Skilled staff and value for money attract banks to Middle England

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

HSBC’s decision to move its retail bank’s head office to Birmingham was a watershed moment for a city that has been steadily building a financial services hub for more than three decades.

“HSBC has changed completely the way the sector has viewed Birmingham,” says Neil Rami, chief executive of Marketing Birmingham, the man charged with winning businesses for the Midlands city.

The bank, which traces the very history of its UK operations to an 1836 Birmingham & Midlands branch in the city, is by no means the first big financial institution to move significant operations to Birmingham.

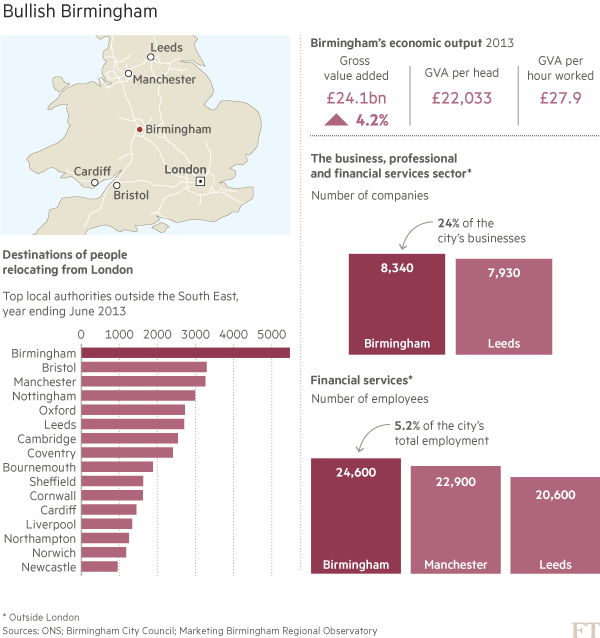

There are more than 20,000 financial services workers based in Birmingham, including 2,500 who already work for HSBC in everything from commercial banking to credit cards and support functions and 1,500 who work for Germany’s Deutsche Bank.

The difference with HSBC’s latest move is the nature of what it is bringing to middle England. Much of what banks already do in Birmingham is “back office” work, the support centres that underpin the wider bank, such as IT, call centres and operations.

By bringing its UK retail head office to the city, HSBC turbocharges Birmingham’s attempt to “move up the value chain”. “This is not a back office function, it’s very much a front office one,” says Mr Rami, who is in talks with other financial services companies as he targets “substantial growth” in Birmingham’s financial sector over the coming year.

The omens look good — Birmingham had more active enquiries for high quality office space than any other regional city in the UK in the second quarter of the year, according to data from property agency Knight Frank.

Antonio Simoes, head of HSBC Europe, says Birmingham triumphed against several other UK cities as the home for HSBC’s UK retail bank, which had to be separated, from the wider HSBC group because of UK regulations designed to protect depositors from losses at investment banks.

Advantages cited by Mr Simoes include Birmingham’s status as a “leading start-up hub”, with 18,000 businesses created in the past year, its central location and good transport links.

“Cost wasn’t a determining factor in our decision. Our planned investment spend in Birmingham to the end of 2018 will be approaching £200m and the move is cost-neutral for us in the medium term,” he adds.

Costs might not have been vital for HSBC, but they are certainly lower in Birmingham than in London, with salaries about a third less and commercial property far cheaper than in the capital, according to Mr Rami.

Paul Anderson, head of Deutsche Bank’s Birmingham team, says having a base in the Midlands helps the bank “cover UK mid-market clients in a more cost-effective manner”.

Ray O’Donoghue, who runs Barclays 900-strong Birmingham site, is trying to bring even more of his bank’s staff to the area. He cites costs as an advantage.

The availability of staff “at all levels” is another important consideration. The operation has close ties with local universities, and has managed to attract colleagues from elsewhere within the Barclays group.

“I’ve had a few that thought they wouldn’t [like it],” says Mr O’Donoghue, who has lived in the area for a decade, and concedes London is still the default first choice for many graduates who do not already have links to Birmingham.

“Because the city is much smaller, graduates can build their own networks a lot easier, their peer groups of accountants and lawyers etc. They will all know each other. Being in Birmingham doesn’t stop people developing their careers elsewhere in the group.”

Indeed, Birmingham is the most popular UK destination for people relocating from London, with 5,480 people making the move in the year ended June 2013, according to the most recent data from the Office for National Statistics.

Staff turnover is lower than in London, Mr O’Donoghue says, so banks save on recruiting and training costs. But it is not all a bed of roses. The rising demand for property, and for staff, could make both more expensive.

There are demographic challenges too, with the local unemployment rate of 10.3 per cent above the UK average of 5.4 per cent. Connections from Birmingham Airport, while improving, are not what some business leaders expect.

Mr Rami says: “We’d like to see the sector growing considerably. We think there’s quite a lot of scope.”

Comments