartile by women on the board were down 7 per cent compared with companies in the bottom quartile. But this may be because groups that have more service businesses tend to have a higher share of women employees. Services have been harder hit by social distancing measures than manufacturing. Some of the 20 Stoxx sectors used in our study are broad, such as “industrial goods and services”, which has companies as different as engineers and staffing agencies.

Also, correlation doesn’t mean causation. The fact that companies in the top-quartile for share of women on the board or female managers outperformed may be because of a range of factors. It could be that women add more diverse opinions and take different approaches. It could be that by hiring from a broader pool that includes both sexes, companies are able to attract the best talent.

But the causation may work the other way: women may be more choosy about their employer and end up picking higher quality businesses. In the period covered by our study, businesses that score well on quality-related attributes such as strong balance sheets or stability of earnings and sales have outperformed. Another possibility is that companies that choose more female leaders are good at other stuff, too. That would make the share of women on boards and in executive teams useful as a signal rather than a direct cause of outperformance.

Perhaps unsurprisingly, the performance of companies with a high share of women at all levels correlates well with that of indices focused on environmental, social and governance factors. So it’s likely we are also picking up the positive impact on share prices from recent large flows into ESG funds.

We also looked at whether the top-quartile companies by women at senior levels performed better on fundamental corporate metrics such as return on equity, earnings per share or revenue growth. They didn’t noticeably, but they didn’t underperform either. We think this means more diversity hasn’t come at a cost.

To be clear, there are very good reasons for enhancing gender diversity even if the performance metrics are not compelling. Don’t forget the most important of them all — a desire, regardless of economic benefit, to ensure equal opportunity for all.

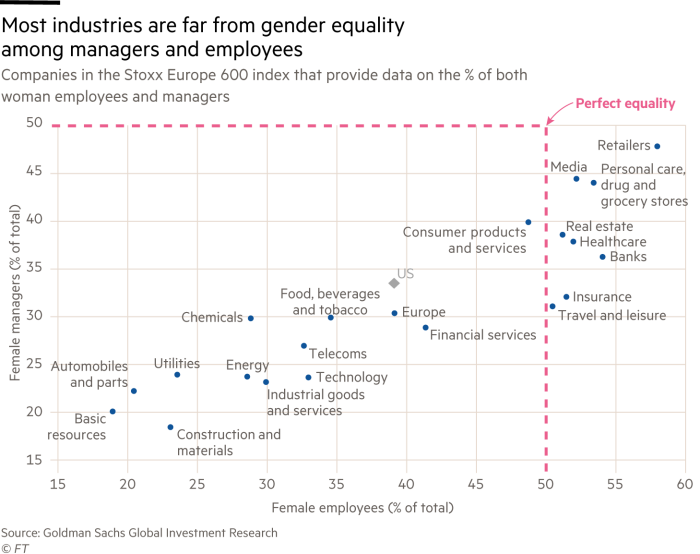

Our study shows that companies are not quite there on this issue. Board representation has risen significantly but the share of female managers (the echelon below the board) has not risen at the same speed. The share of female chief executives remains stubbornly low, at just 6 per cent of all Stoxx Europe 600 CEOs.

Even boards remain disproportionately male.

Some sectors have more female employees than male ones overall, including retail, media, travel and leisure, healthcare and financials. But, all have fewer than 50 per cent female managers.

Having a greater proportion of women in senior positions is not just a diversity score to target or a box to be ticked, but is associated with a lower cost of equity, stronger share-price performance and lower volatility of shares, too. Good news for corporations, investors and society.

Comments