US stocks close within a whisker of record

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

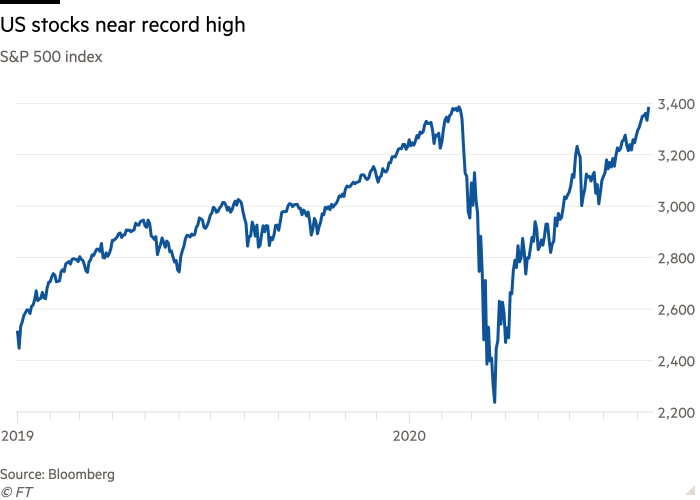

US stocks rallied to within a few points of a new high and Treasuries sold off on Wednesday after improving economic data and rising hopes over a potential coronavirus vaccine.

The S&P 500 ended up 1.4 per cent, having climbed briefly above its record-high close set in February. The rebound gives the US benchmark a 50 per cent gain from March lows.

Gains were propelled by the mega-cap companies that have come to dominate the US benchmark stock index, with shares of Apple, Amazon and Microsoft together accounting for more than a third of the index’s rise on Wednesday.

The advance was nonetheless broad-based, with more than two-thirds of the stocks in the S&P 500 rising. The benchmark index’s valuation also pushed higher, with the S&P trading at 22.5 times its projected earnings over the next 12 months, far above its average of 15.5 times over the past decade.

Wall Street’s advance followed strong trading across European markets, where the Stoxx 600 rose 1.1 per cent. The FTSE 100 closed 2 per cent higher despite second-quarter data showing the UK falling into its deepest recession on record.

US government bond prices remained under pressure and extended Tuesday’s sharp sell-off, as the Treasury auctioned a record $38bn of new 10-year bonds with a 0.677 per cent yield.

Analysts pointed to the large borrowing for some of the pressure on Treasuries on Wednesday, as the yield on the 10-year bond rose 0.008 percentage points to 0.66 per cent. A week ago, it was just 0.5 per cent.

The rise in yields also followed a report that showed core US consumer prices, a gauge of inflation, rose at a more rapid pace than expected last month, the latest indication that parts of the world’s largest economy have begun to stabilise after the heavy blow caused by Covid-19.

Despite the uptick in interest rates, the low borrowing costs secured by the Treasury provided further evidence of the government's ability to borrow massive sums to fund stimulus packages.

“We are not concerned about the market’s ability to absorb [the record supply],” said David Leduc, chief investment officer for active fixed income at Mellon. “The Fed is still in play,” he said, noting that the US central bank has intervened extensively in financial markets this year and has promised to kept interest rates low.

Data from Europe also showed some economic improvement was under way. Eurozone industrial production rose 9.1 per cent in June as the region’s manufacturers increased their activity after a near halt in previous months. In the UK, the gross domestic product report showed economic output rebounded more vigorously than forecast in June following a historic contraction during the spring.

Yields rose on German and UK sovereign debt.

Sentiment was further improved by signs suggesting US coronavirus infection rates were plateauing while progress on a vaccine had been made, said Mark Dowding, chief investment officer at BlueBay Asset Management. This improved outlook had been one factor that had weighed on US Treasuries and pushed yields higher, he said.

“Bond markets had been pricing not just that interest rates would stay at zero for a very long time, but also that the [Federal Reserve] and [European Central Bank] would increase their bond buying at some point,” Mr Dowding said. “Anything that makes that slightly less likely is going to weigh on bond prices.”

Equities in the Asia-Pacific region slipped. China’s CSI 300 index of Shanghai and Shenzhen-listed stocks shed 0.7 per cent while Hong Kong’s Hang Seng rose 1.4 per cent. Australia’s S&P/ASX 200 dropped 0.1 per cent.

In New Zealand, the S&P/NZX 50 index fell 1.3 per cent as authorities put the city of Auckland back into strict lockdown in response to the first locally acquired cases of Covid-19 in more than 100 days.

Additional reporting by Sarah Provan, Tommy Stubbington and Daniel Shane

Letter in response to this article:

Pandemic shows markets are untouched by reality / From Peter Fieldman, Madrid, Spain

Comments